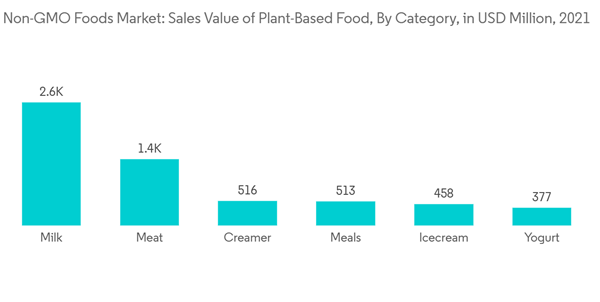

In recent years, clean label claims have been one of the key areas of activity in food and beverage new product development, which is expected to drive the market for non-GMO foods. During the past few years, the non-GMO cereals and grains segment has gained significant popularity and this trend is expected to drive market growth. Factors such as the initiatives undertaken to cultivate and commercialize non-GMO food products are expected to play a significant role in the growth of the market. Over the medium, the market for non-GMO foods is expected to grow owing to the increasing demand for plant-based food and beverage products as well as the demand for clean-label ingredients.

Additionally, rising investments by the market players in their research and development sectors for the production of nare-GMO products are also expected to drive the market to grow. In the past few years, consumer awareness about the consumption of vegan and vegetarian food is also increased owing to its health benefits and nutritional profiles. Owing to this, market players are launching new plant-based foods as alternatives for intolerant and intolerance food. Furthermore, demand for plant-based foods in baby foods is also increasing as it contains all essential growth ingredients and natural products. In July 2022, Danone SA launched a new dairy & plant blend baby food product. The plant blend is made from non-GMO soy and other plant ingredients.

Non-GMO Foods Market Trends

Increase in Demand for Non-GMO Food and Beverage Products

Non-GMO foods are eco-friendly, natural, and made from organic sources due to which they are considered a healthy food and are preferred by health-conscious consumers. The demand for Vegan and vegetarian consumers is growing around the world owing to its benefits and nutritional profile. Owing to this, consumer demand for non-GMO vegan food is also growing. Additionally, the demand for non-GMO beverages is also increasing owing to their convenience and on-the-go trend. The market players are constantly investing in their research and development departments to innovate new products considering consumer demand. The market players are launching new beverage products in the market. For instance, in February 2022, Naked Juice launched new smoothie flavors. The flavors include orange vanilla crème and Key lime flavors. The products are vegan, gluten-free, and made of non-GMO fruits.North America Holds Larget Share

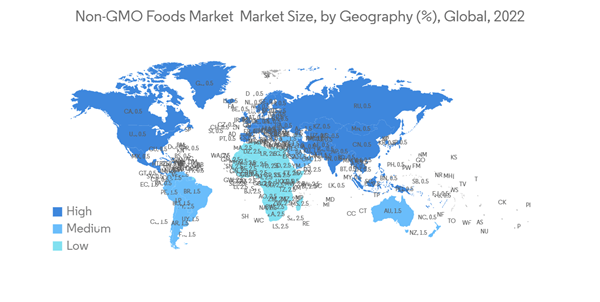

The increasing health awareness among consumers and the rising adoption of vegetarian and vegan lifestyles particularly in developed regions such as North America are stimulating the demand for foods that are formulated using organic and non-GMO ingredients such as grains, seeds, and fruits. Consumers are checking food labels for non-GMO mentions on it and then purchasing the product. Additionally, government initiatives regarding the use of non-GMO ingredients in food are also driving market growth. Considering the demand, the market players are launching new non-GMO products in the market. For instance, in November 2022, Blue Diamond Growers launched a new limited edition of flavored almonds. The product comes in two different flavors i.e., Snickerdoodle and Peppermint Cocoa. The company says that the almonds are non-GMO.Non-GMO Foods Industry Overview

Non-GMO foods market is fragmented with global and regional players dominating the market. Some prominent players in the market include Amy's Kitchen, Inc., Pernod Ricard, The Hain Celestial Group, Inc., The Kellogg's Company, and Nestlé SA. Companies are investing in the expansion of their production facilities to cater to the growing demand for non-GMO food products from consumers. Thus, the rising investment in production facilities by vendors is expected to boost the growth of the non-GMO foods market during the forecast period.Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amy's Kitchen, Inc.

- Blue Diamond Growers

- Organic Valley

- The Hain Celestial Group, Inc.

- Nestle S.A.

- The Kellogg's Company

- PepsiCo Inc.

- Pernod Ricard

- Clif Bar & Company

- Danone SA