Global Protein Ingredients Market - Key Trends & Drivers Summarized

What Are Protein Ingredients and Why Are They Essential?

Protein ingredients are fundamental components derived from both animal and plant sources, crucial for a wide array of applications in the food, beverage, and nutrition industries. These ingredients, including whey protein, casein, soy protein, and pea protein, are rich in essential amino acids necessary for building and repairing body tissues, producing enzymes, and supporting overall health. In the food industry, protein ingredients are used to enhance the nutritional profile of products, improve texture, and extend shelf life. They are also integral to the development of specialized nutrition products such as sports nutrition, weight management supplements, and infant formula. The versatility and health benefits of protein ingredients make them indispensable in addressing the growing consumer demand for nutritious and functional foods.How Are Protein Ingredients Transforming the Food and Beverage Industry?

Protein ingredients are revolutionizing the food and beverage industry by enabling the creation of innovative and health-conscious products that cater to evolving consumer preferences. The rise of plant-based diets has led to an increased demand for plant-derived protein ingredients, such as soy, pea, and rice proteins, which are used in various meat alternatives and dairy-free products. These plant-based proteins not only provide essential nutrients but also align with the sustainability goals of reducing environmental impact. Additionally, advancements in protein extraction and processing technologies have resulted in higher-quality protein ingredients with improved solubility, taste, and functional properties. This has expanded their use in diverse applications, from protein bars and beverages to bakery and confectionery items. The ability of protein ingredients to meet dietary needs and lifestyle choices is driving innovation and growth in the food and beverage sector.What Are the Current Trends Shaping the Protein Ingredients Market?

Several trends are shaping the protein ingredients market, reflecting the dynamic nature of consumer demands and technological advancements. One significant trend is the increasing focus on clean label products, where consumers seek transparent, minimally processed ingredients. This has led to a surge in the popularity of natural protein sources and organic protein ingredients. Another trend is the growing interest in personalized nutrition, where protein ingredients are tailored to meet individual health and dietary needs based on genetic, lifestyle, and health data. The market is also witnessing a shift towards alternative protein sources, such as insect protein and cultured meat, driven by the quest for sustainable and ethical food production. Furthermore, the incorporation of protein ingredients in functional foods and beverages that offer health benefits beyond basic nutrition, such as immune support and gut health, is gaining momentum. These trends highlight the evolving landscape of the protein ingredients market, characterized by innovation and consumer-centric approaches.What Factors Are Driving the Growth in the Protein Ingredients Market?

The growth in the protein ingredients market is driven by several factors, reflecting the increasing demand for health-oriented and sustainable food products. The rising awareness about the health benefits of protein consumption, coupled with the growing prevalence of lifestyle-related health issues such as obesity and diabetes, is propelling the demand for protein-enriched foods and supplements. Technological advancements in protein extraction and formulation are enabling the development of high-quality, functional protein ingredients that cater to specific dietary requirements and preferences. The expanding vegan and vegetarian population is significantly boosting the market for plant-based protein ingredients. Additionally, the surge in sports and fitness activities has led to a higher demand for protein supplements aimed at muscle building and recovery. The food industry's shift towards sustainability and ethical sourcing is driving investments in alternative protein sources, such as algae and cultured proteins, further accelerating market growth. These factors collectively underscore the critical role of protein ingredients in shaping the future of the food and nutrition sectors, addressing both health and environmental challenges.Report Scope

The report analyzes the Protein Ingredients market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Source (Egg, Dairy, Soy, Gluten, Other Sources); Form (Concentrates, Isolates, Other Forms); Application (Food & Beverage, Animal Feed, Infant Formulations, Other Applications).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Spain; Russia; Rest of Europe; Asia-Pacific; Australia; India; South Korea; Rest of Asia-Pacific; Latin America; Argentina; Brazil; Mexico; Rest of Latin America; Middle East; Iran; Israel; Saudi Arabia; UAE; Rest of Middle East; Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Egg Source segment, which is expected to reach US$35.2 Billion by 2030 with a CAGR of 6.9%. The Dairy Source segment is also set to grow at 7.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $17 Billion in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $14.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Protein Ingredients Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Protein Ingredients Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Protein Ingredients Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Amway Corporation, Associated British Foods PLC, Carbery Food Ingredients Limited, Barentz International BV, Agropur Cooperative and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 160 companies featured in this Protein Ingredients market report include:

- Amway Corporation

- Associated British Foods PLC

- Carbery Food Ingredients Limited

- Barentz International BV

- Agropur Cooperative

- Avebe Group

- Armor Proteines SAS

- A&B Ingredients, Inc.

- AMCO Proteins

- BHJ A/S

- Biolac GmbH & Co. KG

- Agridient

- Axiom Foods, Inc.

- Burcon NutraScience Corporation

- Bioway (Xi'an) Organic Ingredients Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amway Corporation

- Associated British Foods PLC

- Carbery Food Ingredients Limited

- Barentz International BV

- Agropur Cooperative

- Avebe Group

- Armor Proteines SAS

- A&B Ingredients, Inc.

- AMCO Proteins

- BHJ A/S

- Biolac GmbH & Co. KG

- Agridient

- Axiom Foods, Inc.

- Burcon NutraScience Corporation

- Bioway (Xi'an) Organic Ingredients Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 755 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

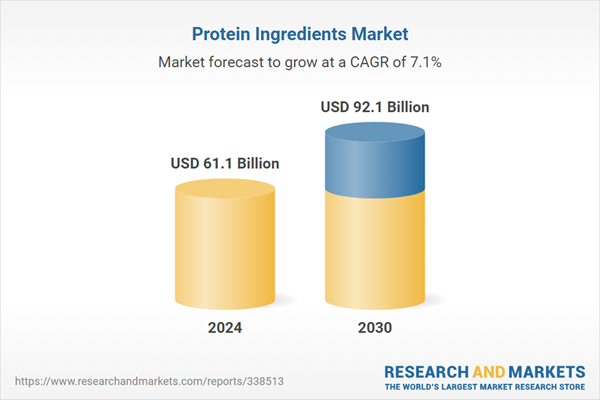

| Estimated Market Value ( USD | $ 61.1 Billion |

| Forecasted Market Value ( USD | $ 92.1 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |