Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Health Awareness and Lifestyle Shifts Toward Clean Eating

A major force behind the growth of the organic food and beverages market is the increasing consumer emphasis on health and nutritional wellness. With the global rise in non-communicable diseases such as obesity, diabetes, and cardiovascular conditions, more individuals are opting for cleaner, safer dietary alternatives. Organic foods - free from synthetic pesticides, GMOs, and artificial additives - are perceived as more wholesome and better aligned with preventive healthcare.In particular, Millennials and Gen Z are prioritizing nutrition as a lifestyle choice, influenced by fitness trends, wellness influencers, and social media content promoting healthy eating. The appeal of organic products is further reinforced by their higher antioxidant levels and improved taste profiles. This lifestyle shift toward chemical-free and environmentally responsible consumption is increasing the frequency of organic product purchases across both developed and emerging markets.

Key Market Challenges

High Production Costs and Premium Pricing

One of the principal obstacles hindering wider adoption of organic food and beverages is the high cost associated with their production and retail pricing. Organic agriculture demands more labor-intensive processes such as manual weeding, compost use, and chemical-free pest management, all of which contribute to elevated costs. The conversion period from conventional to certified organic farming often involves lower yields and substantial financial outlay without immediate economic returns.Moreover, certification and compliance procedures add to the financial burden, particularly for small-scale producers. These factors result in higher retail prices for organic goods, making them less accessible to cost-sensitive consumers, especially in developing economies. Although the demand is rising among health-conscious segments, affordability remains a limiting factor for market expansion. Addressing this challenge will require enhanced infrastructure, policy support, and innovative cost-reduction strategies.

Key Market Trends

Rising Popularity of Plant-Based and Vegan Organic Products

A prominent trend reshaping the organic food and beverages market is the surge in demand for plant-based and vegan organic products. As sustainability, animal welfare, and health concerns gain prominence, consumers are adopting flexitarian, vegetarian, and vegan diets in greater numbers.Organic plant-based alternatives - including almond, oat, and soy milk; vegan cheese; and organic meat substitutes - are becoming staple offerings in grocery aisles. These products combine ethical considerations with health benefits, appealing especially to younger and urban demographics. Food manufacturers are responding with innovations in taste, protein quality, and clean-label formulations, expanding their portfolios with vegan-certified organic snacks and ready meals. This overlap between organic and plant-based movements is reshaping consumption patterns and prompting both startups and established brands to invest in this rapidly evolving niche.

Key Market Players

- Hain Celestial

- Whole Foods Market L.P.

- Dole Food Company, Inc.

- Dairy Farmers of America, Inc.

- General Mills Inc.

- Danone

- United Natural Foods, Inc.

- Gujarat Cooperative Milk Marketing Federation (Amul)

- The Hershey Company

- Amy’s Kitchen, Inc.

Report Scope:

In this report, the Global Organic Food and Beverages Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Organic Food and Beverages Market, By Product Type:

- Organic Food

- Organic Beverages

Organic Food and Beverages Market, By Distribution Channel:

- Supermarkets/Hypermarkets

- Departmental Stores

- Online

- Others

Organic Food and Beverages Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Vietnam

- South America

- Argentina

- Colombia

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Organic Food and Beverages Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Hain Celestial

- Whole Foods Market L.P.

- Dole Food Company, Inc.

- Dairy Farmers of America, Inc.

- General Mills Inc.

- Danone

- United Natural Foods, Inc.

- Gujarat Cooperative Milk Marketing Federation (Amul)

- The Hershey Company

- Amy’s Kitchen, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | June 2025 |

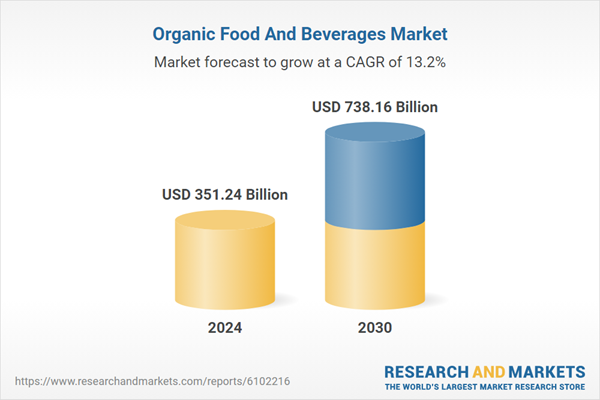

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 351.24 Billion |

| Forecasted Market Value ( USD | $ 738.16 Billion |

| Compound Annual Growth Rate | 13.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |