Global Class 3 Trucks Market - Key Trends & Drivers Summarized

Why Are Class 3 Trucks Becoming the Backbone of Light Commercial Logistics and Specialized Fleets?

Class 3 trucks - defined in the U.S. vehicle classification system as those with a Gross Vehicle Weight Rating (GVWR) between 10,001 and 14,000 pounds - have become an indispensable part of the commercial transportation ecosystem, acting as a key bridge between light-duty and medium-duty trucking. Often comprising heavier-duty pickups, utility chassis cabs, and vocational work trucks, this segment plays a critical role in industries such as construction, energy services, telecommunications, landscaping, municipal operations, and specialty trade services. Their higher payload capacity, rugged chassis construction, and greater upfitting flexibility allow them to serve a broader range of heavy-use applications without moving into the complexities and regulatory requirements of heavier commercial vehicle classes. Class 3 trucks offer fleet operators a sweet spot between capability and affordability - delivering sufficient power, towing capacity, and customization without the licensing restrictions or operating costs associated with Class 4 and above. These vehicles are also widely used in dual-purpose scenarios, functioning as both jobsite vehicles and transportation units. From tow trucks and service bodies to flatbeds and dump truck configurations, the adaptability of Class 3 trucks makes them a foundational element in infrastructure maintenance, asset delivery, and field-based service operations, thereby elevating their relevance across both private and public sector fleets.How Are Electrification and Emissions Mandates Influencing Class 3 Truck Design and Adoption?

The global push toward sustainable transportation and carbon emissions reduction is driving significant evolution in the Class 3 truck segment. Regulatory agencies across North America, Europe, and parts of Asia-Pacific are enforcing stricter vehicle emissions targets, incentivizing the development and adoption of electric and low-emission Class 3 trucks. OEMs and electric vehicle startups are introducing battery-electric versions of Class 3 work trucks and chassis cabs, targeting use cases such as local deliveries, city-based service routes, and municipal operations where range and payload balance can be optimized. These vehicles are being strategically positioned as replacements for internal combustion engine (ICE) variants in emissions-regulated zones and green fleet transitions. Furthermore, powertrain innovation is not limited to battery electrics - hydrogen fuel cells, hybrid-electric systems, and advanced clean diesel technologies are also being explored to extend range and payload performance while reducing carbon footprint. Fleet operators are beginning to incorporate these low-emission Class 3 trucks into their procurement plans, particularly as total cost of ownership (TCO) models improve through tax incentives, lower maintenance costs, and fuel savings. In parallel, ICE trucks in this segment are also seeing improvements in engine efficiency, lightweighting materials, and drivetrain optimization to remain compliant with evolving regulatory standards. As infrastructure for EV charging and hydrogen fueling expands, and as government policies continue to favor green procurement, Class 3 trucks are transitioning toward more sustainable yet high-performance platforms suited for future-ready operations.Is Product Modularity and Fleet Customization Unlocking New Market Opportunities?

One of the defining strengths of Class 3 trucks is their modularity and compatibility with a wide range of upfitting solutions, which has become a key growth enabler in this segment. OEMs and upfit manufacturers are offering increasingly tailored chassis platforms, cab configurations, and body attachments that allow trucks to be precisely customized for industry-specific needs. Whether it's a contractor dump bed, a refrigerated cargo unit, a telecom utility box, or a mobile medical clinic, Class 3 trucks provide the structural integrity and design flexibility needed to accommodate diverse operational use cases. This modularity is particularly important for fleet owners who need vehicles that can perform in specialized roles without compromising cost-efficiency. Additionally, fleet managers are leveraging vehicle configuration software and integrated fleet management platforms to optimize specifications based on route patterns, load requirements, climate conditions, and service schedules. The integration of digital fleet telematics is also adding immense value, with real-time diagnostics, geofencing, fuel monitoring, and predictive maintenance capabilities enhancing uptime and performance tracking. Technology upgrades are extending to driver safety as well, with ADAS features such as forward collision warning, lane departure alerts, backup cameras, and blind spot monitoring becoming more common even in vocational work trucks.What’ s Powering the Steady Expansion of the Global Class 3 Trucks Market?

The growth in the Class 3 trucks market is driven by several critical factors linked to infrastructure development, commercial service expansion, evolving fleet management practices, and regulatory trends. One of the primary demand drivers is the booming construction and infrastructure maintenance sector, where Class 3 trucks serve as cost-effective platforms for equipment transport, mobile jobsite support, and material handling. Additionally, the increasing mechanization of agriculture, energy distribution, and telecom maintenance is pushing procurement of heavy-duty yet maneuverable trucks that don’ t require CDL licensing in many jurisdictions - giving Class 3 trucks a distinct market advantage. On the urban front, the growing complexity of city logistics, trade services, and utility maintenance is supporting demand for trucks that offer sufficient capacity without the operational restrictions of heavier classes. Simultaneously, the electrification movement is opening new avenues for Class 3 vehicles in green municipal fleets, last-mile delivery routes, and sustainability-conscious enterprises.The report analyzes the Class 3 Trucks market, presented in terms of market value. The analysis covers the key segments and geographic regions outlined below.

- Segments: Application (Commercial Application, Industrial Application); Drive Configuration (2WD Drive Configuration, 4WD Configuration, AWD Configuration).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Commercial Application segment, which is expected to reach US$6.3 Trillion by 2030 with a CAGR of a 7.3%. The Industrial Application segment is also set to grow at 4.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.0 Trillion in 2024, and China, forecasted to grow at an impressive 9.8% CAGR to reach $2.2 Trillion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Class 3 Trucks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Class 3 Trucks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Class 3 Trucks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ashok Leyland, BMW Group, Fiat Professional (part of Stellantis), Ford Motor Company, General Motors and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Class 3 Trucks market report include:

- Ashok Leyland

- Daimler Truck (Mercedes-Benz)

- Dongfeng Motor Corporation

- FAW Group Corporation

- Ford Motor Company

- General Motors (Chevrolet)

- Hino Motors, Ltd.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Iveco Group

- Mahindra & Mahindra Limited

- MAN Truck & Bus

- Mitsubishi Fuso Truck and Bus Corporation

- Navistar International

- PACCAR Inc. (Kenworth)

- PACCAR Inc. (Peterbilt)

- Scania AB

- Stellantis (Ram Trucks)

- Tata Motors Limited

- Volvo Trucks

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ashok Leyland

- Daimler Truck (Mercedes-Benz)

- Dongfeng Motor Corporation

- FAW Group Corporation

- Ford Motor Company

- General Motors (Chevrolet)

- Hino Motors, Ltd.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Iveco Group

- Mahindra & Mahindra Limited

- MAN Truck & Bus

- Mitsubishi Fuso Truck and Bus Corporation

- Navistar International

- PACCAR Inc. (Kenworth)

- PACCAR Inc. (Peterbilt)

- Scania AB

- Stellantis (Ram Trucks)

- Tata Motors Limited

- Volvo Trucks

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

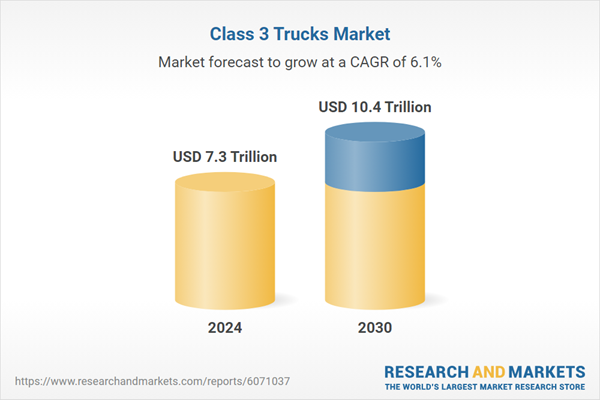

| Estimated Market Value ( USD | $ 7.3 Trillion |

| Forecasted Market Value ( USD | $ 10.4 Trillion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |