Global Drilling Waste Management Market - Key Trends and Drivers Summarized

What Constitutes Drilling Waste, and Why Is Its Management Critical?

Drilling waste management refers to the control, handling, and disposal of the byproducts generated during drilling operations, primarily in the oil and gas industry. This waste includes cuttings, mud, and fluids that contain oil, metals, and other contaminants. Effective management is crucial not only for environmental protection but also for maintaining operational efficiency and adhering to strict regulatory standards. The environmental impacts of improper waste management can be severe, leading to soil and water contamination and affecting local ecosystems. Additionally, operational efficiency is compromised when waste is not effectively minimized or reused, potentially leading to increased costs and downtime. As global awareness of environmental impacts increases, the industry faces intense scrutiny to implement sustainable and responsible waste management practices.How Are Modern Technologies Transforming Drilling Waste Management?

Recent advancements in technology have significantly transformed the landscape of drilling waste management. Innovations such as solidification, centrifugation, and thermal desorption enable more effective separation and reduction of waste, allowing for the recovery of useful materials and the safe disposal of contaminants. Solidification involves mixing waste with materials like fly ash or lime to stabilize contaminants, which can then be safely deposited in landfill sites. Centrifugation uses high-speed rotational forces to separate solids from liquids, reducing the volume of waste and facilitating easier disposal or recycling of fluids. Thermal desorption heats waste to vaporize contaminants, which are then condensed and recovered, leaving behind cleaner, non-hazardous solids. These technologies not only minimize the environmental footprint of drilling operations but also reduce the costs associated with waste disposal and compliance with environmental regulations.What Are the Regulatory and Economic Impacts on Drilling Waste Management Practices?

Regulatory frameworks around the world have a profound impact on drilling waste management practices. Stringent environmental regulations in regions like North America and Europe enforce rigorous standards on waste treatment and disposal to prevent environmental contamination and protect public health. These regulations require companies to adopt advanced waste management solutions, conduct thorough environmental impact assessments, and maintain transparent operational practices. Economically, while the initial investment in advanced waste management technologies can be high, the long-term savings from reduced waste handling, liability, and disposal costs can be significant. Moreover, companies that adopt environmentally responsible waste management practices gain a competitive advantage by enhancing their corporate reputation and aligning with the preferences of investors and consumers who prioritize sustainability.What Drives the Growth in the Drilling Waste Management Market?

The growth in the drilling waste management market is driven by several factors, including the increasing global demand for oil and gas, tighter environmental regulations, and technological innovations. As oil and gas exploration and production activities expand to meet global energy demands, there is a corresponding increase in the generation of drilling waste, necessitating robust waste management solutions. Stricter environmental regulations globally compel industry players to adopt sustainable practices and technologies that mitigate the impact of waste on the environment. Technological advancements that improve the efficiency, effectiveness, and environmental compatibility of waste management solutions also contribute to market growth. Additionally, the rising trend of resource recovery, where valuable materials are extracted from waste, provides economic incentives for improving waste management techniques. These factors collectively enhance the demand for advanced, sustainable, and cost-effective waste management solutions in the drilling industry, underscoring its essential role in modern energy production.Report Scope

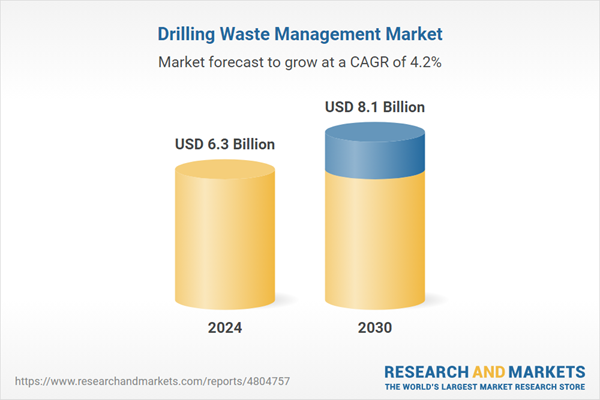

The report analyzes the Drilling Waste Management market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below.- Segments: Service (Treatment & Disposal, Solids Control, Containment & Handling); Application (Off-Shore, On-Shore).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Off-Shore Application segment, which is expected to reach US$5.1 Billion by 2030 with a CAGR of 4.6%. The On-Shore Application segment is also set to grow at 3.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.7 Billion in 2024, and China, forecasted to grow at an impressive 4% CAGR to reach $1.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Drilling Waste Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Drilling Waste Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Drilling Waste Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Augean plc, Baker Hughes, a GE company, Derrick Equipment Company, Halliburton, HeBei GN Solids Control Co.Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Drilling Waste Management market report include:

- Augean plc

- Baker Hughes, a GE company

- Derrick Equipment Company

- Halliburton

- HeBei GN Solids Control Co.Ltd.

- Imdex Ltd

- National Oilwell Varco, Inc.

- Nuverra Environmental Solutions, Inc.

- Ridgeline Canada, Inc.

- Schlumberger Ltd.

- Scomi Group Bhd

- Secure Energy Services Inc.

- Soiltech AS

- Soli-Bond, Inc.

- Specialty Drilling Fluids Ltd.

- STEP OILTOOLS

- Tervita Corporation

- Twma Ltd.

- Weatherford International Ltd.

- Xi'an Kosun Machinery Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Augean plc

- Baker Hughes, a GE company

- Derrick Equipment Company

- Halliburton

- HeBei GN Solids Control Co.Ltd.

- Imdex Ltd

- National Oilwell Varco, Inc.

- Nuverra Environmental Solutions, Inc.

- Ridgeline Canada, Inc.

- Schlumberger Ltd.

- Scomi Group Bhd

- Secure Energy Services Inc.

- Soiltech AS

- Soli-Bond, Inc.

- Specialty Drilling Fluids Ltd.

- STEP OILTOOLS

- Tervita Corporation

- Twma Ltd.

- Weatherford International Ltd.

- Xi'an Kosun Machinery Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.3 Billion |

| Forecasted Market Value ( USD | $ 8.1 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |