Global Plant-Based Foods Market - Key Trends & Drivers Summarized

Why Is the Global Consumer Palette Shifting Rapidly Toward Plant-Based Alternatives?

The surge in plant-based foods is rooted in evolving consumer values around health, sustainability, and ethical consumption. Concerns regarding the health risks associated with high red meat intake - such as heart disease, colorectal cancer, and obesity - have prompted a broad shift toward plant-based diets across developed markets. The COVID-19 pandemic further accelerated this trend by amplifying awareness of immune health and dietary quality, leading to increased demand for nutrient-dense, fiber-rich alternatives derived from legumes, seeds, whole grains, fruits, and vegetables.Moreover, consumers are increasingly motivated by the environmental impact of traditional animal agriculture, which is responsible for a significant share of global greenhouse gas emissions, water use, and land degradation. In this context, plant-based foods are marketed as lower-carbon, resource-efficient, and cruelty-free choices that align with eco-conscious lifestyles. These motivations are particularly strong among millennials and Gen Z demographics, who are not only leading demand for flexitarian and vegan diets but are also driving innovation through their demand for transparency, traceability, and ethical sourcing across the entire value chain.

What Is Enabling the Rapid Innovation in Taste, Texture, and Nutritional Functionality?

The shift in consumer expectations from compromise-based substitutes to indulgent and functional plant-based equivalents is catalyzing product innovation. Advanced food engineering techniques, such as high-moisture extrusion, fermentation, and protein fractionation, are being used to replicate the fibrous texture of meat, the melt and stretch of dairy, and the emulsification properties of eggs. Novel ingredients like mung beans, fava beans, lupin, oats, and mycelium are being explored not just for protein content, but for their ability to mimic culinary characteristics such as browning, chewiness, and mouthfeel.Food-tech firms are developing proprietary plant protein blends that deliver complete amino acid profiles while maintaining sensory appeal. Fortification with micronutrients such as vitamin B12, iron, and omega-3s is addressing nutritional gaps traditionally associated with plant-only diets. Moreover, precision fermentation and cultured fat technologies are enabling fat mimicry, flavor enhancement, and extended shelf life in plant-based meat and dairy analogues. These R&D breakthroughs are allowing brands to compete not just as alternatives, but as premium-quality food products capable of satisfying mainstream consumer demand for taste, performance, and convenience.

How Are Retail, Foodservice, and Regulatory Ecosystems Fueling Mainstream Penetration?

Plant-based foods are increasingly transitioning from niche health store items to mainstream grocery staples and restaurant menu fixtures. Major retail chains are allocating dedicated shelf space for plant-based dairy, meat, and frozen food alternatives, often supported by in-store signage, price promotions, and private label launches. The foodservice industry is similarly embracing plant-based offerings, with fast food giants and fine dining establishments alike incorporating plant-based burgers, chicken, cheeses, and desserts into core menus.On the regulatory front, several countries are issuing dietary guidelines that promote plant-based diets for health and sustainability, while others are investing in domestic plant protein industries through subsidies, research funding, and startup incubators. Labeling standards, allergen regulations, and clean-label compliance are being revised to accommodate novel plant-based ingredients and processes. Investment capital from venture funds, corporate strategic units, and sovereign wealth funds is further accelerating scale-up and infrastructure development across the plant-based food ecosystem. These system-wide shifts are reducing entry barriers for startups and increasing consumer trust in the safety, quality, and accessibility of plant-based products.

What's Powering the Exponential Growth of the Plant-Based Foods Market?

The growth in the global plant-based foods market is driven by several factors, including evolving consumer behavior, escalating climate concerns, and continued technological innovation in food processing. A broad demographic transition toward health-forward, ethical, and sustainable consumption is pushing plant-based products into the mainstream. Expanding product portfolios, improving sensory properties, and increasing affordability are converting one-time trial users into regular consumers. The alignment of plant-based foods with wellness, fitness, and clean-label trends is creating strong synergies across health-conscious consumer segments.Government-led support for plant-based agriculture and domestic food innovation ecosystems - combined with rising investor interest in alternative proteins - is catalyzing rapid expansion, particularly in North America, Europe, and Asia-Pacific. Additionally, the global proliferation of plant-based product launches in bakery, beverages, frozen foods, and ready-to-eat meals is driving retail channel growth. As food security, climate change, and ethical sourcing become more pressing global issues, plant-based foods are evolving from being lifestyle choices to strategic food system solutions. These factors collectively ensure robust, long-term momentum for the global plant-based foods industry across B2B and B2C markets alike.

Report Scope

The report analyzes the Plant-based Foods market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Plant-based Milk & Derivatives, Bakery & Confectionery, Sweet & Savory Snacks, Plant-based Juices, Ready-To-Drink Tea & Coffee, Ready-To-Eat, Read-To-Cook Meals, Other Types); Category (Organic, Conventional); Distribution Channel (Store-based, Non-Store-based).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Plant-based Milk & Derivatives segment, which is expected to reach US$7 Billion by 2030 with a CAGR of a 14.1%. The Plant-based Bakery & Confectionery segment is also set to grow at 9.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.4 Billion in 2024, and China, forecasted to grow at an impressive 15.6% CAGR to reach $5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plant-based Foods Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plant-based Foods Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plant-based Foods Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3 Rivers Biotech, AgriForest Bio-Technologies, Alpha Laboratories Ltd, Australis Capital Inc., Booms Pharm and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Plant-based Foods market report include:

- Amy's Kitchen

- Beyond Meat

- Boca Foods Company

- Daiya Foods Inc.

- Danone S.A.

- Eden Foods Inc.

- Field Roast Grain Meat Co.

- Follow Your Heart

- Gardein (Conagra Brands)

- Hain Celestial Group

- Impossible Foods Inc.

- Lightlife Foods

- MorningStar Farms (Kellogg's)

- Nestlé S.A.

- Oatly AB

- Quorn Foods

- Silk (Danone North America)

- Tofurky (Turtle Island Foods)

- Upfield Holdings B.V.

- VBites Foods Ltd

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Amy's Kitchen

- Beyond Meat

- Boca Foods Company

- Daiya Foods Inc.

- Danone S.A.

- Eden Foods Inc.

- Field Roast Grain Meat Co.

- Follow Your Heart

- Gardein (Conagra Brands)

- Hain Celestial Group

- Impossible Foods Inc.

- Lightlife Foods

- MorningStar Farms (Kellogg's)

- Nestlé S.A.

- Oatly AB

- Quorn Foods

- Silk (Danone North America)

- Tofurky (Turtle Island Foods)

- Upfield Holdings B.V.

- VBites Foods Ltd

Table Information

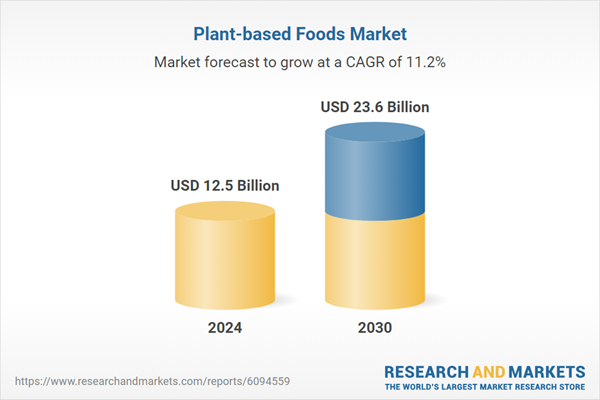

| Report Attribute | Details |

|---|---|

| No. of Pages | 376 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.5 Billion |

| Forecasted Market Value ( USD | $ 23.6 Billion |

| Compound Annual Growth Rate | 11.2% |

| Regions Covered | Global |