Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Indian seed market is also benefiting from increasing privatization, which has further contributed to its upward trajectory. The involvement of private players has brought in new perspectives, innovative technologies, and financial investments that have stimulated the growth and competitiveness of the industry. The rising awareness among farmers about the benefits of hybrid seeds, such as improved yield and resistance to pests and diseases, has fuelled the demand for such seeds in the market.

With continued investment and innovation, India is well-positioned to become a significant player in the global seed industry in the forecast period. The country's vast agricultural landscape, coupled with its commitment to research and development, provides a solid foundation for further advancements in seed production and technology. As the Indian seed market continues to flourish, it holds immense potential to not only meet the domestic demand but also contribute significantly to global food security.

Key Market Drivers

Increase in Population

The increase in population directly impacts the demand for food grains, thereby driving the need for high-quality seeds. In 2023, India's annual population growth rose by 0.1 percentage points (+14.71%) compared to the previous year. This marked the first instance of an increase in population growth during the observed period. As the population continues to grow, the pressure on the agricultural sector to meet the rising demand for food becomes even more significant. This has led to an increased focus on the development and distribution of high-yielding varieties (HYV) of seeds that can help farmers achieve higher crop yields.The rising awareness among about farmers about the benefits of using certified HYV seeds has also contributed to the growth of the seed market. These seeds are specifically bred for their superior characteristics, including resistance to pests and diseases, as well as a higher nutritional profile. By using these seeds, farmers can enhance their crop yields and ensure a steady supply of nutritious food.

The government's initiatives to support farming communities and promote sustainable farming practices have played a crucial role in driving the acceptance of hybrid and genetically modified (GM) seeds. These seeds have the potential to dramatically increase crop yields and make a substantial contribution to food security in the country. With the right regulations and safety measures in place, the adoption of GM seeds can help address the challenges of limited arable land and changing climatic conditions.

Apart from government support, the private sector also plays a pivotal role in driving the growth of the seed industry. Through their research and development efforts, private companies have introduced innovative seed technologies that can withstand the challenges posed by climate change, pests, and diseases. These advancements not only boost agricultural productivity but also provide farmers with sustainable solutions to improve their livelihoods.

The burgeoning population in India is a significant driver for the growth of the seed market. However, it is crucial to recognize that addressing the challenges of food security and sustainable agricultural growth requires a comprehensive approach. With the right mix of policy support, private sector participation, and farmer education, the seed industry can continue to play a crucial role in ensuring food security and sustainable agricultural growth in the country, ultimately benefiting both farmers and consumers alike.

Surge in Technological Advancements

One of the most significant technological advancements impacting the seed industry is the advent of Genetically Modified (GM) seeds. These seeds are engineered in laboratories using advanced biotechnology techniques to introduce specific traits such as resistance to pests, diseases, and adverse climatic conditions. By modifying the genetic makeup of these seeds, scientists can enhance their characteristics and improve their performance in various agricultural settings.This scientific breakthrough offers immense potential for increased yield and better quality crops, making GM seeds an attractive option for farmers looking to optimize their agricultural practices. According to data presented in 2024, the Indian Council of Agricultural Research (ICAR) plans to introduce 100 new seed varieties and farming technologies within 100 days, with a focus on climate-resilient and biofortified varieties. This initiative is part of the government's 100-day action plan aimed at strengthening India's agricultural sector, involving significant workforce efforts and the development of seed hubs.

Another significant technological advancement that is revolutionizing the seed industry is the use of artificial intelligence (AI) and machine learning in seed selection and crop management. AI algorithms can analyze vast amounts of data, including soil composition, weather patterns, and historical crop performance, to predict which seeds will perform best under specific conditions. This kind of precision farming allows farmers to make informed decisions about seed selection, optimizing crop yields and minimizing resource wastage. By harnessing the power of AI, farmers can achieve higher profits and more sustainable farming practices.

The traditional seed production technology, utilizing the "seed plot technique," has been successfully implemented in India for over five decades to produce high-quality potato seed. This process involves tuber indexing for all major viruses and clonal multiplication of virus-free mother tubers through four cycles for breeder seed production. The breeder seed produced by ICAR-CPRI is then supplied to various state government organizations for further multiplication across three additional cycles: Foundation Seed 1 (FS-1), Foundation Seed 2 (FS-2), and Certified Seed (CS), all under stringent health standards.

The COVID-19 pandemic has accelerated the adoption of digital technologies across various sectors, including the seed industry. Social distancing norms and restrictions on physical interaction have prompted a shift towards remote and digital solutions. In the seed industry, this has led to the rise of e-commerce platforms specifically designed for the sale and distribution of seeds. These online platforms provide farmers, especially those in remote areas, with convenient access to a wide range of high-quality seeds. By embracing e-commerce, the seed industry is not only ensuring the availability of quality seeds but also promoting inclusivity and accessibility.

The surge in technological advancements is playing a pivotal role in driving the growth of the seed market in India. By embracing these advancements, the seed industry can not only meet the increasing demand for food grains but also foster sustainable and profitable farming practices. The continuous innovation in seed technology, including GM seeds and AI-driven precision farming, holds great promise for the future of agriculture, ensuring food security and promoting environmental stewardship.

Key Market Challenges

Volatility in Seed Price Control and Affordability

The volatility of seed prices poses a significant challenge to farmers. Fluctuating prices make it difficult for farmers to effectively plan their crops and budget their expenses. This unpredictability in prices can have adverse effects on their productivity and profitability. Small and potential negative impact on private-sector investment. The lower royalty rates for farm-saved seeds, compared to certified seeds, may discourage investment in research and development of new seed varieties, consequently limiting the availability of improved seeds for farmers.The volatility of seed prices poses a significant challenge to farmers. Fluctuating prices make it difficult for farmers to effectively plan their crops and budget their expenses. This unpredictability in prices can have adverse effects on their productivity and profitability. Small and marginal farmers, who often operate on thin profit margins, are particularly vulnerable to the detrimental effects of price volatility. For these farmers, any unexpected increase in seed prices can be financially devastating.

The affordability of high-quality seeds is another pressing issue in the seed market. Technological advancements have led to the development of superior seed varieties that offer improved yields and resistance to pests and diseases. However, these high-quality seeds often come with a higher price tag compared to traditional varieties. This disparity in cost makes it challenging for many farmers, especially those in remote areas, to access and afford these high-quality seeds, limiting their ability to benefit from the latest advancements in seed technology.

The seed market is plagued by the issue of counterfeit seeds. These fake seeds, often sold at reduced prices, attract farmers looking to cut costs. However, the use of counterfeit seeds often leads to crop failure, exacerbating the already challenging financial situation faced by farmers. The consequences of crop failure not only include financial losses but also the loss of valuable time and effort invested in the cultivation process.

Seed pricing is a multifaceted process influenced by various factors, including production costs, research and development expenses, royalty fees, trade margins, local taxes, and commodity price fluctuations. The regulation of seed prices aims to protect farmers from inflated prices, but it also raises concerns about private-sector investment. Price volatility, affordability of high-quality seeds, and counterfeit seeds further compound the challenges faced by farmers in the seed market. Addressing these issues is crucial to ensure a fair and sustainable seed industry that supports the needs of farmers and promotes agricultural growth.

Fragmented Distribution Channels and Limited Market Access

Despite being the second-most populous country globally, India's agricultural landscape is characterized by small and fragmented landholdings, often owned by marginal and small-scale farmers. This fragmentation extends to the distribution channels for seeds, with numerous intermediaries involved in the supply chain, including wholesalers, retailers, and local agents.The inefficiencies inherent in this fragmented distribution system lead to several bottlenecks, including high transaction costs, delays in seed delivery, and limited reach to remote farming communities. Small-scale farmers, who form the backbone of Indian agriculture, often struggle to access high-quality seeds due to the limited presence of formal seed outlets in their vicinity. Additionally, the dominance of informal seed markets, where counterfeit and substandard seeds proliferate, further exacerbates the problem, undermining farmers' confidence in adopting modern seed technologies.

The lack of adequate infrastructure, such as cold storage facilities and reliable transportation networks, hampers the timely distribution of seeds, especially during peak planting seasons. As a result, farmers may resort to using saved seeds or purchasing seeds from unregulated sources, compromising crop productivity and quality.

Addressing the challenge of fragmented distribution channels and limited market access requires concerted efforts to streamline the seed supply chain, enhance market infrastructure, and promote the adoption of digital technologies for efficient seed delivery and tracking. Collaboration between public and private sectors, along with investments in rural infrastructure and extension services, is essential to overcome this hurdle and unlock the growth potential of the Indian seed market.

Key Market Trends

Shift towards Organic and Sustainable Seeds

The organic seeds market is experiencing a notable surge in growth, driven by the global shift towards sustainable agricultural practices. As farmers increasingly recognize the importance of sustainable farming, they are embracing organic methods that involve the use of organic seeds, natural fertilizers, and biological pest control techniques. This holistic approach not only benefits the environment but also leads to the production of healthier and more nutrient-rich crops.Namdhari Seeds has transformed the landscape of food production in India by redefining seed technology and making a significant impact on the agricultural sector. Through its innovative approach to seed production, the company has introduced cutting-edge solutions that enhance crop yields and ensure sustainable farming practices. Namdhari Seeds has not only contributed to increasing agricultural productivity but has also played a vital role in improving the livelihoods of farmers across the country.

One of the key factors driving the adoption of organic seeds is the growing consumer demand for non-chemical and non-synthetic foods. With an increasing focus on personal health and well-being, consumers are actively seeking out organically grown produce that is free from harmful substances. This shift in consumer preferences has resulted in a significant increase in the consumption of organic food, consequently fueling the demand for organic seeds in the market.

In addition to consumer demand, the Indian government has played a pivotal role in promoting the use of organic and sustainable seeds. Through initiatives like the Paramparagat Krishi Vikas Yojana (PKVY), the government is actively encouraging the adoption of organic farming practices in villages across the country. These efforts aim to create a conducive environment for sustainable agriculture, reinforcing the importance of organic and sustainable seeds in achieving food security and environmental sustainability.

The shift towards organic and sustainable seeds represents a significant and positive trend in the Indian seed market. It reflects a collective effort from farmers, consumers, the government, and the private sector to drive sustainable agriculture and ensure food security. With continued support and collaboration, this trend is expected to persist, contributing to the long-term growth and sustainability of the Indian seed market.

Segmental Insights

Product Type Insights

Based on the category of product type, genetically modified seeds have emerged as the fastest growing segment in the Indian market for seed in 2024. One of the primary reasons for the proliferation of GM (genetically modified) seeds in India is the increased crop yield they offer. GM seeds are specifically engineered to enhance productivity by incorporating desirable traits into the plants. This is a factor of utmost importance given the country's ever-growing population and the rising demand for food to sustain it. The use of GM seeds has seen a tremendous surge in India due to their potential to significantly boost crop output, ensuring an adequate and stable food supply for the nation.Another substantial advantage of GM seeds lies in their built-in resistance to pests and diseases. For instance, Bt cotton, the only GM crop currently allowed in India, has been widely embraced by cotton farmers for its remarkable resistance to the bollworm, a notorious pest responsible for significant crop losses in the past. This pest resistance not only safeguards the cotton plants but also leads to a substantial reduction in the usage of chemical pesticides. As a result, farmers can benefit from cost-effective agricultural practices while also contributing positively to the environment and their own well-being.

Crop Type Insights

Based on Crop Type, Cotton segment is projected to experience rapid growth during the forecast period. Cotton, one of the most vital cash crops in India, holds a significant position in both the industrial and agricultural economies of the country. The fibers derived from cotton are extensively utilized in the textile industry, which not only contributes significantly to India's economy but also plays a crucial role in providing employment opportunities to a large population. The demand for cotton seeds has skyrocketed, as farmers strive to meet the ever-increasing demands of the cotton and textile industries.The introduction and widespread adoption of Bt cotton, a genetically modified variety, have further strengthened the dominance of cotton in the seed market. Bt cotton, engineered to resist the notorious bollworm pest that had previously caused substantial losses for cotton farmers, has revolutionized cotton cultivation. The inherent resistance of Bt cotton has resulted in a significant reduction in the cost of spraying and insecticides, making cotton farming more profitable and sustainable for farmers in the long run. This, in turn, has propelled the growth of the cotton industry, contributing to the overall economic development of the nation.

Regional Insights

Based on region, West emerged as the dominant region in the India Seed Market in 2024, holding the largest market share in terms of value. Western India, comprising states like Maharashtra, Gujarat, and Rajasthan, is renowned for its diverse agro-climatic conditions. This unique combination of factors creates an ideal environment for the cultivation of a wide variety of crops, showcasing the agricultural prowess of the region. The fertile lands and favorable climates allow farmers to grow an extensive range of crops, including cereals, fruits, vegetables, and spices, meeting the demands of both the domestic and international markets.This rich agricultural diversity translates into a thriving seed industry. The availability of a wide range of seeds, including hybrid and genetically modified varieties, has contributed to Western India's dominance in the seed market. Farmers and agricultural enthusiasts have access to an extensive range of high-quality seeds, enabling them to optimize crop production and achieve sustainable agricultural practices.

Key Market Players

- Syngenta India Private Limited

- Corteva Agriscience

- Bayer CropScience Limited

- Kaveri Seed Company Limited

- Advanta India Ltd

- Rijk Zwaan India Seeds Pvt Ltd

- BASF India Limited

- East-West Seed India Pvt. Ltd.

- Limagrain Field Seeds India

- Nuziveedu Seeds Limited (NSL)

Report Scope:

In this report, the India Seed Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Seed Market, By Product Type:

- Varietal Seeds

- Hybrid Seeds

- Genetically Modified Seeds

India Seed Market, By Crop Type:

- Cereals

- Fruits & Vegetables

- Oilseeds

- Cotton

- Others

India Seed Market, By Region:

- North

- East

- West

- South

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Seed Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Syngenta India Private Limited

- Corteva Agriscience

- Bayer CropScience Limited

- Kaveri Seed Company Limited

- Advanta India Ltd

- Rijk Zwaan India Seeds Pvt Ltd

- BASF India Limited

- East-West Seed India Pvt. Ltd.

- Limagrain Field Seeds India

- Nuziveedu Seeds Limited ( NSL )

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | January 2025 |

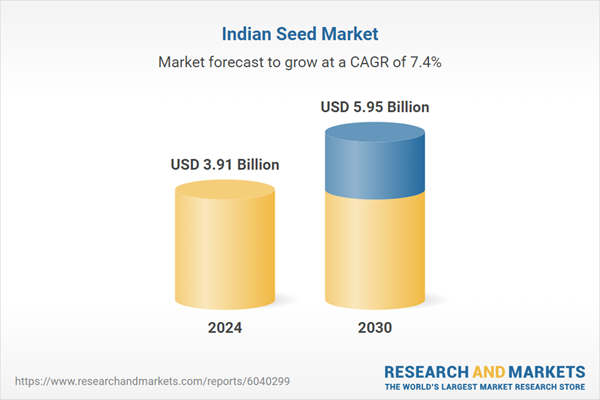

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.91 Billion |

| Forecasted Market Value ( USD | $ 5.95 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |