Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One major hurdle slowing wider market expansion is the tightening of government rules concerning ingredient safety and sustainable packaging, which leads to increased production costs and compliance burdens for manufacturers. Despite these obstacles, the industry maintains strong momentum in core segments. As reported by the Spanish Cosmetics, Toiletry and Perfumery Association (Stanpa), sales of lip makeup products rose by 11.6% in 2024, demonstrating a sustained consumer desire for color cosmetics even in the face of economic and regulatory headwinds.

Market Drivers

The rise of e-commerce and digital retail channels acts as a transformative force for the industry, fundamentally reshaping how consumers find and buy beauty products. Brands are increasingly utilizing artificial intelligence and virtual try-on tools to bridge the gap between physical and digital experiences, enabling customers to accurately visualize shades and textures prior to purchase. This integration of technology, combined with aggressive social media campaigns, expands market access far beyond traditional brick-and-mortar boundaries. As noted in L'Oréal’s '2023 Annual Report' from February 2024, e-commerce represented 27.1% of the Group’s consolidated sales, highlighting the vital importance of digital platforms for major beauty companies.Additionally, the resilience of the "Lipstick Effect" serves as a crucial secondary driver, maintaining demand during economic downturns as consumers favor affordable luxuries like premium lip products over expensive discretionary spending. This behavioral pattern ensures market stability and prompts manufacturers to innovate within the high-end segment. For instance, Coty Inc. reported in its 'Third Quarter Fiscal 2024 Results' in May 2024 that Prestige Makeup revenues increased by roughly 25%, showing persistent demand for luxury color cosmetics. This strength supports the wider retail landscape, with Ulta Beauty reporting a 9.8% increase in net sales to $11.2 billion for fiscal year 2023, reflecting strong category engagement.

Market Challenges

The increasing stringency of government regulations regarding ingredient safety and eco-friendly packaging represents a major barrier to the global lipstick market's advancement. Manufacturers are under mounting pressure to reformulate product lines to comply with rigorous safety standards, a shift demanding significant investment in research and development. This process often necessitates eliminating established pigments or preservatives in favor of alternative compounds that may be scarcer or more costly. Such operational adjustments inevitably drive up production expenses, which can dampen consumer demand if passed on through higher retail prices.Furthermore, the complexity of adhering to varied international environmental laws complicates supply chain logistics and delays the commercial launch of new products. The sheer scale of this regulatory environment is evidenced by the volume of new policies; according to Cosmetics Europe, the association tracked over 80 legislative files linked to the European Green Deal in 2024 with direct implications for the cosmetics sector. This dense legal landscape forces companies to divert resources from marketing and expansion initiatives toward compliance management, thereby limiting manufacturer agility and hindering the broader trajectory of market growth.

Market Trends

The proliferation of hybrid lip oils and tinted balms signals a fundamental shift toward multifunctional cosmetics that merge color with therapeutic benefits. This "skinification" trend meets consumer desires for hydration and glossy finishes, prompting manufacturers to infuse products with active ingredients such as hyaluronic acid and plant oils. By blurring the lines between skincare and makeup and moving away from heavier formulas, this approach drives significant category growth through enhanced functionality. As reported by Premium Beauty News in February 2025, within the article 'U.S. prestige beauty sales rose 7% in 2024 to $33.9 billion,' the lip segment emerged as the top-performing makeup category with a 19% increase in 2024, largely fueled by the popularity of these hybrid products.Concurrently, the market is witnessing a revival of 1990s aesthetics, characterized by brown and nude palettes paired with distinct lip contouring. This nostalgic trend has revitalized demand for lip liners and earth-toned lipsticks as consumers aim to replicate defined, retro looks using modern long-wear formulas. Brands are capitalizing on this preference by broadening their shade ranges to include diverse brown undertones and promoting precision application products that cater to this specific style. The commercial impact is clear; according to TheIndustry.beauty in July 2025, in the article 'Lipstick sales soar as 2025's top trends revealed,' nostalgia-driven demand caused sales of brown lip liners to surge by 45% year-on-year, significantly outperforming broader category growth.

Key Players Profiled in the Lipstick Market

- Louis Vuitton SE

- Estee Lauder Companies Inc.

- Oriflame Holding AG

- L'Oreal SA

- Procter & Gamble (P&G) Company

- Avon Products, Inc.

- Shiseido Company, Limited

- Revlon, Inc.

- Markwins Beauty Brands, Inc.

- Stargazer Products

Report Scope

In this report, the Global Lipstick Market has been segmented into the following categories:Lipstick Market, by Product Type:

- Matte

- Gloss

- Others (Sheer

- Crème

- Stain

- Satin

- etc.)

Lipstick Market, by Form:

- Stick

- Liquid

- Palette

Lipstick Market, by Sales Channel:

- Supermarkets/Hypermarkets

- Departmental Stores

- Multi Branded Stores

- Exclusive Stores

- Online

- Others (Salon

- etc.)

Lipstick Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Lipstick Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Lipstick market report include:- Louis Vuitton SE

- Estee Lauder Companies Inc.

- Oriflame Holding AG

- L'Oreal SA

- Procter & Gamble (P&G) Company

- Avon Products, Inc.

- Shiseido Company, Limited

- Revlon, Inc.

- Markwins Beauty Brands, Inc.

- Stargazer Products

Table Information

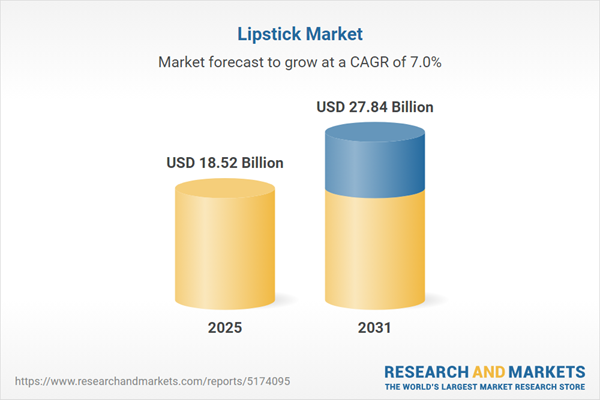

| Report Attribute | Details |

|---|---|

| No. of Pages | 183 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 18.52 Billion |

| Forecasted Market Value ( USD | $ 27.84 Billion |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |