Mattresses - Key Trends and Drivers

Mattresses, essential for bed support and comfort, have evolved to accommodate various sleeping preferences and needs through diverse materials and structures. Reflecting both technological advancements and cultural preferences, mattresses range from traditional materials such as hair and cotton to modern innovations such as memory foam and gel-infused foams. Moreover, the mattress industry witnesses a shift towards smart technology integration and online sales models, catering to consumer demand for enhanced sleep experiences and convenience.Growth in the mattress industry is led by increasing awareness of the importance of quality sleep for overall health and wellness. Technological innovations such as smart mattresses equipped with sleep trackers and temperature control systems redefine comfort and sleep quality. Expansion of online sales channels and a focus on sustainability further contribute to industry growth, with eco-friendly materials and health-focused products gaining traction among consumers seeking personalized sleep solutions. Sustainability and eco-friendliness in materials and manufacturing processes, as well as the adoption of advanced cooling technologies and dual comfort features, reflect the industry's response to evolving consumer preferences for personalized, health-conscious sleep solutions.

The integration of technology in mattresses is a rapidly emerging trend. Smart mattresses equipped with sleep trackers, temperature control technologies, and even smart home connectivity is designed to enhance the sleep experience through technology. The advent of smart technology in mattresses has been a game-changer. Integrated with sensors, these mattresses monitor sleep patterns, heart rate, and even breathing rhythms throughout the night. The data collected is then analyzed to provide insights into sleep quality, duration, and health. This feature allows mattresses to adjust firmness and temperature autonomously, tailoring the sleeping environment to individual preferences, which significantly enhances the overall sleep experience.

Report Scope

The report analyzes the Mattresses market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.- Segments: Product Type (Innerspring, Memory Foam, Latex, Other Product Types).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Innerspring Mattresses segment, which is expected to reach US$36.5 Billion by 2030 with a CAGR of a 4.8%. The Memory Foam Mattresses segment is also set to grow at 7.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $17.5 Billion in 2024, and China, forecasted to grow at an impressive 10.8% CAGR to reach $24.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Mattresses Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Mattresses Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Mattresses Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arai Helmet Ltd., Chih Tong Helmet Co., Ltd., LAZER SA, Nolangroup SpA, NZI Technical Protection SL (NZI Helmets) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 269 companies featured in this Mattresses market report include:

- Casper Sleep Inc.

- Corsicana Bedding Inc.

- Innocor Inc.

- King Koil

- Kingsdown Inc.

- Paramount Bed Co. Ltd.

- Relyon Limited

- Restonic Mattress Corporation

- Serta Simmons Bedding LLC

- Silentnight Group Ltd.

- Sleep Number Corporation

- Spring Air International

- Tempur Sealy International Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Casper Sleep Inc.

- Corsicana Bedding Inc.

- Innocor Inc.

- King Koil

- Kingsdown Inc.

- Paramount Bed Co. Ltd.

- Relyon Limited

- Restonic Mattress Corporation

- Serta Simmons Bedding LLC

- Silentnight Group Ltd.

- Sleep Number Corporation

- Spring Air International

- Tempur Sealy International Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 413 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

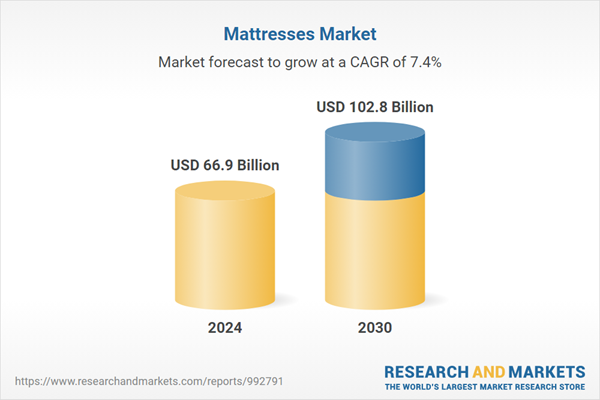

| Estimated Market Value ( USD | $ 66.9 Billion |

| Forecasted Market Value ( USD | $ 102.8 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |