Energy drinks are among the most fascinating and dynamic beverage categories owing to their innovative ideas, intriguing flavors, and versatile positioning options. Customers like the stimulants' energizing effects, which led to rising demand for energy drinks that are manufactured from naturally occurring sources of energy like guayusa, guarana, and others. This new generation of energy drinks offers additional marketing opportunities for a range of positioning options since they contain useful components like proteins, BCAAs, vitamins, or minerals.

Energy drinks are typically popular among South America's millennials and Gen Z population. It delivers the needs and requirements of the consumer like living a hectic lifestyle, suffering busy schedule, bachelors, hostelers, and others which might offer potential growth to the market. Furthermore, Brazil followed by Argentina is the fastest-growing market for the beverage sector in the South American region. It also benefits from the relative affordability of energy drinks, which adds to its appeal.

In the South American market, lowering sugar content is one of the strong driving factors in the beverage sector. The demand for energy drinks and carbonated water is growing however the overall beverage sector is declining. Sales of carbonated beverages and energy drinks are rising as a result of more health-conscious consumers' demand for less sweet and naturally derived products. Thus, the demand for sugar-free and reduced-sugar options is driving the market for energy drinks.

South America Energy Drink Market Trends

Foodservice and E-commerce Channels Significantly Creating Shelf Space to Energy Drinks

Energy drinks have changed from being an aspirational commodity sold generally in retail stores and gas stations to becoming relevant in daily life. The most common morning purchases in the South American market are energy drinks, chips, and beef. The drinks are sold directly to customers looking for a way to get through the workdays by street sellers at traffic junctions. Energy drinks have been popular due to the concept of a beverage that may provide both refreshment and an energy boost, enabling individuals to stay alert and increase productivity for longer.Energy drink is consumed in South America as it is an exciting option with wellness attributes. Cosumer-led health and wellness trends are also taking a toll on the continued growth of the energy drink segment among other beverages. Modern grocery supermarkets and significant US/European hypermarket chains are continuously expanding their operations in the region to ensure the availability of beverages. This, in turn, has led to increased consumption of the products in the region. For instance, Campbell Soup Company generated around 22% of consolidated net sales from continuing operations in 2022 through Wal-Mart Stores Inc. and its affiliates. Moreover, with the desire for new flavor experiences among consumers, energy drinks are considered an alternative to soft drinks. It has also found its space in nightclubs as a social drink or beverage mixer.

Growing Consumer Preference Towards Healthy Drinks in the Region

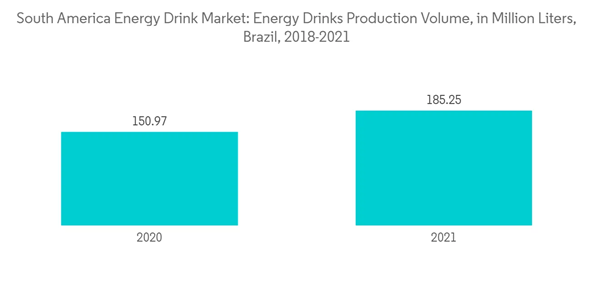

In the past few years, the consumption of energy drinks has drastically increased, especially among adolescents and young people. Energy drinks are aggressively advertised with the claim that they would offer you more energy and raise your mental and physical performance. Recently, manufacturers have shifted their attention away from athletes to millennials or the gen z population. Advertising for energy drinks is strong in locations where teens and young adults congregate. The average age of energy drink drinkers is between 13 and 35 years. Energy drinks are the second most popular dietary supplement used by teenagers. This is the result of consumers' increased attention to fitness and health. Energy drinks are marketed as an alternative to carbonated drinks. Thus, there has been a significant rise in the number of consumers switching from carbonated beverages to energy drinks in recent years, thus, boosting sales in the region. According to the Brazilian Association of Soft Drinks and Non-Alcoholic Beverages (ABIR), in 2021, consumption of energy drinks in Brazil amounted to approximately 0.87 liters per person, slightly up from 0.71 liters per person a year earlierSouth America Energy Drink Industry Overview

Emerging national economies, modernizing retail channels, and rising middle-class incomes present new growth opportunities for manufacturers of energy drinks in South America. Manufacturers are ensuring that their brands are carefully aligned with rising consumer demand for healthier options, particularly among an important core of younger, urban consumers. Players are also continuously making efforts to effectively communicate with the new, urban demographic in the region due to the increasing urban population and prevalence of migrants in the region. Additionally, manufacturers are also striving to strengthen their product offerings by establishing strategic partnerships. In 2022, Keurig Dr. Pepper established a strategic partnership with Red Bull to distribute the energy drink in the Mexican market. The agreement also allows for the distribution of any future ready-to-drink beverages developed or launched by Red Bull in the country.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Red Bull GmbH

- The Coca-Cola Company

- PepsiCo, Inc.

- Mutalo Group

- Anheuser-Busch InBev SA/NV (Ambev SA)

- AJE Group

- Globalbev Bebidas e Alimentos SA

- Grupo Petrópolis

- Bebidas Grassi

- Integralmédica Suplementos Nutricionais S/A