Speak directly to the analyst to clarify any post sales queries you may have.

The high purity dearomatized hydrocarbon solvents market is experiencing rapid transformation driven by shifting regulatory requirements, technology enhancements, and evolving operational needs. Senior decision-makers require precise, actionable insights to navigate these changes and position their organizations for sustainable growth in a dynamic industrial environment.

Market Snapshot: High Purity Dearomatized Hydrocarbon Solvents Market Growth and Trends

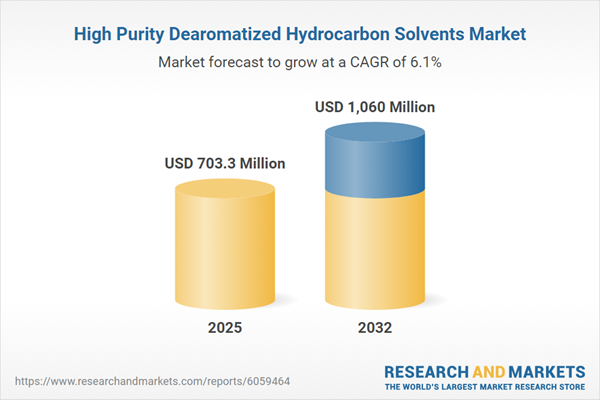

The high purity dearomatized hydrocarbon solvents market expanded from USD 664.80 million in 2024 to USD 703.30 million in 2025. It is projected to reach USD 1.06 billion by 2032 at a CAGR of 6.09%. This upward trend is driven by increasing usage across electronics, coatings, adhesives, and automotive industries. Organizational focus has shifted to optimizing product performance, ensuring regulatory compliance, minimizing environmental impact, and enhancing worker safety. The adoption of advanced formulations and technologies further supports the sector’s push for reliable solutions tailored to high-value industrial applications.

Scope & Segmentation of the High Purity Dearomatized Hydrocarbon Solvents Market

- Type: Market segmentation includes aliphatic dearomatized hydrocarbon solvents, blended variants, and cycloparaffinic (naphthenic) formulations. These options are selected for their adaptability to diverse industrial processes and custom chemical applications.

- Boiling Range: Solutions are categorized by high boiling point (200°C and above), medium (140-200°C), or low (80-140°C) boiling point ranges, allowing for precise matching to specific volatility and solvency requirements across production environments.

- Application Areas: Key usage sectors encompass adhesives and sealants, aerospace and automotive, agrochemicals, metalworking and industrial cleaning, paints and coatings, pharmaceuticals and personal care, and printing inks. Each segment has distinct compliance and formulation needs, shaping demand profiles and supplier priorities.

- Distribution Channels: Distribution is conducted through both offline and online platforms, allowing suppliers to tailor their customer reach strategies to market channel evolution and client preference trends.

- Regions & Key Markets: The market comprises the Americas (United States, Canada, Mexico, Brazil, Argentina, Chile, Colombia, Peru), Europe (United Kingdom, Germany, France, Russia, Italy, Spain, Netherlands, Sweden, Poland, Switzerland), Middle East (United Arab Emirates, Saudi Arabia, Qatar, Turkey, Israel), Africa (South Africa, Nigeria, Egypt, Kenya), and Asia-Pacific (China, India, Japan, Australia, South Korea, Indonesia, Thailand, Malaysia, Singapore, Taiwan). Regional dynamics, such as infrastructure maturity and regulatory standards, play a significant role in shaping localized demand and supplier approaches.

- Key Companies Profiled: Key industry participants include Arham Petrochem, CEPSA QUÍMICA, Chevron Phillips Chemical, Eastern Petroleum, Exxon Mobil, Idemitsu Kosan, LyondellBasell, MEHTA PETRO, Pon Pure Chemicals, Shell International, SOLVENTECH, TotalEnergies, Maoming Zhengmao Petrochemical, Neste Oyj, and Sasol Limited. These firms drive innovation and supply security while supporting global and local application needs.

Key Takeaways: Strategic Insights for Senior Decision-Makers

- Technological advancements, particularly in catalytic process controls, continue to raise solvent purity standards and enable the formulation of specialized solutions for critical manufacturing applications.

- The momentum toward low-aromatic and reduced-toxicity products aligns with increasingly stringent regulatory demands and a heightened focus on operational health and safety within industrial sites.

- The implementation of closed-loop solvent recovery systems and digital process monitoring is central to achieving operational efficiency, minimizing raw material losses, and supporting sustainability objectives now prioritized by most global manufacturers.

- Focused segmentation based on both solvent type and boiling range allows end-users to optimize chemical selection for precise volatility and solvency needs, especially in sensitive electronics and aerospace environments.

- Fluctuations in regional regulations and differences in production infrastructure require manufacturers and distributors to diversify offerings and refine distribution strategies to effectively address varied local market requirements.

- Collaborative partnerships between solvent producers and equipment manufacturers contribute to ongoing product innovation, better customer support, and distinguish providers in an increasingly competitive global market.

Tariff Impact: Shaping Supply Chains and Market Dynamics

Recent modifications in U.S. tariffs on major hydrocarbon derivatives are influencing supply chain and sourcing strategies within the market. Domestic producers are leveraging this shift to strengthen their position, while importers respond with adaptive inventory and procurement methods. These changes have also encouraged new joint ventures and created the need for supply chain resilience, affecting how stakeholders navigate sourcing and risk in the dearomatized hydrocarbon solvents sector.

Methodology & Data Sources

This analysis is grounded in expert interviews with manufacturers, technical service providers, and market end-users. Data validation draws from regulatory filings, trade association sources, and authoritative industry publications, with findings tested through expert sessions and multi-source triangulation procedures to ensure credibility and precision.

Why This Report Matters

- Supports leadership in aligning procurement, regulatory compliance, and product development initiatives with the sector’s changing technological and legal context.

- Highlights the effects of current tariff policies and uncovers underlying supply chain vulnerabilities, facilitating proactive risk management and partnership innovation.

- Provides forward-looking insights that help organizations anticipate industry standards, adapt to evolving customer requirements, and maintain market competitiveness.

Conclusion

This report delivers actionable intelligence and a clear, strategic perspective on the high purity dearomatized hydrocarbon solvents market. Informed decision-making amid changing conditions enables stakeholders to guide their organizations securely toward growth and operational advantage.

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this High Purity Dearomatized Hydrocarbon Solvents market report include:- Arham Petrochem Private Limited

- CEPSA QUÍMICA, S.A.

- Chevron Phillips Chemical Company LLC

- Eastern Petroleum Private Limited

- Exxon Mobil Corporation

- Idemitsu Kosan Co.,Ltd

- LyondellBasell Industries Holdings B.V.

- MEHTA PETRO REFINERIES LTD

- Pon Pure Chemicals Group

- Shell International B.V.

- SOLVENTECH

- TotalEnergies SE

- Maoming Zhengmao Petrochemical Co., Ltd.

- Neste Oyj

- Sasol Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | November 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 703.3 Million |

| Forecasted Market Value ( USD | $ 1060 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |