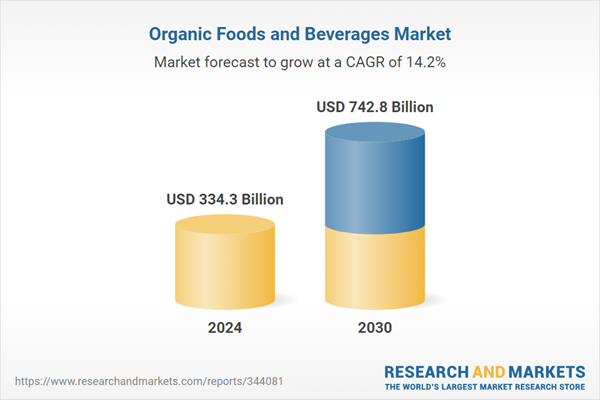

Global Organic Foods and Beverages Market - Key Trends & Drivers Summarized

Organic foods and beverages have seen a significant rise in popularity over the past few decades, largely due to increasing consumer awareness about health, environmental sustainability, and food safety. Organic products are grown and processed without the use of synthetic fertilizers, pesticides, genetically modified organisms (GMOs), and other artificial additives. This method of production not only helps in maintaining ecological balance but also enhances the nutritional quality of food. As a result, a wide variety of organic products are now available in the market, ranging from fresh fruits and vegetables to dairy products, meats, cereals, and beverages like juices, wines, and teas. These products are often perceived as healthier and safer compared to their conventionally produced counterparts, contributing to their growing demand.The market for organic foods and beverages is characterized by a diverse range of products and a robust supply chain. Organic farming practices emphasize crop rotation, green manure, compost, and biological pest control to maintain soil productivity and control pests on farms. Organic dairy and meat products come from animals that are fed organic feed and are not given antibiotics or growth hormones. In terms of beverages, organic wines, juices, and teas are produced using organically grown fruits and leaves, without synthetic additives or preservatives. The certification process for organic products is stringent, involving various inspections and adherence to specific standards set by regulatory bodies like the USDA in the United States and the EU Organic Certification in Europe. This rigorous process ensures the integrity and authenticity of organic labels, which is crucial for maintaining consumer trust.

The growth in the organic foods and beverages market is driven by several factors. Increasing consumer health consciousness and the rising prevalence of lifestyle-related diseases are major drivers, as people are becoming more inclined to choose foods that promote better health. Rising consumer concerns about food safety in the recent years particularly with growing instances of harmful chemical and pesticide residue being found in food products; the use of genetically modified organisms (GMOs) in food products; outbreak of diseases such as mad cow disease; and presence of bacteria in foods and food irradiation are fueling growth in the market. Advancements in organic farming and food processing techniques have improved the efficiency and scalability of organic production, making organic products more accessible and affordable. Additionally, the surge in e-commerce and the proliferation of online retail platforms have made it easier for consumers to purchase organic products. Government initiatives and subsidies to promote organic farming also play a significant role in market growth. Furthermore, there is a growing trend towards sustainable and environmentally friendly consumption, with more consumers opting for organic products to reduce their carbon footprint and support biodiversity. These factors collectively contribute to the expanding market for organic foods and beverages, making it one of the fastest-growing segments in the food industry.

Report Scope

The report analyzes the Organic Foods and Beverages market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Segment (Fruits & Vegetables, Meat, Fish & Poultry, Dairy Products, Frozen & Processed Foods, Beverages, Other Segments).

- Geographic Regions/Countries: World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fruits & Vegetables segment, which is expected to reach US$258.8 Billion by 2030 with a CAGR of 15.5%. The Meat, Fish & Poultry segment is also set to grow at 15.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $109.1 Billion in 2024, and China, forecasted to grow at an impressive 17.3% CAGR to reach $77.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Organic Foods and Beverages Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Organic Foods and Beverages Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Organic Foods and Beverages Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abazeer, Albertsons Companies, Inc., Alnatura Produktions- und Handels GmbH, Amy's Kitchen, Inc., Arla Foods amba and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 83 companies featured in this Organic Foods and Beverages market report include:

- Abazeer

- Albertsons Companies, Inc.

- Alnatura Produktions- und Handels GmbH

- Amy's Kitchen, Inc.

- Arla Foods amba

- Aurora Organic Dairy

- Danone S.A

- Eden Foods, Inc.

- Hain Celestial Group

- Organic India

- Organic Valley

- SunOpta, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abazeer

- Albertsons Companies, Inc.

- Alnatura Produktions- und Handels GmbH

- Amy's Kitchen, Inc.

- Arla Foods amba

- Aurora Organic Dairy

- Danone S.A

- Eden Foods, Inc.

- Hain Celestial Group

- Organic India

- Organic Valley

- SunOpta, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 284 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 334.3 Billion |

| Forecasted Market Value ( USD | $ 742.8 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |