A wafer is a sort of dry, crispy, thin biscuit that comes in a wide range of shapes, sizes, and packaging. It is a component of ice cream, biscuits, and chocolate bars. Wafers are becoming more popular among consumers as they are a convenient food that is sold in essentially all retail establishments. Wafer biscuits can be made into cookies by sandwiching cream flavoring between them. Its surface is waffle-patterned. Consumers in the market frequently preferred coated wafers, which were among the wafer products most frequently preferred.Furthermore, the wafer biscuit market is being driven by rising demand for healthy snacks and rising per capita consumption in developing countries.The booming demand for healthy snacking has led many manufacturers to introduce health-efficient wafer biscuits with fortified active ingredients, mainly protein, fiber, and vitamins.

Further, wafer biscuits hold strong popularity, owing to their diversified flavor ranges and growing popularity among kids and adults. They crave convenient snacking options, which led the wafer biscuit market to record robust growth. Owing to the demand, manufacturers are actively launching their products with novel flavors and packaging options. For instance, in August 2022, the Voortman Bakery launched pumpkin spice wafers. The cookies are baked with real pumpkins. They contain no artificial colors or flavors, nor do they contain high-fructose corn syrup. On a general note, the proliferation of supermarkets and hypermarkets has increased the visibility of wafer biscuits in the market, facilitating consumers' identification of new products on the market.

Wafer Biscuits Market Trends

Rising Demand for Convenience and Healthy Snacking

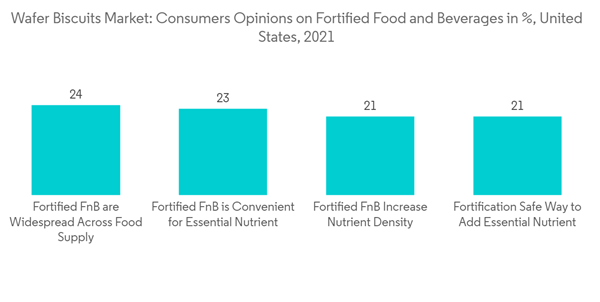

The growing preference for convenient snacking and easier consumer accessibility through the advancing retail sector are among the few factors augmenting the wafer biscuit market's growth. Moreover, the booming demand for healthy snacking has led many manufacturers to introduce health-efficient biscuits with fortified active ingredients, mainly protein, fiber, and vitamins. Furthermore, the better-for-you snacking segment is where players are positioning and innovating their product lines. For instance, in 2021, PT Kaldu Sari will offer a line of vitamin-fortified wafers called Nabati Vitakrim, which is offered in peanut butter flavor. The peanut butter cream from Nabati Vitakrim has vitamin E fortification in it. While Vitamin C is present in its earlier offering, which is called the Nabati Vitakrim raspberry yogurt cream wafer,The shift in consumption towards bakery products owing to better appeal, taste, and convenience is a significant driver of market growth. In addition, rising demand for convenience foods is propelling market growth. While demand for nutrition is growing worldwide, wafer biscuit consumption is rising accordingly. Demand for wafer biscuits in the snack category has been increasing daily because of an active lifestyle, less time spent cooking homemade food, and rising income. According to the USDA Foreign Agricultural Service, the retail sales value for packaged biscuits and snack bars across India stood at USD 6.14 billion in 2021. There has been a consistent increase in sales value for this segment since 2014 across the country.

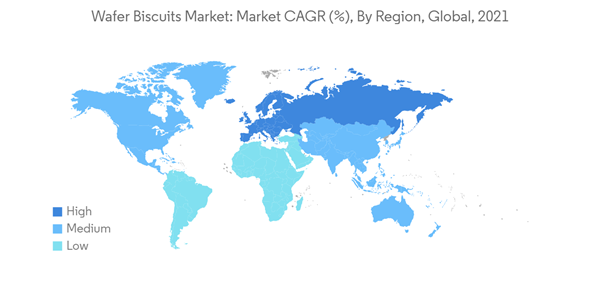

Europe Holds the Major Share in Wafer Biscuit Market

The European region dominates the wafer biscuit market, with the largest share due to the high standard of living and many regional vendors. The market has witnessed a significant demand for wafer biscuits owing to product innovations in the sector and the use of high-quality ingredients. In 2021, according to ITC Trade Map Trade statistics for international business development (by value), the main importers of waffles and wafers include countries such as Germany (USD 379,807), France (USD 284,508), and the United Kingdom (USD 259,769), after the United States of America.The market for wafer biscuits across Europe is driven by sensory innovation, where manufacturers are stepping up their efforts to provide products with novel shapes and colors. In recent years, the countries have developed a taste for both traditional and unconventional flavors. Thus, in July 2021, in the United Kingdom stores, Ferrero introduced the German biscuit brand 'Duplo.' The brand offers various wafer biscuits in different flavors and convenient packaging options. These products are made of two layers of crispy wafer with a hazelnut filling and are coated in milk chocolate.

Wafer Biscuits Market Competitor Analysis

Nestle S.AMars, Incorporated, Mondelez International, Inc., Lotte Corporation, and The Hershey Company are among the key players in the wafer biscuits market. Owing to the rapidly developing nature of the market, launching a new product has become one of the most important strategies to gain a competitive edge. The players in the market have also been adopting expansion as a key strategy, followed by mergers and acquisitions. These strategic moves have proven successful for global players seeking to strengthen their presence in the market.Additional benefits of purchasing the report:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Mars, Incorporated

- Nestlé S.A.

- Mondelēz International, Inc

- The Hershey Company

- Lotte Corporation

- Ravi Foods Pvt. Ltd. (RFPL)

- The Kellogg Company

- Hostess Brands, LLC

- Loacker S.p.A.

- Universal Robina Corporation