The shift towards health-conscious formulations, such as non-hydrogenated and trans-fat-free shortenings, continues to fuel product innovation. Technological progress and tighter food regulations are pushing manufacturers to innovate with ingredients that are both sustainable and adaptable to evolving consumer preferences. The growing popularity of home baking, along with the rapid expansion of food service chains in developing regions, is driving further demand.

Companies are actively refining their product portfolios to cater to diverse regional flavor preferences, evolving dietary requirements, and the rising demand for transparent, clean-label ingredients. By aligning their offerings with cultural tastes and health-conscious consumer trends, manufacturers are positioning themselves to capitalize on expansion opportunities in both mature and high-growth developing markets. This localized approach not only enhances customer loyalty but also allows brands to stay competitive amid tightening food regulations and shifting consumption patterns worldwide.

The all-purpose shortenings segment represented the largest segment in 2024, contributing USD 1.6 billion and a 38.5% share. Their wide usage across various processed foods and bakery applications stems from their dependable performance, affordability, and multi-functionality. These attributes make them highly desirable among large-scale food manufacturers seeking versatile and consistent ingredients.

The direct sales segment accounted for a 48.8% share in 2024 and is anticipated to grow at a CAGR of 5%, remaining the most preferred route to the market. This sales approach appeals to large industrial buyers who seek tailored product specifications, bulk supply capabilities, and prompt delivery. It also offers a strategic advantage by enabling manufacturers to maintain pricing control, technical support, and streamlined supply logistics, making it the fastest-growing distribution method in the sector.

Europe Emulsified Shortenings Market held a 34.3% share in 2024. This leadership stems from the region’s advanced food production ecosystem, increased consumption of processed and specialty baked goods, and rising consumer inclination toward healthier fat alternatives. European regulations favor clean-label products and ethically sourced ingredients, which align with market demands. Reliable sourcing practices, such as the use of sustainably harvested oils, have further accelerated regional growth in the emulsified shortenings space.

Key players such as AAK AB, Wilmar International, Archer Daniels Midland Company, Bunge, and Cargill Incorporated play a pivotal role in the global emulsified shortenings landscape. These companies have anchored themselves at the forefront of innovation and distribution through robust global networks and diversified portfolios. Leading companies in the emulsified shortenings market are focusing on several strategic approaches to secure and expand their market positions.

Custom formulation development remains a top priority, allowing suppliers to cater to specific client needs across commercial and industrial applications. Many are investing in clean-label technologies and healthier fat alternatives to align with regulatory and consumer health expectations. A strong emphasis is placed on sustainability, with firms adopting certified palm oils and plant-based inputs to appeal to environmentally conscious buyers. Additionally, firms are strengthening direct-to-customer distribution channels to ensure product consistency and cost efficiency.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Cargill Incorporated

- Bunge

- Archer Daniels Midland Company

- AAK AB

- Wilmar International

- Fuji Oil Holdings

- IOI Group

- Musim Mas

- Olenex

- Intercontinental Specialty Fats

- Ventura Foods

- Apical Group

- Sime Darby Plantation

- Mewah International

- Carotino

- Liberty Oil Mills

- Felda IFFCO

- Oleo- Fats

- PT SMART

- Golden Agri- Resources

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | June 2025 |

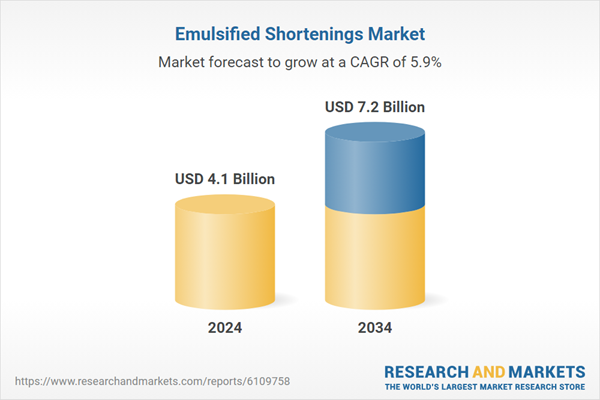

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 4.1 Billion |

| Forecasted Market Value ( USD | $ 7.2 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |