Global 5G Printed Circuit Boards Market - Key Trends & Drivers Summarized

Why Are 5G PCBs Becoming Critical Components in High-Frequency, High-Density Electronics Infrastructure?

Printed circuit boards (PCBs) designed for 5G applications are fundamental to the performance and reliability of next-generation wireless systems. These advanced PCBs support the high-frequency signal transmission, thermal management, and compact integration needed for 5G base stations, user equipment, network hardware, and IoT devices. As 5G rollouts scale globally, PCBs must meet increasingly stringent electrical, mechanical, and environmental performance requirements.Compared to conventional PCBs, 5G variants demand high-speed laminates, low-loss materials, and precise signal integrity for frequencies ranging from sub-6 GHz to mmWave bands. They must also handle dense interconnects and multi-layer stack-ups while ensuring minimal signal degradation. As a result, PCB manufacturers are reengineering board architecture and material systems to support the demands of ultra-reliable, low-latency communication.

How Are Material Innovation and Fabrication Techniques Advancing 5G PCB Performance?

The performance of 5G PCBs hinges on dielectric materials with low loss tangents, high thermal stability, and consistent impedance control. High-frequency laminates such as PTFE, LCP, and ceramic-filled composites are being adopted to reduce transmission losses and enable signal clarity in mmWave applications. Multilayer HDI (High-Density Interconnect) technologies, advanced via structures (microvias, stacked vias), and hybrid PCB designs are enabling high routing density and thermal management in compact footprints.On the manufacturing side, precision etching, laser drilling, and advanced plating techniques are improving dimensional accuracy and reducing signal distortion. Embedded components, conformal shielding, and integrated thermal vias are being incorporated to meet EMI/EMC standards and manage heat in densely packed 5G hardware. These advancements are making PCBs more capable of supporting the electrical demands of 5G transceivers, RF modules, and antenna arrays.

Which Applications and Markets Are Leading Demand for 5G PCBs?

5G PCBs are being deployed across a wide range of applications including macro and small cell base stations, network interface devices, mobile handsets, RF front ends, CPE units, and connected industrial systems. Telecom equipment manufacturers are the primary consumers, closely followed by OEMs in smartphones, wearables, autonomous vehicles, and smart factory automation platforms.Asia-Pacific, home to leading PCB fabricators and 5G infrastructure vendors, remains the dominant production and consumption region. China, South Korea, Taiwan, and Japan are major hubs for high-frequency PCB manufacturing and are ramping capacity to meet domestic and export demand. North America and Europe follow, with emphasis on high-end PCBs for defense, aerospace, and telecom applications. Emerging economies in Southeast Asia, India, and the Middle East are gradually increasing 5G infrastructure investment, driving new opportunities for PCB suppliers.

How Are Supply Chain Pressures, Standardization, and Technological Convergence Shaping Market Dynamics?

The 5G PCB supply chain is highly materials-dependent, and disruptions in the availability of high-performance substrates, copper foils, and specialty resins can impact lead times and pricing. To mitigate this, manufacturers are diversifying sourcing strategies, investing in domestic fabrication lines, and pursuing vertical integration to control quality and supply continuity.Standardization efforts through industry bodies such as IPC and IEEE are promoting design consistency and compatibility across OEM platforms, improving efficiency in design-to-production workflows. Meanwhile, the convergence of 5G with AI, IoT, and edge computing is driving demand for PCBs that can support multifunctional, high-density integration. This is encouraging closer collaboration between designers, material scientists, and fabricators to push the boundaries of signal performance and system reliability.

What Are the Factors Driving Growth in the 5G Printed Circuit Boards Market?

The 5G PCB market is expanding rapidly as global connectivity infrastructure shifts toward high-frequency, data-intensive applications. Key growth drivers include rising investments in 5G base stations, expanding deployment of mmWave user devices, and demand for precision RF hardware across sectors. Material innovation, high-speed board architecture, and advanced fabrication methods are enabling PCBs to meet the unique challenges of 5G-era communication systems.Looking ahead, market success will depend on how effectively PCB suppliers align material science, miniaturization, and cost-efficiency with the evolving demands of telecom, consumer, and industrial device manufacturers. As electronics become increasingly frequency-driven and functionally converged, could 5G PCBs emerge as the strategic core of tomorrow's connected technology ecosystem?

Report Scope

The report analyzes the 5G Printed Circuit Boards market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Single-Sided, Double-Sided, Multi-Layered, High-Density Interconnect, Other Types); End-Use (Automotive, Telecommunication, Consumer Electronics, Industrial, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Single-Sided Printed Circuit Boards segment, which is expected to reach US$12.7 Billion by 2030 with a CAGR of a 13.4%. The Double-Sided Printed Circuit Boards segment is also set to grow at 14.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.9 Billion in 2024, and China, forecasted to grow at an impressive 19.1% CAGR to reach $8.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global 5G Printed Circuit Boards Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global 5G Printed Circuit Boards Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global 5G Printed Circuit Boards Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ADLINK Technology Inc., Advantech Co., Ltd., Amazon Web Services (AWS), American Tower Corporation, Cisco Systems, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this 5G Printed Circuit Boards market report include:

- Advanced Circuits, Inc.

- Amphenol Printed Circuits

- AT&S Austria Technologie & Systemtechnik AG

- Chin-Poon Industrial Co., Ltd.

- Compeq Manufacturing Co., Ltd.

- Daeduck Electronics Co., Ltd.

- Dynamic Electronics Co., Ltd.

- Ellington Electronics Technology Co., Ltd.

- Flex Ltd.

- Fujikura Ltd.

- HannStar Board Corporation

- Ibiden Co., Ltd.

- Isola Group

- Jabil Inc.

- Kinsus Interconnect Technology Corp.

- Kyocera Corporation

- Lianchuang Electronic Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Nippon Mektron, Ltd.

- Panasonic Industry Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Circuits, Inc.

- Amphenol Printed Circuits

- AT&S Austria Technologie & Systemtechnik AG

- Chin-Poon Industrial Co., Ltd.

- Compeq Manufacturing Co., Ltd.

- Daeduck Electronics Co., Ltd.

- Dynamic Electronics Co., Ltd.

- Ellington Electronics Technology Co., Ltd.

- Flex Ltd.

- Fujikura Ltd.

- HannStar Board Corporation

- Ibiden Co., Ltd.

- Isola Group

- Jabil Inc.

- Kinsus Interconnect Technology Corp.

- Kyocera Corporation

- Lianchuang Electronic Technology Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Nippon Mektron, Ltd.

- Panasonic Industry Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 291 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

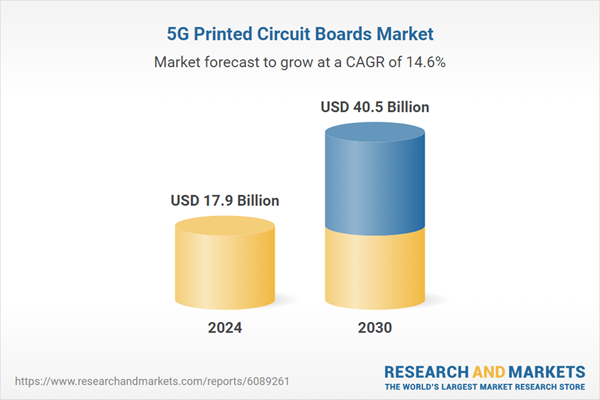

| Estimated Market Value ( USD | $ 17.9 Billion |

| Forecasted Market Value ( USD | $ 40.5 Billion |

| Compound Annual Growth Rate | 14.6% |

| Regions Covered | Global |