Dominant products in the market include shellfish like lobsters, oysters, crabs, and clams, along with various popular fish species. These items are in high demand, especially in premium markets, where consumers seek upscale dining experiences with top-tier seafood. The food service industry is one of the major driving forces, with restaurants continually innovating menus around live seafood offerings to meet the evolving tastes of diners.

Aquaculture is becoming a central focus of the industry, thanks to advancements in sustainable farming technologies. These innovations offer a cost-effective and environmentally friendly alternative to traditional wild-caught seafood methods, addressing ecological concerns over ocean resource depletion. As global protein demand rises, aquaculture is helping bridge the supply gap, especially in fast-growing markets like North America and the Asia-Pacific. While wild fishing still accounts for a considerable share, aquaculture is accelerating in adoption due to its scalability and resource efficiency.

Fish species such as tilapia, sea bass, and groupers generated USD 22.3 billion in 2024. These varieties are popular across Asia-Pacific and Western countries, supported by a strong inland farming ecosystem in nations like China, India, and Vietnam. With demand climbing in restaurants, specialty seafood retailers, and wet markets, this segment maintains a robust market share.

The live lobster segment reached USD 12.6 billion in 2024 and is on track to hit USD 26.5 billion by 2034. Lobsters are among the highest-grossing live seafood products, with strong demand from North America, Europe, and select Asian regions. Modern aquaculture and streamlined logistics are making live lobster more accessible than ever.

The United States Live Seafood Market brought in USD 13.8 billion in 2024, propelled by health-focused dietary shifts and an appetite for premium, fresh seafood. With a rise in sustainably certified and responsibly harvested products, US retailers and suppliers are meeting evolving consumer expectations. Cold-chain innovation and better water quality management are further optimizing product delivery.

Key players in this space include Cooke Aquaculture, Dongwon Industries, Maruha Nichiro Corporation, and Seajoy Seafood Corporation. These companies are leading the way with investments in sustainable practices, broader product portfolios, and enhanced logistics to keep pace with growing demand for high-quality live seafood.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this live seafood market report include:- Cooke Aquaculture

- Dongwon Industries

- Fremont Fish Market

- Hendrix Genetics

- Maruha Nichiro Corporation

- Marine Harvest (now Mowi)

- Mowi ASA (Formerly Marine Harvest)

- Nordic Group

- Seajoy Seafood Corporation

- Thai Union Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 263 |

| Published | April 2025 |

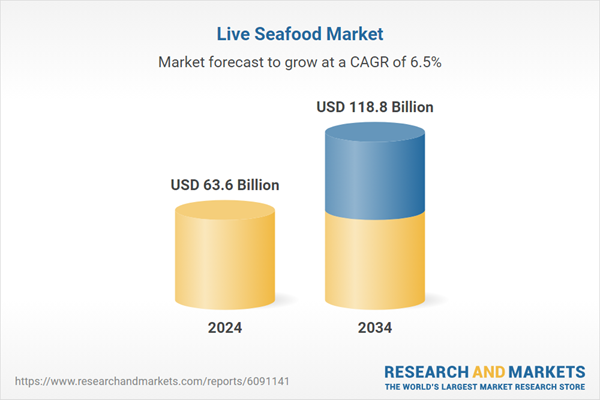

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 63.6 Billion |

| Forecasted Market Value ( USD | $ 118.8 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |