This market is driven not only by regulatory pressure but also by growing investor interest in sustainable technologies. As carbon pricing mechanisms tighten and decarbonization becomes central to corporate strategies, businesses are seeking reliable, long-term solutions that ensure compliance while supporting sustainability commitments. Moreover, the growing push for circular carbon economies is reinforcing the need for technologies that capture, recycle, and even permanently remove CO₂. In this context, amine-based carbon capture offers a proven track record of performance and flexibility. It can be deployed at industrial scale today while also serving as a platform for innovation, including integration with carbon utilization and storage systems. With advancements in material science, process engineering, and automation, this market is expected to continue expanding rapidly, offering significant opportunities for new entrants and established players alike.

Amine-based capture technology is known for its high efficiency, particularly in post-combustion applications where flue gases are rich in carbon dioxide. The process relies on aqueous amine solutions to chemically absorb CO₂, which is then released during the regeneration phase, allowing the solvent to be reused in continuous cycles. This technology is especially well-suited for retrofitting existing coal and gas-fired power plants, as well as other industrial facilities, without the need for extensive modifications. The increasing urgency to meet climate targets and reduce industrial carbon footprints is pushing innovation in this field, with an emphasis on improving solvent performance, increasing CO₂ loading capacity, and reducing the energy required for regeneration.

One of the most forward-looking developments in this space is direct air capture using solid sorbents enhanced with amines. Although more energy-intensive than capturing emissions at the source, this technology holds the potential to reverse emissions by extracting CO₂ directly from the atmosphere. As attention shifts toward net-negative emission strategies, this approach is gaining traction among climate tech investors and governments alike.

Recent R&D efforts are focused on improving the selectivity and reactivity of amine-based solvents, aiming to reduce overall operational costs while enhancing capture efficiency. This includes the development of new solvent formulations with higher thermal stability and lower degradation rates. Innovations are being driven by cross-sector collaboration involving chemical engineers, environmental scientists, and clean energy specialists, all working toward making carbon capture systems more viable for large-scale deployment. These advancements are particularly important in hard-to-abate sectors like cement, steel, and refining, where electrification is not a feasible path to decarbonization.

The monoethanolamine (MEA) segment accounted for a dominant 38.6% market share in 2024. Known for its strong affinity to carbon dioxide and its ability to form stable carbamate compounds, MEA remains a cornerstone of chemical absorption systems. Its reliability, operational consistency, and widespread availability have made it a go-to choice for post-combustion capture, particularly in legacy energy infrastructure.

Post-combustion capture technologies led the market with a 53.1% share in 2024, largely because of their seamless integration into existing systems. Industries favor this method as it allows them to reduce carbon emissions with minimal disruption to operations. Supported by decades of pilot testing, commercial projects, and engineering improvements, post-combustion capture continues to be the most practical and widely adopted solution.

The United States Amine-Based Carbon Capture Market was valued at USD 190.4 million in 2024. Federal incentives like tax credits, coupled with flexible state-level regulations, have made the U.S. a leading market for carbon capture innovation. Fast-track permitting for Class VI wells by the Environmental Protection Agency and delegated state authorities has shortened project timelines and boosted investor confidence, further accelerating deployment.

Key industry players include Toshiba Energy Systems & Solutions, Linde PLC, Mitsubishi Heavy Industries, Fluor Corporation, Koch-Glitsch, Shell CANSOLV, BASF SE, Pentair, Carbon Clean, and GEA Group. These companies are focusing on enhancing solvent regeneration efficiency, launching modular carbon capture units, and scaling up pilot projects into full-scale commercial operations. Their efforts are helping to drive down costs and improve the scalability of next-generation amine systems across a wide range of industrial applications.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies featured in this amine-based carbon capture market report include:- BASF SE

- Carbon Clean

- Fluor Corporation

- GEA Group

- Koch-Glitsch

- Linde PLC

- Mitsubishi Heavy Industries

- Pentair

- Shell CANSOLV

- Toshiba Energy Systems & Solutions

Table Information

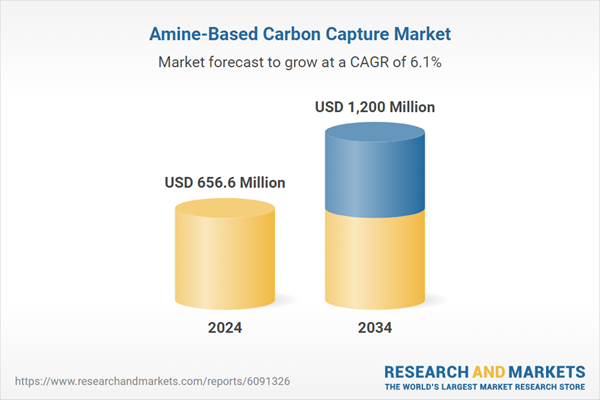

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | April 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 656.6 Million |

| Forecasted Market Value ( USD | $ 1200 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |