One major driver of the bunker fuel market growth is the steady expansion of the global maritime trade. As international shipping volumes continue to rise due to an increased demand for consumer goods, raw materials, and industrial products, the need for reliable marine fuel solutions grows accordingly. Bunker fuel remains a primary energy source for commercial vessels, including container ships, bulk carriers, and tankers. Expanding port infrastructure and fleet modernization are further contributing to sustained fuel consumption. In addition to this, the government is also imposing regulations for cleaner fuel adoption. For instance, in January 2025, The U.S. Treasury and IRS released guidance on Section 45Z, offering 2025 tax credits for producing transportation fuels, including SAF and non-SAF, with reduced lifecycle greenhouse gas emissions. Additionally, regulatory measures, such as the International Maritime Organization's (IMO) 2020 sulfur cap, are reshaping fuel preferences, accelerating the demand for compliant low-sulfur fuel alternatives in key shipping routes. This, in turn, is facilitating the bunker fuel market demand across the globe.

The United States plays a significant role in the global bunker fuel market through its well-established port infrastructure, extensive refining capacity, and regulatory alignment with international maritime standards. For instance, in October 2024, ABS announced granting of AiP to VARD’s ammonia bunkering barge, developed by the RADIUS consortium, compatible with vessels like Höegh’s Aurora Class and MMMCZCS’s 15,000 TEU container ship, targeting 2030 East Coast operations. Major ports, such as Houston, Los Angeles, and New York, serve as key bunkering hubs, supplying a range of marine fuels, including very low sulfur fuel oil (VLSFO) and marine gas oil (MGO). The U.S. refiners are actively producing compliant fuels to meet IMO 2020 regulations, while also investing in cleaner alternatives like LNG and biofuels. This also represents one of the key bunker fuel market trends across the country. Strategic geographical positioning and robust trade activity further enable the U.S. to support global maritime fuel demands efficiently.

Bunker Fuel Market Trends:

Stringent environmental regulations

Stringent environmental regulations implemented by governing agencies of several countries are propelling the bunker fuel market growth. According to the World Meteorological Organization, global carbon dioxide (CO₂) emissions was reported to reach 41.6 Billion tons in 2024, up from 40.6 Billion tonnes in 2023, with rising temperatures causing increasingly severe environmental impacts. In response to concerns about air pollution and greenhouse gas (GHG) emissions, international organizations, such as the International Maritime Organization (IMO), are implementing various regulations. These regulations mandate the use of cleaner, low-sulfur bunker fuels, encouraging the industry to invest in cleaner technologies and fuels. Ship operators must comply with these rules, driving the demand for compliant fuels and catalyzing innovation in the sector. This shift towards cleaner fuels not only benefits the environment but also opens new market opportunities for suppliers of low-sulfur and alternative bunker fuels, positioning them for long-term growth and profitability in the evolving maritime industry.Global trade expansion

As economies are expanding and international commerce is flourishing, the demand for maritime transport is increasing. Bunker fuel is prominent in the shipping industry, powering cargo vessels that transport goods across the oceans worldwide. This increasing need for shipping services results in higher bunker fuel market demand. Developing economies are witnessing a rise in trade activities, further impelling the growth of the market. According to UN Trade & Development, global trade is projected to reach nearly USD 33 Trillion in 2024, reflecting a 3.3% annual growth, driven primarily by a 7% increase in trade in services. Moreover, the diversification of trade routes and the rising number of new shipping hubs are contributing to a more dynamic and robust bunker fuel market. The growing trend of global trade, making bunker fuel an essential component of the international supply chain is offering a favorable market outlook.Technological advancements in maritime industry

Ongoing technological advancements in the maritime industry are strengthening the growth of the market. Modern vessels are designed to be more fuel-efficient and environment friendly. Innovations like advanced engine designs, hull optimization, and route planning software help ships consume less fuel per voyage. This not only reduces operating costs for shipping companies but also lowers their environmental footprint. According to the 2024 Review of Maritime Transport by UNCTAD, maritime trade volume is projected to expand by 2% in 2024, with containerized trade volumes forecasted to grow by 3.5%. Additionally, between 2025 and 2029, total seaborne trade is expected to increase at an average rate of 2.4%, driving higher fuel consumption. As shipowners and operators increasingly prioritize fuel efficiency and emissions reductions, they are more likely to adopt eco-friendly bunker fuels, such as liquefied natural gas (LNG) and hydrogen-based alternatives. This shift towards cleaner technologies and fuels is presenting growth opportunities for suppliers of bunker fuels, aligning with the sustainability goals.Emerging markets and industrialization

Rapid industrialization in emerging markets is strengthening the growth of the market. Several countries are experiencing substantial economic growth, leading to increased production and trade activities. These nations rely heavily on maritime transport to import raw materials and export finished goods. Consequently, there is a growing need for bunker fuels to power the vessels involved in these trade routes. For instance, in March 2025, Hafnia, in partnership with Studio 30 50, is launching FuelSure, a digital platform integrating real-time data to enhance transparency, accountability, and cost efficiency in the maritime bunker fuel market. As industrialization is driving economic development in these regions, the demand for bunker fuels is rising. Moreover, emerging markets are witnessing an increase in cruise tourism, further catalyzing the demand for bunker fuels.Bunker Fuel Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the global bunker fuel market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on fuel type, vessel type, and seller.Analysis by Fuel Type:

- High Sulfur Fuel Oil (HSFO)

- Very Low Sulfur Fuel Oil (VLSFO)

- Marine Diesel Oil (MDO)

- Liquefied Natural Gas (LNG)

Analysis by Vessel Type:

- Containers

- Tankers

- General Cargo

- Bulk Carrier

- Others

Analysis by Seller:

- Major Oil Companies

- Leading Independent Sellers

- Small Independent Sellers

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Key Regional Takeaways:

United States Bunker Fuel Market Analysis

The United States bunker fuel market is experiencing steady growth, driven by the rising demand for marine transportation and increasing trade activities. The country's extensive coastline and strategic ports play a crucial role in facilitating bunker fuel consumption across the shipping sector. The growing adoption of low-sulfur fuel oils (LSFO), in line with IMO 2020 regulations, is significantly influencing market trends as shipping companies seek to comply with stringent emission norms. Moreover, the rising emphasis on eco-friendly fuel alternatives, such as liquefied natural gas (LNG) and biofuels, is reshaping the market landscape. Advancements in fuel storage infrastructure and the expansion of shipping routes are further supporting market growth. The market is also benefitting from increased trade volumes, with the United States goods and services deficit rising by 17.0% in 2024, alongside a 3.9% increase in exports and a 6.6% rise in imports, according to the Bureau of Economic Analysis. With ongoing regulatory developments, rising maritime trade, and the adoption of sustainable fuels, the United States bunker fuel market is poised for consistent expansion in the coming years.North America Bunker Fuel Market Analysis

The North America bunker fuel market is supported by a strong maritime infrastructure, advanced refining capacity, and strategic coastal locations. Major ports such as Houston, Los Angeles, Vancouver, and New York serve as key bunkering hubs for international and domestic shipping routes. The implementation of the IMO 2020 sulfur cap has prompted a shift toward very low sulfur fuel oil (VLSFO) and marine gas oil (MGO), driving refiners and suppliers in the region to adapt product offerings. Growing emphasis on cleaner marine fuels, including liquefied natural gas (LNG) and biofuels, is encouraging investments in alternative fuel infrastructure. For instance, in response to a 2024 trade probe, the U.S. may imposed up to $1 million port fees or $1,000 per net ton on vessels owned by Chinese maritime transport operators. Regulatory alignment, stable demand from cargo and cruise operations, and technological innovation position North America as a competitive and compliant bunker fuel market.Europe Bunker Fuel Market Analysis

The Europe bunker fuel market is growing steadily, driven by the region’s expanding maritime trade and stringent environmental regulations. The implementation of the IMO 2020 sulfur cap has accelerated the shift toward low-sulfur fuel oils (LSFO) and alternative fuels. Major ports in countries play a crucial role in driving bunker fuel demand across the region. The rising adoption of liquefied natural gas (LNG) and biofuels as cleaner alternatives is further supporting market growth. Further forcing shipping companies towards greener fuel options is the implementation of the EU Emissions Trading System (EU ETS) from January 2024. It captures all CO₂ emissions from every large vessel (5,000 gross tonnage and above) entering the EU ports, irrespective of their flag. This regulatory expansion is expected to accelerate the transition to sustainable bunker fuels. The region’s ongoing investments in green shipping initiatives and emission reduction technologies are creating new growth opportunities.Asia Pacific Bunker Fuel Market Analysis

The Asia Pacific bunker fuel market is witnessing robust growth, driven by the region’s position as a global trade hub and increasing maritime activities. The presence of major ports is fueling the demand for bunker fuel. The widespread adoption of low-sulfur fuel oils (LSFO) following the IMO 2020 regulations is reshaping the market landscape. Additionally, rising investments in LNG bunkering infrastructure and the growing preference for eco-friendly fuel alternatives are supporting market expansion. The region's inflating trade activities further contribute to market growth, with the Press Information Bureau reporting that FY 2023-24 closed with the highest monthly merchandise exports of the current fiscal year in March 2024, reaching USD 41.68 Billion. This surge in exports is driving greater demand for marine transportation, consequently boosting bunker fuel consumption.Latin America Bunker Fuel Market Analysis

The Latin America bunker fuel market is expanding steadily, supported by the region’s growing maritime trade and shipping activities. Countries like Brazil, Mexico, and Panama serve as key bunkering hubs, driving fuel demand across the region. The shift toward low-sulfur fuel oils (LSFO) in line with international regulations is reshaping market preferences. Furthermore, increasing investments in port infrastructure and fuel storage facilities are contributing to market expansion. According to The Maritime Executive, Brazil's privatization plan targets over 50 projects, including port leases and concessions slated for the next two years, with expected investments worth over USD 3 Billion in the Brazilian port sector. These infrastructure developments are expected to enhance the region's bunkering capacity and fuel storage facilities.Middle East and Africa Bunker Fuel Market Analysis

The Middle East and Africa bunker fuel market is growing due to strategic location and increasing maritime trade. Major ports in Saudi Arabia, UAE, and South Africa support fuel demand. Low-sulfur fuel oils and LNG are reshaping the market while rising port infrastructure investments and regulatory compliance support market expansion. The region’s maritime sector is witnessing notable progress, with reports stating that Saudi Arabia recorded a 6.4% increase in gross tonnage of its maritime fleet in 2024 compared to 2023, strengthening its position in the Arab and regional maritime transport sectors. The region’s strategic importance in global shipping routes and the rising focus on environmental sustainability, is projected to positively influence the bunker fuel market forecast.Competitive Landscape:

The bunker fuel market features a competitive landscape marked by the presence of major oil companies, regional suppliers, and independent bunker traders. Key players maintain a strong market position through extensive global networks, advanced refining capabilities, and diversified fuel offerings. For instance, in March 2024, Chevron’s first hybrid electric bunker tanker, launched in Singapore, announced its plans to supply regional maritime customers with fuel while using 20% less energy than conventional tankers, helping lower emissions, and operational costs. These companies are increasingly investing in low-sulfur and alternative fuels to comply with evolving environmental regulations. Additionally, independent suppliers and local distributors compete by offering flexible pricing and localized services in high-traffic ports. Strategic partnerships, mergers, and technological innovations in fuel quality and delivery systems continue to shape competition and drive market differentiation.The report provides a comprehensive analysis of the competitive landscape in the bunker fuel market with detailed profiles of all major companies, including:

- Bomin Bunker Holding GmbH & Co. KG (Marquard & Bahls AG)

- BP Plc

- Chevron Corporation

- Exxon Mobil Corporation

- Gazprom Neft PJSC (Gazprom)

- LUKOIL

- Neste Oyj

- Petroliam Nasional Berhad (PETRONAS)

- Royal Dutch Shell Plc

- TOTAL S.A.

Key Questions Answered in This Report

1. How big is the bunker fuel market?2. What is the future outlook of bunker fuel market?

3. What are the key factors driving the bunker fuel market?

4. Which region accounts for the largest bunker fuel market share?

5. Which are the leading companies in the global bunker fuel market?

Table of Contents

Companies Mentioned

- Bomin Bunker Holding GmbH & Co. KG (Marquard & Bahls AG)

- BP Plc

- Chevron Corporation

- Exxon Mobil Corporation

- Gazprom Neft PJSC (Gazprom)

- LUKOIL

- Neste Oyj

- Petroliam Nasional Berhad (PETRONAS)

- Royal Dutch Shell Plc

- TOTAL S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

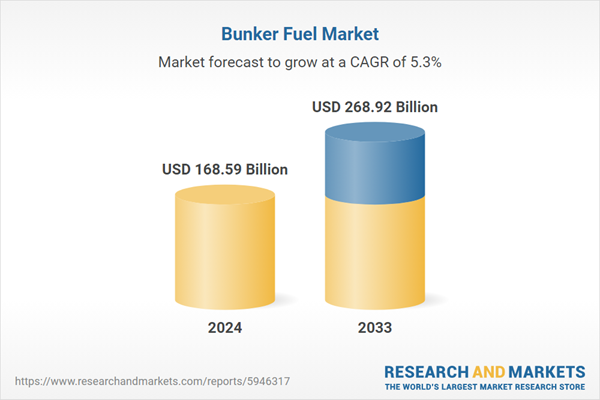

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 168.59 Billion |

| Forecasted Market Value ( USD | $ 268.92 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |