Native starch refers to a polysaccharide found in various staple food crops, such as maize, potato, rice, and cassava. It is basically the pure form of starch and comprises long-chain carbohydrates that are insoluble in cold water and swell at different temperature conditions. It is incorporated in a wide variety of consumable products, such as bakery mixes, frozen cakes, sheeted snacks, batter mixes, brewing adjuncts, dry mix soups and sauces, processed meat, pudding powders, cold process salad dressings, dips, and fruit preparations. It is also added to pet food products as native starch is an effective source of energy for dogs and cats and enhances the density and texture of the product. It is used as a stabilizing, thickening, gelling, and moisture-retaining agent. It is also employed to stiffen textiles for improving the appearance of fabrics by imparting a glossy texture. It is widely used as a flocculant, binder, and bonding agent in the paper industry.

Native Starch Market in India Trends:

At present, the increasing demand for native starch as it is biodegradable, cost-effective, and renewable in nature represents one of the primary factors influencing the market positively in India. Besides this, the rising utilization of native starch in various cleansing products to provide a milky formulation, improve foam formation, and provide moisturization to the skin is propelling the growth of the market in the country. In addition, the growing employment of native starch in cosmetic powders, talc, and baby powder is offering a favorable market outlook. Apart from this, the increasing utilization of glucose syrup as a sweetener in manufacturing candies, fondants, and beer is contributing to the growth of the market in India. Additionally, there is a rise in the application of native starch in producing naturally genetically modified organism (GMO) free and non-allergic vegan cheese. This, coupled with the increasing production of various starch derivatives, such as maltodextrin and cyclodextrin, is supporting the market growth in the country. Moreover, the rising usage of bioethanol as a motor fuel and as an additive in gasoline is strengthening the market growth. Furthermore, the increasing adoption of native starch in the production of adhesives ideal for bonding paper-based materials and making corrugated boards and tube winding is bolstering the growth of the market in India.Key Market Segmentation:

The publisher provides an analysis of the key trends in each sub-segment of the native starch market in India report, along with forecasts at the country and state level from 2025-2033. Our report has categorized the market based on end use and feedstock.End Use Insights:

- Food

- Textile

- Paper

- Pharmaceuticals

- Other Industries

Feedstock Insights:

- Corn Starch

- Cassava Starch

- Wheat Starch

- Others

Regional Insights:

- Andhra Pradesh

- Bihar

- Chhattisgarh

- Delhi

- Goa

- Gujarat

- Haryana

- Himachal Pradesh

- Jharkhand

- Karnataka

- Kerala

- Madhya Pradesh

- Maharashtra

- Odisha

- Punjab

- Rajasthan

- Tamil Nadu

- Telangana

- Uttar Pradesh

- Uttarakhand

- West Bengal

- Others

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the native starch market in India. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include Roquette Riddhi Siddhi Private Limited, Gujarat Ambuja Exports Limited, Sukhjit Starch & Chemicals Ltd., Sayaji Industries Limited, Universal Starch Chem Allied Ltd., etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report

1. What was the size of the native starch market in India in 2024?2. What is the expected growth rate of the native starch market in India during 2025-2033?

3. What are the key factors driving the native starch market in India?

4. What has been the impact of COVID-19 on the native starch market in India?

5. What is the breakup of the native starch market in India based on the end use?

6. What are the key regions in the native starch market in India?

7. Who are the key players/companies in the native starch market in India?

Table of Contents

1 Preface2 Scope and Methodology

2.1 Objectives of the study

2.2 Stakeholders

2.3 Data Sources

2.3.1 Primary Sources

2.3.2 Secondary Sources

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.4.2 Top-Down Approach

2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

4.1 Overview

4.2 Key Industry Trends

5 Global Native Starch Industry

5.1 Market Overview

5.2 Market Performance

5.2.1 Production Volume Trends

5.2.2 Consumption Volume Trends

5.2.3 Value Trends

5.3 Price Trends

5.4 Market Breakup by Region

5.5 Market Breakup by Feedstock

5.6 Market Breakup by End Use

5.7 Market Forecast

5.7.1 Volume Trends

5.7.2 Value Trends

5.7.3 Price Trends

5.8 Trade Data

5.8.1 Imports

5.8.2 Exports

6 India Native Starch Industry

6.1 Market Overview

6.2 Market Performance

6.2.1 Production Trends

6.2.2 Consumption Trends

6.3 Impact of COVID-19

6.4 Price Trends

6.5 Market Breakup by Region

6.6 Market Breakup by Feedstock

6.7 Market Breakup by End Use

6.8 Market Forecast

6.8.1 Production Trends

6.8.2 Consumption Trends

6.8.3 Price Trends

6.9 Trade Data

6.9.1 Imports

6.9.2 Exports

7 India Native Starch Industry: Regional Analysis

7.1 Andhra Pradesh

7.2 Bihar

7.3 Chhattisgarh

7.4 Delhi

7.5 Goa

7.6 Gujarat

7.7 Haryana

7.8 Himachal Pradesh

7.9 Jharkhand

7.10 Karnataka

7.11 Kerala

7.12 Madhya Pradesh

7.13 Maharashtra

7.14 Odisha

7.15 Punjab

7.16 Rajasthan

7.17 Tamil Nadu

7.18 Telangana

7.19 Uttar Pradesh

7.20 Uttarakhand

7.21 West Bengal

7.22 Others

8 India Native Starch Industry: Breakup by End Use

8.1 Food

8.2 Textile

8.3 Paper

8.4 Pharmaceuticals

8.5 Other Industries

9 India Native Starch Industry: Breakup by Feedstock

9.1 Corn Starch

9.2 Cassava Starch

9.3 Wheat Starch

9.4 Others

10 India Native Starch Market: Value Chain Analysis

11 India Native Starch Market: Margin Analysis

11.1 Farmers Margins

11.2 Collectors Margins

11.3 Native Starch Manufacturers Margins

11.4 Distributors Margins

11.5 Exporters Margins

12 India Native Starch Market: SWOT Analysis

12.1 Overview

12.2 Strengths

12.3 Weaknesses

12.4 Opportunities

12.5 Threats

13 India Native Starch Market: Porter’s Five Forces Analysis

13.1 Overview

13.2 Bargaining Power of Buyers

13.3 Bargaining Power of Suppliers

13.4 Degree of Rivalry

13.5 Threat of New Entrants

13.6 Threat of Substitutes

14 India Native Starch Market: Competitive Landscape

14.1 Market Structure

14.2 Share of Key Players

15 India Native Starch Market: Manufacturing Analysis from Various Feedstocks

15.1 Corn

15.1.1 Manufacturing Process

15.1.2 Process Flow

15.1.3 Mass Balance and Feedstock Requirements

15.1.4 Land Requirements and Expenditures

15.1.5 Construction Requirements and Expenditures

15.1.6 Machinery Requirements

15.1.7 Raw Material Requirements

15.1.8 Packaging Requirements

15.1.9 Transportation Requirements

15.1.10 Utility Requirements

15.1.11 Manpower Requirements

15.1.12 Other Capital Investments

15.1.13 Capital Cost of the Project

15.1.14 Techno-Economic Parameters

15.1.15 Income Projections

15.1.16 Expenditure Projections

15.1.17 Taxation and Depreciation

15.1.18 Financial Analysis

15.1.19 Profit Analysis

15.2 Wheat

15.2.1 Manufacturing Process

15.2.2 Process Flow

15.2.3 Mass Balance and Raw Material Requirements

15.2.4 Land Requirements and Requirements

15.2.5 Construction Requirements and Expenditures

15.2.6 Machinery Requirements

15.2.7 Raw Materials Requirements and Expenditures

15.2.8 Packaging Requirements and Expenditures

15.2.9 Transportation Requirements and Expenditures

15.2.10 Utility Requirements and Expenditures

15.2.11 Manpower Requirements and Expenditures

15.2.12 Other Capital Investments

15.2.13 Capital Cost of the Project

15.2.14 Techno-Economic Parameters

15.2.15 Income Projections

15.2.16 Expenditure Projections

15.2.17 Taxation and Depreciation

15.2.18 Financial Analysis

15.2.19 Profit Analysis

15.3 Cassava

15.3.1 Manufacturing Process

15.3.2 Process Flow

15.3.3 Mass Balance and Feedstock Requirements

15.3.4 Land Requirements and Expenditures

15.3.5 Construction Requirements and Expenditures

15.3.6 Machinery Requirements

15.3.7 Raw Material Requirements

15.3.8 Packaging Requirements

15.3.9 Transportation Requirements

15.3.10 Utility Requirements

15.3.11 Manpower Requirements

15.3.12 Other Capital Investments

15.3.13 Capital Cost of the Project

15.3.14 Techno-Economic Parameters

15.3.15 Income Projections

15.3.16 Expenditure Projections

15.3.17 Taxation and Depreciation

15.3.18 Financial Analysis

15.3.19 Profit Analysis

16 Key Player Profiles

16.1 Roquette Riddhi Siddhi Private Limited

16.1.1 Company Overview

16.1.2 Description

16.1.3 Plant Capacities

16.1.4 Financial Performance

16.2 Gujarat Ambuja Exports Limited

16.2.1 Company Overview

16.2.2 Description

16.2.3 Plant Capacities

16.2.4 Financial Performance

16.3 Sukhjit Starch & Chemicals Ltd.

16.3.1 Company Overview

16.3.2 Description

16.3.3 Plant Capacities

16.3.4 Financial Performance

16.4 Sayaji Industries Limited

16.4.1 Company Overview

16.4.2 Description

16.4.3 Plant Capacities

16.4.4 Financial Performance

16.5 Universal Starch Chem Allied Ltd.

16.5.1 Company Overview

16.5.2 Description

16.5.3 Plant Capacities

16.5.4 Financial Performance

List of Figures

Figure 1: India: Native Starch Market: Major Drivers and Challenges

Figure 2: Global: Native Starch Market: Production Volume Trends (in Million Tons), 2019-2024

Figure 3: Global: Native Starch Market: Consumption Volume Trends (in Million Tons), 2019-2024

Figure 4: Global: Native Starch Market: Value Trends (in Billion USD), 2019-2024

Figure 5: Global: Native Starch Market: Average Prices (in USD/Ton), 2019-2024

Figure 6: Global: Native Starch Market: Production Breakup by Region (in %), 2024

Figure 7: Global: Native Starch Market: Consumption Breakup by Region (in %), 2024

Figure 8: Global: Native Starch Market: Production by Feedstock (in %), 2024

Figure 9: Global: Native Starch Market: Breakup by End Use (in %), 2024

Figure 10: Global: Native Starch Market Forecast: Production Volume Trends (in Million Tons), 2025-2033

Figure 11: Global: Native Starch Market Forecast: Consumption Volume Trends (in Million Tons), 2025-2033

Figure 12: Global: Native Starch Market Forecast: Value Trends (in Billion USD), 2025-2033

Figure 13: Global: Native Starch Market Forecast: Average Prices (in USD/Ton), 2025-2033

Figure 14: Global: Native Starch: Import Volume Breakup by Country

Figure 15: Global: Native Starch: Export Volume Breakup by Country

Figure 16: India: Native Starch Market: Production Volume Trends (in Million Tons), 2019-2024

Figure 17: India: Native Starch Market: Consumption Volume Trends (in Million Tons), 2019-2024

Figure 18: India: Native Starch Market: Average Prices (in USD/Ton), 2019-2024

Figure 19: India: Native Starch Market: Production Breakup by Region (in %), 2024

Figure 20: India: Native Starch Market: Consumption Breakup by Region (in %), 2024

Figure 21: India: Native Starch Market: Production Breakup by Feedstock (in %), 2024

Figure 22: India: Native Starch Market: Production Breakup by End Use (in %), 2024

Figure 23: India: Native Starch Market Forecast: Production Volume Trends (in Million Tons), 2025-2033

Figure 24: India: Native Starch Market Forecast: Consumption Volume Trends (in Million Tons), 2025-2033

Figure 25: India: Native Starch Market Forecast: Average Prices (in USD/Ton), 2025-2033

Figure 26: India: Native Starch: Import Volume Breakup by Country

Figure 27: India: Native Starch: Export Volume Breakup by Country

Figure 28: Andhra Pradesh: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 29: Bihar: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 30: Chhattisgarh: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 31: Delhi: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 32: Goa: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 33: Gujarat: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 34: Haryana: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 35: Himachal Pradesh: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 36: Jharkhand: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 37: Karnataka: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 38: Kerala: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 39: Madhya Pradesh: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 40: Maharashtra: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 41: Odisha: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 42: Punjab: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 43: Rajasthan: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 44: Tamil Nadu: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 45: Telangana: Native Starch Market: Consumption Volume (in ‘000 Tons), 2024 & 2033

Figure 46: Uttar Pradesh: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 47: Uttarakhand: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 48: West Bengal: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 49: Others: Native Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 50: India: Native Starch (Food Industries) Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 51: India: Native Starch (Textile Industries) Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 52: India: Native Starch (Paper Industries) Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 53: India: Native Starch (Pharmaceutical Industries) Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 54: India: Native Starch (Other Industries) Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 55: India: Corn Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 56: India: Cassava Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 57: India: Wheat Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 58: India: Other Starch Market: Consumption Volume (in ‘000 Tons), 2019, 2024 & 2033

Figure 59: India: Native Starch Industry: Value Chain Analysis

Figure 60: India: Native Starch Industry: Profit Margins at Various Levels of the Supply Chain

Figure 61: India: Native Starch Industry: SWOT Analysis

Figure 62: India: Native Starch Industry: Porter’s Five Forces Analysis

Figure 63: Native Corn Starch Manufacturing Plant: Detailed Process Flow

Figure 64: Native Corn Starch Manufacturing Process: Conversion Rate of Products

Figure 65: Native Corn Starch Manufacturing Plant: Breakup of Capital Costs (in %)

Figure 66: Native Wheat Starch Manufacturing Plant: Various Types of Unit Operations Involved

Figure 67: Native Wheat Starch Manufacturing Plant: Detailed Process Flow

Figure 68: Native Wheat Starch Manufacturing Process: Conversion Rate of Feedstocks

Figure 69: Native Wheat Starch Manufacturing Plant: Wheat Starch-A, Wheat Starch-B and Wheat Gluten Packaging

Figure 70: Native Wheat Starch Manufacturing Plant: Breakup of Capital Costs (in %)

Figure 71: Native Cassava Starch Manufacturing Plant: Detailed Process Flow

Figure 72: Cassava Starch Manufacturing: Conversion Rate of Feedstocks

Figure 73: Native Cassava Starch Manufacturing Plant: Breakup of Capital Costs (in %)

List of Tables

Table 1: Global: Native Starch Market: Key Industry Highlights, 2024 and 2033

Table 2: Global: Native Starch Market: Import Data of Major Countries

Table 3: Global: Native Starch Market: Export Data of Major Countries

Table 4: India: Native Starch Market: Key Industry Highlights, 2024 and 2033

Table 5: India: Native Starch Market: Import Data of Major Countries

Table 6: India: Native Starch Market: Export Data of Major Countries

Table 7: India: Native Starch Market Forecast: Breakup by Region (in ‘000 Tons), 2025-2033

Table 8: India: Native Starch Market Forecast: Breakup by Feedstock (in ‘000 Tons), 2025-2033

Table 9: India: Native Starch Market Forecast: Breakup by End Use (in ‘000 Tons), 2025-2033

Table 10: Andhra Pradesh: Native Starch Market: Production Capacity

Table 11: Gujarat: Native Starch Market: Production Capacity

Table 12: Haryana: Native Starch Market: Production Capacity

Table 13: Himachal Pradesh: Native Starch Market: Production Capacity

Table 14: Karnataka: Native Starch Market: Production Capacity

Table 15: Madhya Pradesh: Native Starch Market: Production Capacity

Table 16: Maharashtra: Native Starch Market: Production Capacity

Table 17: Punjab: Native Starch Market: Production Capacity

Table 18: Tamil Nadu: Native Starch Market: Production Capacity

Table 19: Telangana: Native Starch Market: Production Capacity

Table 20: Uttar Pradesh: Native Starch Market: Production Capacity

Table 21: Uttarakhand: Native Starch Market: Production Capacity

Table 22: West Bengal: Native Starch Market: Production Capacity

Table 23: India: Native Starch Market: Competitive Landscape

Table 24: Native Corn Starch Manufacturing Plant: Raw Material Requirements (in Tons/ Day)

Table 25: Native Corn Starch Manufacturing Plant: Costs Related to Land and Site Development (in USD)

Table 26: Native Corn Starch Manufacturing Plant: Costs Related to Civil Works (in USD)

Table 27: Native Corn Starch Manufacturing Plant: Machinery Costs (in USD)

Table 28: Native Corn Starch Manufacturing Plant: Raw Material Requirements (in Tons/Day)

Table 29: Native Corn Starch Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

Table 30: Native Corn Starch Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

Table 31: Native Corn Starch Manufacturing Plant: Capital Costs (in USD)

Table 32: Native Corn Starch Manufacturing Plant: Techno-Economic Parameters

Table 33: Native Corn Starch Manufacturing Plant: Income Projections (in USD)

Table 34: Native Corn Starch Manufacturing Plant: Expenditure Projections (in USD)

Table 35: Native Corn Starch Manufacturing Plant: Taxation (in USD)

Table 36: Native Corn Starch Manufacturing Plant: Depreciation (in USD)

Table 37: Native Corn Starch Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability

Table 38: Native Corn Starch Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability

Table 39: Native Corn Manufacturing Plant: Profit and Loss Account (in USD)

Table 40: Native Wheat Starch Manufacturing Plant: Costs Related to Land and Site Development (in USD)

Table 41: Native Wheat Starch Manufacturing Plant: Costs Related to Civil Works (in USD)

Table 42: Native Wheat Starch Manufacturing Plant: Costs Related to Machinery (in USD)

Table 43: Native Wheat Starch Manufacturing Plant: Raw Material Requirements

Table 44: Native Wheat Starch Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

Table 45: Native Wheat Starch Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

Table 46: Native Wheat Starch Manufacturing Plant: Capital Costs (in USD)

Table 47: Native Wheat Starch Manufacturing Plant: Techno-Economic Parameters

Table 48: Native Wheat Starch Manufacturing Plant: Income Projections (in USD)

Table 49: Native Wheat Starch Manufacturing Plant: Expenditure Projections (in USD)

Table 50: Native Wheat Starch Manufacturing Plant: Taxation (in USD)

Table 51: Native Wheat Starch Manufacturing Plant: Depreciation (in USD)

Table 52: Native Wheat Starch Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability

Table 53: Native Wheat Starch Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability

Table 54: Native Wheat Starch Manufacturing Plant: Profit and Loss Account

Table 55: Native Cassava Starch Manufacturing Plant: Raw Material Requirements (in Tons/Day)

Table 56: Native Cassava Starch Manufacturing Plant: Costs Related to Land and Site Development (in USD)

Table 57: Native Cassava Starch Manufacturing Plant: Costs Related to Civil Works (in USD)

Table 58: Native Cassava Starch Manufacturing Plant: Machinery Costs (in USD)

Table 59: Native Cassava Starch Manufacturing Plant: Raw Material Requirements (in Tons/Day)

Table 60: Native Cassava Starch Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

Table 61: Native Cassava Starch Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

Table 62: Native Cassava Starch Manufacturing Plant: Capital Costs (in USD)

Table 63: Native Cassava Starch Manufacturing Plant: Techno-Economic Parameters

Table 64: Native Cassava Starch Manufacturing Plant: Income Projections (in USD)

Table 65: Native Cassava Starch Manufacturing Plant: Expenditure Projections (in USD)

Table 66: Native Cassava Starch Manufacturing Plant: Taxation (in USD)

Table 67: Native Cassava Starch Manufacturing Plant: Depreciation (in USD)

Table 68: Native Cassava Starch Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability

Table 69: Native Cassava Starch Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability

Table 70: Native Cassava Manufacturing Plant: Profit and Loss Account (in USD)

Table 71: Roquette Riddhi Siddhi: Plant Capacities, 2018

Table 72: Riddhi Siddhi: Key Financials (in USD Million)

Table 73: Gujarat Ambuja: Plant Capacities, 2018

Table 74: Gujarat Ambuja: Key Financials (in USD Million)

Table 75: Sukhjit Starch: Plant Capacities, 2018

Table 76: Sukhjit Starch: Key Financials (in USD Million)

Table 77: Sayaji Industries: Plant Capacities, 2018

Table 78: Sayaji Industries: Key Financials (in USD Million)

Table 79: Universal Starch: Plant Capacities, 2018

Table 80: Universal Starch: Key Financials (in USD Million)

Companies Mentioned

- Roquette Riddhi Siddhi Private Limited

- Gujarat Ambuja Exports Limited

- Sukhjit Starch & Chemicals Ltd.

- Sayaji Industries Limited

- Universal Starch Chem Allied Ltd.

Table Information

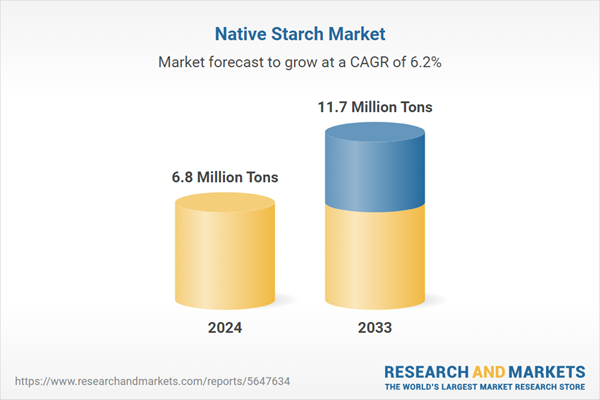

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value in 2024 | 6.8 Million Tons |

| Forecasted Market Value by 2033 | 11.7 Million Tons |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | India |

| No. of Companies Mentioned | 5 |