Global Unified Communications As A Service (UCaaS) In Energy Market - Key Trends & Drivers Summarized

How Are Energy Enterprises Rethinking Communications Infrastructure for Operational Continuity?

The energy sector-spanning oil and gas, power generation, renewables, and utilities-is undergoing a communications overhaul as it grapples with decentralized operations, remote workforces, and evolving compliance mandates. Unified Communications as a Service (UCaaS) is emerging as a strategic enabler in this context, offering cloud-based integration of voice, video, messaging, conferencing, and collaboration tools. Unlike siloed legacy PBX or VPN-based systems, UCaaS platforms offer scalability, mobility, and network-agnostic access critical to the geographically distributed structure of energy businesses. For firms operating across offshore rigs, field service units, and multi-plant infrastructures, seamless real-time communication is not a luxury-it is a core operational requirement.Utilities, for instance, are shifting from location-bound call centers to omnichannel virtual service desks that use UCaaS to unify customer service voice calls, chatbots, and agent desktops. Grid operators rely on UCaaS for incident coordination, field dispatch, and infrastructure maintenance updates through persistent group chats and video bridges. Oil and gas companies utilize UCaaS integrations with GIS, SCADA, and ERP platforms to streamline upstream and downstream workflows. By enabling voice-enabled alerts, automated team huddles, and incident logging from mobile devices, UCaaS ensures continuity even under restricted connectivity zones, disaster scenarios, or shift handovers.

What Technologies Are Making UCaaS Platforms Enterprise-Ready for Energy Use Cases?

The functionality of UCaaS platforms is being shaped by emerging technology integrations tailored for the complex demands of the energy industry. Advanced UCaaS suites now incorporate AI-driven speech analytics, real-time language translation, and intelligent call routing-features essential for multi-lingual, cross-border energy teams. Integration with workflow automation engines allows communication triggers based on SCADA alarms, IoT sensor data, or operational KPIs. These functionalities are critical in minimizing downtime and enabling predictive maintenance by triggering collaborative response sessions even before equipment fails.Another major technological leap lies in edge-device compatibility and hybrid architecture. Since many energy firms operate in bandwidth-constrained or air-gapped environments, UCaaS providers are offering modular deployments with local caching, minimal latency video codecs, and failover routing. Integration with ruggedized mobile hardware and satellite connectivity solutions ensures that field engineers, rig operators, and wind farm technicians can maintain voice/video access even in remote zones. Identity and access management (IAM) controls, role-based access, and compliance-ready encryption protocols (such as FIPS 140-2 and ISO 27001) are standard features, particularly as energy firms navigate NERC-CIP, GDPR, and region-specific cybersecurity mandates.

Where Are UCaaS Deployments Gaining Maximum Traction Across the Energy Value Chain?

UCaaS adoption is accelerating across both traditional and renewable energy sub-segments, driven by the need for centralized visibility, agile response mechanisms, and workforce decentralization. In oil and gas, upstream operations-exploration, drilling, production-benefit from UCaaS-enabled multi-party collaboration between HQ, field sites, and third-party contractors. Downstream refineries and distribution networks use the technology for internal compliance briefings, asset monitoring alerts, and emergency protocols. In the renewable sector, wind and solar farm operators rely on cloud-native communication platforms for O&M coordination, grid response alerts, and real-time performance reviews.Electric utilities and transmission operators are witnessing a sharp increase in UCaaS adoption as they manage distributed energy resources (DERs), microgrids, and demand response programs. With the shift to smart grids and digital substations, communication between control centers, maintenance crews, and regional offices must be continuous and contextual. UCaaS helps unify SCADA dashboards, mobile inspection reports, and command center conversations into a single collaborative framework. In energy retail, sales, billing, and support teams are utilizing AI-driven UCaaS platforms to manage customer journeys across voice, web, and app-based channels. The rise of community solar projects and prosumer engagement is further expanding the customer interface scope for UCaaS platforms.

What Is Powering the Expansion of the UCaaS Market in the Energy Sector?

The growth in the UCaaS in energy market is driven by several factors, including the decentralization of energy generation, the emergence of hybrid work models, and the digital transformation of asset operations. With global energy enterprises transitioning toward more flexible, software-defined infrastructures, UCaaS emerges as a critical backbone that supports communication workflows across headquarters, control rooms, field teams, and partner ecosystems. The post-pandemic shift to hybrid work has accelerated investments in video conferencing, cloud voice, and secure messaging platforms that can operate across various terrains and regulatory jurisdictions.Cost optimization is also a significant driver. By replacing capital-intensive hardware systems and MPLS-based telecom setups with flexible cloud subscriptions, energy firms can reallocate IT budgets toward analytics, cybersecurity, and core operations. Additionally, the rising frequency of climate-related disasters, cyberattacks on critical infrastructure, and asset aging issues necessitate fast, redundant, and interoperable communication channels-further solidifying the business case for UCaaS. As green energy mandates expand and ESG compliance takes center stage, UCaaS helps enterprises create a more agile, resilient, and transparent operational culture.

The market is also benefiting from vendor innovation and ecosystem partnerships. Cloud communications providers are tailoring energy-specific UCaaS offerings bundled with rugged device support, SCADA integrations, and industry-grade encryption. Partnerships with cloud hyperscalers (AWS, Azure, GCP) and telecom carriers are enabling global coverage and edge acceleration for mission-critical energy applications. As energy firms continue to modernize control centers, field service management, and customer operations, UCaaS will play a foundational role in ensuring their digital infrastructure remains synchronized, secure, and scalable.

Scope of the Report

The report analyzes the Unified Communications as a Service (UCaaS) in Energy market, presented in terms of market value (USD). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Telephony Component, Collaboration Component, Unified Messaging Component, Conferencing Component, Other Components); Deployment (Private Deployment, Public Deployment, Hybrid Model Deployment); Organization Size (Large Enterprises, SMEs).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Telephony Component segment, which is expected to reach US$2.0 Billion by 2030 with a CAGR of a 15.2%. The Collaboration Component segment is also set to grow at 14.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $506.4 Million in 2024, and China, forecasted to grow at an impressive 12.9% CAGR to reach $646.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Unified Communications as a Service (UCaaS) in Energy Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Unified Communications as a Service (UCaaS) in Energy Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Unified Communications as a Service (UCaaS) in Energy Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 8x8, Inc., Alcatel-Lucent Enterprise, AT&T Communications, Avaya Inc., BT Group plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Unified Communications as a Service (UCaaS) in Energy market report include:

- 8x8, Inc.

- Alcatel-Lucent Enterprise

- AT&T Communications

- Avaya Inc.

- BT Group plc

- Cisco Systems, Inc.

- Comcast Business

- Dialpad

- Google LLC (Google Workspace)

- GoTo (formerly Jive/LogMeIn)

- Lumen Technologies

- Microsoft Corporation (Teams)

- Mitel Networks Corporation

- Net2Phone

- Nextiva

- Polycom (now part of Poly)

- Ribbon Communications Inc.

- RingCentral, Inc.

- Verizon Enterprise Solutions, LLC

- Vonage Business (formerly Nexmo)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025 (E), competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 8x8, Inc.

- Alcatel-Lucent Enterprise

- AT&T Communications

- Avaya Inc.

- BT Group plc

- Cisco Systems, Inc.

- Comcast Business

- Dialpad

- Google LLC (Google Workspace)

- GoTo (formerly Jive/LogMeIn)

- Lumen Technologies

- Microsoft Corporation (Teams)

- Mitel Networks Corporation

- Net2Phone

- Nextiva

- Polycom (now part of Poly)

- Ribbon Communications Inc.

- RingCentral, Inc.

- Verizon Enterprise Solutions, LLC

- Vonage Business (formerly Nexmo)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 166 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

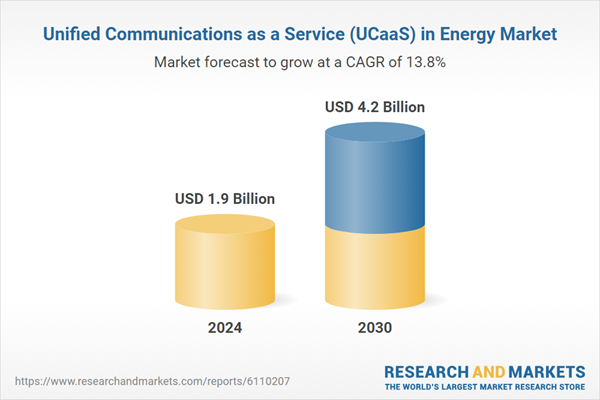

| Estimated Market Value ( USD | $ 1.9 Billion |

| Forecasted Market Value ( USD | $ 4.2 Billion |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Global |