Remote consultations through telehealth services are also improving maternity care accessibility. Governments and health organizations are promoting digital maternal solutions to address existing care gaps. As disposable incomes rise globally, parents are more inclined to invest in advanced, comfortable, and safe maternity products. The surge in online retail platforms has also transformed accessibility and convenience. With greater privacy, wider product choices, and the ability to compare offerings, e-commerce continues to attract modern, tech-savvy parents who are looking for quality solutions to support the motherhood journey.

In 2024, personal care products generated USD 19 billion and are forecasted to grow at a CAGR of 7.4% by 2034. These items dominate the global market, largely due to growing awareness of skincare and wellness among pregnant and postpartum women. Concerns such as skin irritation, pigmentation, and stretch marks are prompting demand for a broad spectrum of solutions, including creams, gels, and organic skincare lines. Increasing participation of women in the workforce, along with a preference for natural, safe, and high-performing products, continues to fuel growth in this segment. Mothers are prioritizing both convenience and effectiveness, supporting a shift toward trusted and eco-conscious brands.

The offline retail channels segment accounted for 78.1% share in 2024 and is projected to maintain a CAGR of 7.1% during 2025-2034. Physical retail stores hold a dominant position because they offer hands-on product assessment. Pregnant consumers prefer the opportunity to touch, test, and evaluate items before making a purchase - particularly when it comes to comfort, fit, quality, and size. Sales personnel add value by guiding customers based on their individual needs, which improves the shopping experience and builds brand trust. Offline formats also support a more curated product comparison, especially when purchasing wearables, health devices, or skin care solutions.

United States Maternity Products Market held 75.4% share in 2024 and is on track to grow at a CAGR of 7.1% during 2025-2034. Consumers in the US are highly attuned to maternal health and prioritize both safety and innovation. An increase in working mothers and rising income levels are contributing to greater spending on premium-quality maternity products. Additionally, product development focused on sustainable and tech-driven innovations is gaining strong consumer interest. The market’s maturity and fast adoption of health-enhancing technologies continue to position the US as a leader in this space.

Leading companies in the Global Maternity Products Market include Gap, Motherhood, H&M Mama, Seraphine, JoJo Maman Bébé, A Pea in the Pod, PinkBlush, HATCH, Old Navy, Cake, Frida, ASOS, Destination, Isabella Oliver, and The Moms Co. Companies in the maternity products industry are focusing on innovation, quality, and omnichannel retail strategies to expand their presence. Many brands are enhancing their digital storefronts and optimizing e-commerce channels to meet rising demand for convenient, discreet shopping experiences. Product portfolios are being diversified with organic, dermatologically tested, and sustainability-certified offerings to cater to the health-conscious consumer base. Collaborations with healthcare professionals and influencers help boost brand credibility and consumer engagement. In-store experiences are being improved through personalized consultation services and curated displays.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- A Pea in the Pod

- ASOS

- Cake

- Destination

- Frida

- Gap

- H&M Mama

- Hatch

- Isabella Oliver

- JoJo Maman Bébé

- Motherhood

- Old Navy

- Pink Blush

- Seraphine

- The Moms Co.

Table Information

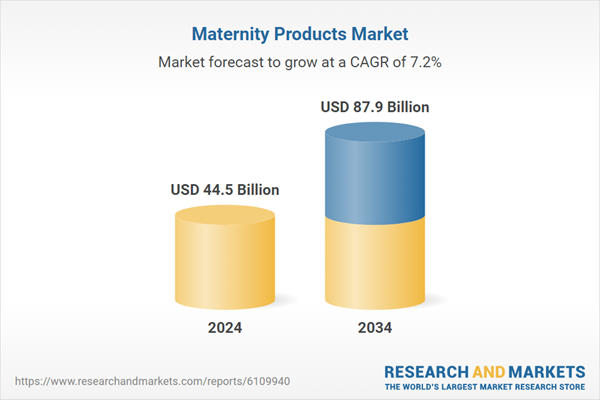

| Report Attribute | Details |

|---|---|

| No. of Pages | 120 |

| Published | June 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 44.5 Billion |

| Forecasted Market Value ( USD | $ 87.9 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |