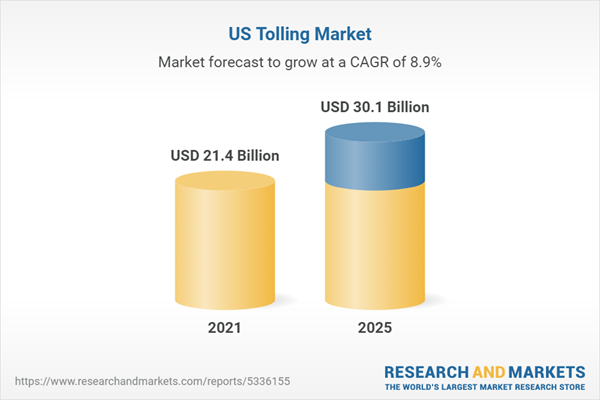

Growth of the overall US tolling market has also been forecasted for the period 2021-2025, taking into consideration the previous growth patterns, the growth drivers and the current and future trends.

Verra Mobility Corporation, KAPSCH (KAPSCH TrafficCom), Roper Technologies, Inc. (TransCore), Abertis (Emovis) and Sociedad Ibérica de Construcciones Eléctricas (Sice Inc.) are some of the key players operating in the US tolling market, whose company profiling has been done in the report. In this segment of the report, business overview, financial overview and business strategies of the companies are provided.

Company Coverage

- Verra Mobility Corporation

- KAPSCH (KAPSCH TrafficCom)

- Roper Technologies, Inc. (TransCore)

- Abertis (Emovis)

- Sociedad Ibérica de Construcciones Eléctricas (Sice Inc.)

Executive Summary

There are usually two tolling elements: charging methods and collecting methods. Charging methods includes three types: Time Based Charges and Access Fees, Motorway and other Infrastructure Tolling and Distance or Area Charging. Whereas, collection method is classified into three categories namely, open toll system, closed toll system and open road/electronic toll system.

Electronic toll collection system is composed of three major components. First RFID (RFID tag, or transponder, consists of a chip and an antenna), second is reader and third is in-lane computer. RFID tag emits the information/identification data through antenna to the reader. Reader transmits the data to central database and facilitate with full information of the owner. Lastly, in-lane computer generates the appropriate toll charge of the vehicle and slip the information in the customers prepaid account.

The US tolling market has increased at a significant CAGR during the years 2016-2020 and projections are made that the market would rise in the next four years i.e. 2021-2025 tremendously. The US tolling market is expected to increase due many growth drivers such as Escalating Rental Car Industry, Approaching New Projects, Truck Only Tolls, Modification in Electronic Toll Collection System, etc. Yet the market faces some challenges such as Economic Risk for the Tolling Business, Struggle to increase interoperability, etc.

Table of Contents

Companies Mentioned

- Verra Mobility Corporation

- KAPSCH (KAPSCH TrafficCom)

- Roper Technologies, Inc. (TransCore)

- Abertis (Emovis)

- Sociedad Ibérica de Construcciones Eléctricas (Sice Inc.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 63 |

| Published | May 2021 |

| Forecast Period | 2021 - 2025 |

| Estimated Market Value ( USD | $ 21.4 Billion |

| Forecasted Market Value ( USD | $ 30.1 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | United States |

| No. of Companies Mentioned | 5 |