Global Defense Navigation Market - Key Trends & Drivers Summarized

How Are Evolving Threat Environments Reshaping Navigation Technologies in Defense?

Modern battlefield environments are increasingly complex, contested, and GPS-denied, demanding significant advances in defense navigation technologies. Traditional Global Navigation Satellite Systems (GNSS) are now frequently targeted by jamming and spoofing, prompting a sharp rise in the development of alternative and hybrid navigation systems. Inertial Navigation Systems (INS), integrated with GNSS, are gaining traction as they provide position tracking even when GPS signals are compromised. Additionally, quantum navigation and celestial navigation are emerging as next-generation solutions, enabling militaries to operate in signal-denied environments with precision.Another key shift is the rise of autonomy and unmanned platforms, which heavily depend on precise navigation capabilities. Autonomous drones, unmanned ground vehicles (UGVs), and underwater autonomous vehicles (AUVs) are being deployed in surveillance, reconnaissance, and combat roles. These platforms require high-accuracy positioning, orientation, and path-planning data to function effectively in complex terrains. As such, advanced navigation solutions that combine AI, sensor fusion, and environment mapping are being embedded into these systems, expanding the strategic scope of modern defense missions.

What Role Do AI and Sensor Fusion Play in Enabling Next-Generation Navigation Capabilities?

Artificial Intelligence (AI) and machine learning are playing a transformative role in enhancing defense navigation. AI algorithms are being used to process data from multiple sensors - including gyroscopes, accelerometers, LiDAR, and radar - to enable real-time decision-making and route optimization. This sensor fusion approach improves redundancy, accuracy, and reliability, especially in GPS-compromised zones. Predictive analytics powered by AI can also forecast environmental disruptions, helping systems recalibrate their navigation paths dynamically.Moreover, AI enables context-aware navigation, especially critical in urban warfare or subterranean operations. For instance, SLAM (Simultaneous Localization and Mapping) techniques, bolstered by AI, allow for real-time mapping and navigation in unknown or dynamic environments. Military vehicles and units can therefore maintain accurate positional awareness without relying on satellite signals. Such capabilities are crucial not only for tactical advantage but also for safeguarding operational continuity during electronic warfare scenarios.

How Is the Integration of Navigation Systems with C4ISR Enhancing Operational Superiority?

The fusion of navigation technologies with C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) systems is reshaping modern defense logistics and mission coordination. By linking navigation inputs with real-time situational awareness platforms, defense forces can achieve synchronized movements across units, streamline target acquisition, and enhance force deployment agility. Navigation systems embedded in weapon guidance, air defense systems, and strategic missile platforms ensure accuracy in strike operations, especially in denied or high-interference environments.Additionally, network-centric warfare depends on secure and coordinated navigation feeds across platforms. Embedded GPS/INS modules, interoperable across fleets and systems, are enabling unified battlefield visibility and cooperative engagement strategies. This integration ensures precise coordination between airborne, maritime, and ground forces. Militaries are also investing in encrypted and resilient Position, Navigation, and Timing (PNT) architectures that interface with electronic warfare defenses to avoid signal manipulation, thereby maintaining the integrity of battlefield maneuvers and logistics pipelines.

What Are the Main Catalysts Driving Market Expansion in Defense Navigation?

The growth in the defense navigation market is driven by several factors, primarily linked to the adoption of autonomous military platforms, the need for GPS-independent navigation in contested environments, and the integration of navigation systems with broader defense intelligence ecosystems. The increasing deployment of unmanned aerial and ground systems for ISR (Intelligence, Surveillance, and Reconnaissance) missions has significantly intensified demand for resilient and accurate navigation solutions. This is further amplified by geopolitical conflicts and the need for secure force projection in both terrestrial and naval theaters.Technological advancements such as quantum sensing, AI-powered sensor fusion, and multi-sensor redundancy frameworks are reshaping the competitive landscape. Defense agencies are increasingly procuring advanced INS/GPS hybrids, as well as optical navigation systems for submarines and stealth aircraft. The ongoing modernization of defense infrastructure, especially in NATO countries and Indo-Pacific military alliances, has created strong demand for modular and software-defined navigation systems. Furthermore, efforts to build space-based PNT alternatives and the expansion of battlefield digitalization initiatives continue to act as key accelerators in the global defense navigation market.

Report Scope

The report analyzes the Defense Navigation market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Platform (Airborne Platform, Naval Platform, Land Platform); Technology (Fiber Optic Gyro Navigation System, Ring Laser Gyro Navigation System, Mechanical Navigation System, Hemispherical Resonator Gyro Navigation System, Micromechanical Systems-based Navigation System, Other Technologies); Application (Ship Application, Boat Application, Autonomous Underwater Vehicle Application, Remotely Operated Underwater Vehicle Application).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Airborne Platform segment, which is expected to reach US$178.2 Billion by 2030 with a CAGR of a 3.3%. The Naval Platform segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $61.4 Billion in 2024, and China, forecasted to grow at an impressive 7.1% CAGR to reach $57.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Defense Navigation Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Defense Navigation Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Defense Navigation Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACMAT, Achleitner Fahrzeugbau, AM General LLC, Automotive Industries Ltd. (AIL), BAE Systems plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Defense Navigation market report include:

- Advanced Navigation

- Aselsan A.S.

- BAE Systems plc

- Cobham Limited

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- Esterline Technologies Corporation

- Furuno Electric Co., Ltd.

- Garmin Ltd.

- General Dynamics Corporation

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Moog Inc.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Navigation

- Aselsan A.S.

- BAE Systems plc

- Cobham Limited

- Curtiss-Wright Corporation

- Elbit Systems Ltd.

- Esterline Technologies Corporation

- Furuno Electric Co., Ltd.

- Garmin Ltd.

- General Dynamics Corporation

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Moog Inc.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 387 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

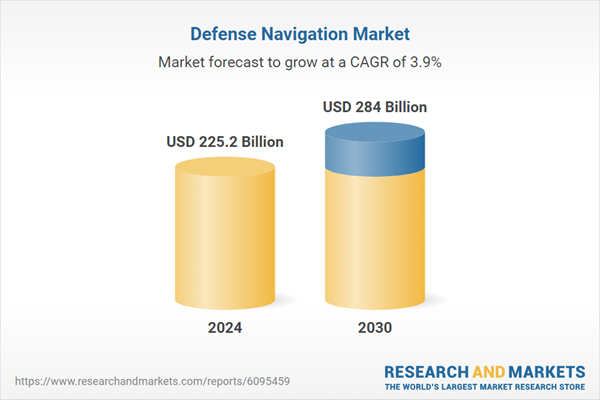

| Estimated Market Value ( USD | $ 225.2 Billion |

| Forecasted Market Value ( USD | $ 284 Billion |

| Compound Annual Growth Rate | 3.9% |

| Regions Covered | Global |