Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Health Consciousness and Awareness

The escalating consciousness surrounding health and wellness within the Saudi Arabian populace emerges as a pivotal force propelling various sectors, particularly the dietary supplements industry. This heightened awareness stems from a multifaceted shift towards prioritizing preventive healthcare measures and addressing lifestyle-related diseases, which have become increasingly prevalent in the country. Individuals are recognizing the significance of proactively managing their health through holistic approaches, including dietary modifications and the integration of supplements into their daily regimen.In response to the burgeoning emphasis on preventive healthcare, there has been a notable surge in the adoption of dietary supplements among Saudis. These supplements are perceived as essential tools for fortifying overall well-being and bridging nutritional gaps that may arise from dietary deficiencies or lifestyle choices. As individuals strive to optimize their health and vitality, they turn to supplements as convenient and accessible means to complement their existing nutrition and lifestyle practices. The growing prevalence of lifestyle-related diseases, such as obesity, diabetes, and cardiovascular ailments, has heightened concerns regarding health outcomes and spurred proactive measures among the population. Recognizing the potential role of dietary supplements in mitigating health risks and supporting optimal health, individuals are increasingly inclined to incorporate these products into their wellness routines.

Rising Disposable Incomes

As Saudi Arabia’s economy continues to experience robust growth, the consumer market, particularly in sectors like healthcare and wellness, is witnessing a substantial shift. According to a USDA report, the population of Saudi Arabia is currently 33.1 million, with a per-capita income of USD 27,680. The country is characterized by strong economic indicators, including a low unemployment rate of 5%, a controlled inflation rate of less than 2%, and minimal inflation on food products (less than 1%). These economic conditions have significantly increased the disposable income of the Saudi population, allowing individuals to spend more on enhancing their quality of life, particularly on health-related products and services.One key driver of this transformation is the growing consumer demand for healthier options. With more disposable income, individuals are increasingly willing to invest in their health, fueling demand for wellness and healthcare products, especially dietary supplements. Consumers are now more focused on preventive healthcare, recognizing the long-term benefits of maintaining their health through lifestyle choices and supplements that support overall well-being.

This shift is not limited to any one demographic group; from affluent urban residents to middle-income households, more consumers are prioritizing their health and wellness needs. As a result, dietary supplements have become an essential part of many people’s daily routines. Furthermore, the rising popularity of online shopping, particularly in food and health-related products, is facilitating easy access to these supplements across the country, contributing to the growth of this market segment. The increased affordability of dietary supplements, combined with the nation’s growing awareness around preventive health practices, is driving the expansion of the dietary supplements market in Saudi Arabia

Urbanization and Changing Lifestyles

The rapid urbanization and modernization of Saudi Arabia have led to significant shifts in dietary habits and overall lifestyle, which have, in turn, influenced the country's health landscape. According to the Ministry of Municipal and Rural Affairs, approximately 82.1% of the population now resides in urban areas, with the remaining 17.9% living in rural regions. Six urban regions have recorded high urbanization rates exceeding 80%, including the Eastern Province (93.2%), Riyadh (90.9%), Holy Makkah (87.6%), Northern Borders (86.7%), Tabuk (85.9%), and Jouf (84.5%). Urbanization is expected to continue growing, reaching 97.6% by 2030.As urban centers expand, traditional eating habits are being replaced by more convenient but often nutritionally inadequate food choices. The rise of sedentary lifestyles, driven by long commutes, office-based jobs, and limited physical activity, coupled with the increasing consumption of processed foods full of preservatives, additives, and sugars, has contributed to nutritional deficiencies among the Saudi population.

To address these gaps, many Saudis are turning to dietary supplements. A study published in Cureus in June 2023 found that 63% of participants did not change their supplement consumption patterns during the pandemic, while 16% increased and 21.4% reduced their use. Iron, calcium (particularly for pregnant women), omega-3 (for individuals over 65), and vitamin D were the most commonly used supplements. Recognizing the insufficiency of their diets, Saudi consumers are increasingly relying on supplements to bridge nutritional gaps and safeguard their health in the face of modern lifestyle challenges.

Aging Population

Saudi Arabia’s demographic profile is undergoing a profound transformation, primarily driven by advances in healthcare, improved living conditions, and rising life expectancy. As a result, the country is experiencing significant population aging. According to a report by the UNFPA, the number of people aged 60 and above is projected to increase dramatically from 2 million (5.9% of the population) in 2020 to 10.5 million (23.7% of the population) by 2050. This aging trend is presenting new challenges to healthcare and society, as the country’s elderly population grows rapidly.The increasing number of older adults in Saudi Arabia has been accompanied by a rise in age-related health concerns, which are becoming more prevalent and require urgent attention. Conditions like osteoporosis, arthritis, and cognitive decline, particularly dementia, are major health issues that affect quality of life for the elderly. For example, osteoporosis, a condition that weakens bones, currently affects 28.2% of women and 37.8% of men over 50 in Saudi Arabia. As the population ages, the incidence of musculoskeletal disorders, such as knee osteoarthritis, has also increased. A study indicates that 60.6% of individuals aged 66-75 suffer from knee osteoarthritis, compared to just 30.8% of those aged 46-55.

These conditions limit mobility, independence, and overall well-being, necessitating an urgent focus on addressing their impact. In response to these age-related health concerns, there has been a notable uptick in the demand for dietary supplements tailored to address the specific needs of older adults. Supplements targeting bone health, such as calcium and vitamin D, play a crucial role in supporting bone density and strength, thereby reducing the risk of fractures and osteoporosis. Similarly, supplements containing omega-3 fatty acids, renowned for their anti-inflammatory properties, are sought after for their potential to alleviate joint pain and stiffness associated with arthritis. As the elderly population continues to expand, the demand for supplements targeted at age-related conditions is expected to rise, creating significant opportunities for manufacturers and suppliers in the healthcare sector.

Key Market Challenges

Regulatory Compliance and Quality Assurance

One of the primary challenges facing the Saudi Arabia Dietary Supplements Market is ensuring compliance with stringent regulatory requirements and maintaining high standards of quality assurance. The Saudi Food and Drug Authority (SFDA) regulates the import, manufacture, and distribution of dietary supplements, imposing rigorous standards to ensure product safety, efficacy, and labeling accuracy. Navigating the complex regulatory landscape, obtaining necessary certifications, and adhering to evolving regulatory frameworks can pose significant hurdles for market players, particularly smaller businesses and new entrants. Ensuring consistent quality control throughout the supply chain, including sourcing raw materials, manufacturing processes, and distribution channels, presents ongoing challenges for industry stakeholders.Market Fragmentation and Competition

The Saudi Arabia Dietary Supplements Market is characterized by a high degree of fragmentation and intense competition, with numerous domestic and international players vying for market share. This competitive landscape poses challenges for companies in terms of differentiation, brand positioning, and market penetration strategies. Established brands with extensive marketing budgets and distribution networks often dominate the market, making it difficult for smaller players to gain traction and establish a foothold. Counterfeit products, unauthorized imports, and substandard supplements further exacerbate market fragmentation and undermine consumer confidence, necessitating robust enforcement measures and heightened vigilance from regulatory authorities.Key Market Trends

Prevalence of Lifestyle-related Diseases

The escalating prevalence of lifestyle-related diseases, including obesity, diabetes, and cardiovascular ailments, has emerged as a pressing public health concern in Saudi Arabia, prompting a paradigm shift in healthcare priorities and driving heightened awareness about the pivotal role of nutrition and dietary supplementation in disease prevention and management. As the kingdom grapples with the health implications of modern lifestyles characterized by sedentary behaviors, poor dietary choices, and stress-inducing environments, there has been a growing recognition of the need for proactive interventions to mitigate the escalating burden of chronic diseases.In response to this imperative, there has been a notable surge in demand for dietary supplements targeting specific health conditions prevalent in Saudi Arabia. Among these, diabetic-friendly supplements and cholesterol-lowering supplements have witnessed particularly robust demand, reflecting the acute need for adjunctive therapies to support disease management and promote optimal health outcomes among affected individuals.

Government Initiatives Promoting Health and Wellness

The Saudi Arabian government has undertaken proactive measures to address the burgeoning challenges posed by lifestyle-related diseases and to foster a culture of health and wellness among its populace. Through a series of concerted initiatives and campaigns, the government has prioritized public health and advocated for healthier lifestyles, with a particular emphasis on promoting balanced nutrition and preventive healthcare practices.Central to the government's efforts are extensive campaigns aimed at raising awareness about the importance of dietary habits and nutritional intake in mitigating the risk of chronic diseases. These campaigns, often disseminated through various media channels and public platforms, serve to educate the population about the significance of dietary supplements as complementary tools in fulfilling nutritional needs and fortifying overall health. By spotlighting the pivotal role of dietary supplements in preventive healthcare, the government endeavors to empower individuals to take proactive steps towards optimizing their health and well-being. Through targeted messaging and educational outreach, citizens are encouraged to incorporate dietary supplements into their daily routines as part of a holistic approach to wellness.

Segmental Insights

Product Type Insights

Based on Product Type, the Vitamin emerged as the fastest growing segment in the Saudi Arabia Dietary Supplements market during the forecast period. As health awareness increases in Saudi Arabia, vitamins are increasingly recognized as vital for preventing nutritional deficiencies and promoting overall well-being. A study published in journal Cureus in June 2023 revealed that 68.7% of Saudi women visiting fitness centers in Riyadh regularly use dietary supplements, with vitamins being the most commonly consumed (82.8%), followed by amino acids and proteins (30.3%). The growing focus on preventive healthcare and long-term wellness is driving this demand.Additionally, the aging population in Saudi Arabia has raised the need for vitamins targeting age-related health concerns, such as bone health, cognitive function, and immune support. With urbanization and less balanced diets, people are turning to vitamins to address nutritional gaps caused by processed foods. Due to their ease of use, widespread availability, and affordability, vitamins have become the preferred supplement for individuals seeking to improve their health and energy. Consequently, the demand for vitamins in Saudi Arabia is growing rapidly, making them a leading segment in the dietary supplements market.

Form Insights

Based on Form, capsules emerged as the dominating segment in the Saudi Arabia Dietary Supplements market in 2024. Capsules offer several advantages that resonate with consumers, including ease of consumption, convenient dosing, and superior stability of active ingredients. These encapsulated formulations are preferred by many individuals due to their ease of swallowing, especially for those who may have difficulty with larger tablets or dislike the taste of powders. Capsules are known for their versatility, allowing for the encapsulation of a wide range of ingredients, including vitamins, minerals, botanical extracts, and specialized formulations. While other forms such as tablets, powders, soft gels, and liquid supplements also hold significance in the market, it is the convenience, efficacy, and broad applicability of capsules that contribute to their dominance in the Saudi Arabian dietary supplements landscape.Regional Insights

Based on Region, Central Region emerged as the dominating region in the Saudi Arabia Dietary Supplements market in 2024. The Central region encompasses major urban centers such as Riyadh, the capital city, and the surrounding metropolitan areas, which serve as economic, cultural, and commercial hubs of the kingdom. This region boasts a dense population, characterized by a diverse demographic mix ranging from affluent urbanites to middle-income households, as well as a burgeoning expatriate community.Several factors contribute to the dominance of the Central region in the Saudi Arabian dietary supplements market. Riyadh, as the capital city and a key economic center, houses a significant concentration of healthcare facilities, including hospitals, clinics, and pharmacies, which serve as vital distribution channels for dietary supplements. The presence of renowned medical institutions, healthcare professionals, and specialty clinics further amplifies demand for dietary supplements among residents seeking preventive healthcare and wellness solutions. The Central region is characterized by higher levels of disposable income and purchasing power compared to other parts of the kingdom, owing to its status as an economic powerhouse and center of commerce and industry. For instance, the average household income in Riyadh is USD 3,385.59. As a result, consumers in this region exhibit greater willingness and ability to invest in health and wellness products, including dietary supplements, as part of their proactive approach to personal well-being.

Key Market Players

- Pfizer Saudi Limited Corporate

- Abbott Saudi Arabia Trading Llc

- Bayer Saudi Arabia LLC

- Nestlé Saudi Arabia LLC

- GSK Saudi Arabia

- Sewar

- Dr Nutrition Saudi Arabia

- JNK Nutrition KSA

- Dallah Pharma

- Bashir Shakib Al-Jabri & Co. Ltd.

Report Scope:

In this report, the Saudi Arabia Dietary Supplements Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Dietary Supplements Market, By Product Type:

- Vitamin

- Combination Dietary Supplement

- Protein

- Herbal Supplement

- Fish Oil & Omega Fatty Acid

- Others

Saudi Arabia Dietary Supplements Market, By Form:

- Capsules

- Tablets

- Powder

- Soft Gels

- Liquid

Saudi Arabia Dietary Supplements Market, By Distribution Channel:

- Pharmacies and Drug Stores

- Online

- Supermarkets and Hypermarkets

- Others

Saudi Arabia Dietary Supplements Market, By Application:

- Immunity

- General Health

- Energy & Weight Management

- Bone & Joint Health

- Others

Saudi Arabia Dietary Supplements Market, By End User:

- Adults

- Geriatric

- Pregnant Females

- Children

- Infants

Saudi Arabia Dietary Supplements Market, By Region:

- Western Region

- Central Region

- Southern Region

- Eastern Region

- Northern Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Dietary Supplements Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Pfizer Saudi Limited Corporate

- Abbott Saudi Arabia Trading Llc

- Bayer Saudi Arabia LLC

- Nestlé Saudi Arabia LLC

- GSK Saudi Arabia

- Sewar

- Dr Nutrition Saudi Arabia

- JNK Nutrition KSA

- Dallah Pharma

- Bashir Shakib Al-Jabri & Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 83 |

| Published | January 2025 |

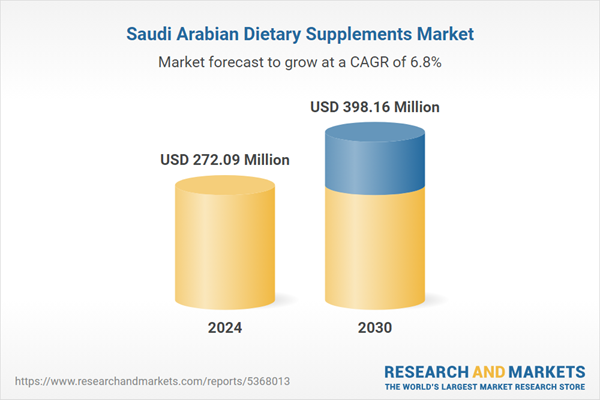

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 272.09 Million |

| Forecasted Market Value ( USD | $ 398.16 Million |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |