Key Highlights

- Customers across the country are increasingly looking for value-for-money products that are natural and beneficial for the skin and provide a range of combined benefits of high-priced premium products, like anti-aging, whitening, and moisturizing, at a lower-than-premium cost. As the aesthetic appeal of the young generation is rising, the penetration of color cosmetics products in the market is increasing.

- Furthermore, rising consciousness about appearance and improving quality of life is majorly driving the color cosmetics market in the country. Companies are venturing into organic color cosmetics due to their increasing demand among large sections of society. High investment in advertising and marketing initiatives, including promotions on social networking platforms and endorsements by celebrities, has increased the brand awareness and visibility of beauty and personal care products among consumers.

- Over the short term, as consumers become more interested in the cruelty-free (no animal testing), vegetarian (no byproducts of animal slaughter), and vegan (no animal ingredients at all) beauty market is expected to accelerate the sales of organic and natural personal care products segment in the country.

- However, the strong presence of counterfeit/low-cost products or those products having high chemical concentrations, which are detrimental to human application, are restraining the growth of the market across the country.

Argentina Beauty And Personal Care Products Market Trends

Skincare Products Dominating the Market

- Skincare products are expected to grow rapidly in Argentina, owing to the growing demand among women and young consumers. The most popular products in the country are multifunctional skincare products that protect skin from the harsh sun and other environmental conditions and promote an even lighter skin tone.

- A growing preference for organic and natural skincare products, particularly among younger generations, is driving market growth. Organic facial care products such as scrubs, toners, and cleansers leverage the power of the most potent vegetable and fruit extracts, herbs, and clays to intensely cleanse, repair, and nourish the skin without harsh chemicals. Thereby, such factors drive the market growth over the forecast period.

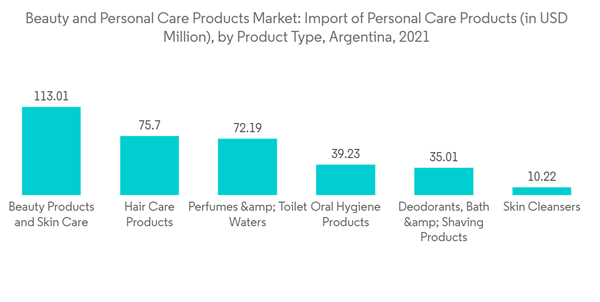

- Moreover, multiple stores of Sephora and Mecca Cosmetics across Argentina have exposed consumers to international brands, which in turn fuels the market growth for skincare products over the forecast period. According to the International Trade Centre data, the import of skin care products in the country has increased significantly over the years, with a value of USD 98.06 million from 2020 to USD 113.01 million in 2021. Thus, the increased import value of skincare products signifies the market potential in the country.

Growing Demand for Natural/Organic Beauty and Personal Care Products

- Growing concerns regarding the side effects of chemicals in personal care products, which lead to ailments such as skin irritation, allergies, and skin dullness, have fueled the demand for natural and organic beauty and personal care products in Argentina. Natural skincare and cosmetic products that are free from chemicals and transparent about the content have been preferred by consumers, which is likely to drive demand for natural skin care products.

- To capitalize on this growing interest, the manufacturers in the market have been revamping and expanding their product offerings by introducing a wide range of organic personal care products containing plant-based, clean-label ingredients, with claims such as 'organic,' 'vegan,' 'natural,' 'chemical-free' and 'cruelty-free.' Furthermore, the growing trend of organic concept stores for bio-cosmetic products is also expected to boost the growth of the country's natural and organic beauty and personal care products.

Argentina Beauty And Personal Care Products Industry Overview

The Argentine beauty and personal care products market is fragmented and highly competitive, with the major players trying to maintain their market share and leadership by adopting various business strategies like product innovations, partnership, expansion, mergers, and acquisitions, as well as building an online presence and developing online marketing strategies by tying up with various e-retail platforms like Amazon. Some of the major players in the beauty and personal care products market in Argentina are Shiseido, Beiersdorf AG, L'Oreal SA, Procter & Gamble, and Unilever PLC, among others. Currently, the most common strategy utilized by companies to capture the attention of consumers in Argentina has been to launch products with natural ingredients and environmentally-friendly packaging.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- L'Oreal SA

- The Procter & Gamble Company

- Beiersdorf AG

- Unilever PLC

- The Estee Lauder Companies Inc.

- Shiseido Co. Ltd

- Mary Kay Inc.

- The Avon Company

- Revlon

- Amway Corporation