Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The U.S. energy drink market is witnessing dynamic growth, driven by evolving consumer preferences and a surge in product innovations. Key trends shaping the market include a growing emphasis on natural and plant-based ingredients, with consumers seeking clean-label energy drinks free from artificial additives. Flavored energy drinks - particularly fruit-forward varieties like strawberry, lemonade, orange, and pineapple - are gaining popularity among younger demographics.

Additionally, health-conscious consumers are propelling demand for low- and no-sugar formulations. A parallel trend towards sustainable packaging is emerging, with brands increasingly adopting recyclable materials, such as aluminum cans and glass bottles. These developments reflect a broader shift toward healthier, environmentally responsible, and innovative energy drink solutions in the United States.

Key Market Drivers

Increasing Demand for Functional Beverages

The surging demand for functional beverages is a primary driver of growth in the U.S. energy drink market. As consumers become more health-conscious, they are seeking beverages that deliver benefits beyond basic hydration. Energy drinks, often formulated with ingredients such as caffeine, taurine, and B-vitamins, are valued for their ability to enhance energy levels, focus, and stamina - qualities that align with the fast-paced modern lifestyle.This trend is closely tied to the broader wellness movement, with consumers favoring energy drinks that support mental clarity, physical endurance, and stress management. Many leading brands are positioning their products to highlight functional benefits, offering targeted solutions for cognitive performance, athletic enhancement, or general vitality, catering to a wide range of consumer needs.

Key Market Challenges

Regulatory Scrutiny and Legal Challenges

Regulatory scrutiny poses a significant challenge to the U.S. energy drink market. Increasing health concerns have prompted greater oversight by the U.S. Food and Drug Administration (FDA) and other regulatory bodies. Although the FDA does not classify energy drinks strictly as food or drugs, it has issued guidelines to promote accurate labeling and ensure consumer safety.Additionally, several states and municipalities have proposed or enacted regulations restricting the sale of energy drinks to minors, reflecting concerns over the health risks associated with high-caffeine products. Legal challenges related to misleading marketing claims, particularly around mental performance or athletic benefits, have further intensified pressure on manufacturers to substantiate product claims with scientific evidence and ensure transparent labeling practices.

Key Market Trends

Sustainability and Eco-Friendly Packaging

Sustainability is becoming a key trend within the U.S. energy drink market, as environmentally conscious consumers increasingly demand eco-friendly products. In response, energy drink manufacturers are adopting sustainable practices across their operations, with a focus on packaging innovation.Aluminum cans, known for their recyclability and lower environmental impact compared to plastic bottles, are becoming the preferred packaging format. Some brands are also exploring biodegradable plastics and glass packaging as part of their broader corporate social responsibility initiatives. This shift toward sustainable materials not only enhances brand image but also appeals to a growing segment of consumers who prioritize environmental stewardship in their purchasing decisions.

Key Market Players

- PepsiCo, Inc.

- Monster Beverage Corporation

- Red Bull Media House North America, Inc.

- Nestlé USA Inc.

- The Coca-Cola Company

- AriZona Beverages USA, LLC

- Campbell Soup Company (V8 Energy)

- National Beverage Corp.

- Vital Pharmaceuticals, Inc.

- Dr Pepper/Seven Up, Inc. (Venom, Xyience Energy)

Report Scope:

In this report, the United States Energy Drink Market has been segmented into the following categories, along with detailed industry trend analysis:United States Energy Drink Market, By Product Type:

- Organic

- Conventional

United States Energy Drink Market, By End User:

- Teenagers

- Adults

- Geriatric Population

United States Energy Drink Market, By Sales Channel:

- Supermarkets/Hypermarkets

- Departmental Stores

- Online

- Others

United States Energy Drink Market, By Region:

- South

- West

- Midwest

- Northeast

Competitive Landscape

Company Profiles: Detailed analysis of major companies operating in the United States Energy Drink Market.Available Customizations:

With the provided market data, the publisher offers customization options to meet specific business needs, including:

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- PepsiCo, Inc.

- Monster Beverage Corporation

- Red Bull Media House North America, Inc.

- Nestlé USA Inc.

- The Coca-Cola Company

- AriZona Beverages USA, LLC.

- Campbell Soup Company (V8 Energy)

- National Beverage Corp.

- Vital Pharmaceuticals, Inc

- Dr. Pepper/Seven Up, Inc. (Venom, Xyience Energy)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | April 2025 |

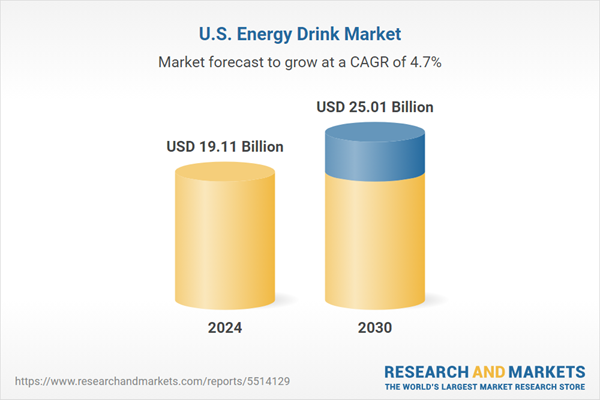

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 19.11 Billion |

| Forecasted Market Value ( USD | $ 25.01 Billion |

| Compound Annual Growth Rate | 4.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |