Speak directly to the analyst to clarify any post sales queries you may have.

Discover the Diverse Ready-to-Eat Soft Foods Market Landscape Where Convenience, Nutrition and Innovation Unite to Meet Evolving Consumer Demands Across Segments

The ready-to-eat soft food market has emerged as a pivotal segment catering to a broad spectrum of consumers seeking convenience without compromising on nutrition. In recent years, busy professionals, health-conscious individuals, and time-poor families have all influenced the surge in demand for products designed to deliver balanced meals in a single serving. Simultaneously, advances in food science have enabled manufacturers to engineer soft textures that appeal to varied palates while retaining essential nutrients. This convergence of consumer lifestyles and technological innovations has set the stage for rapid evolution in product development and go-to-market approaches.Furthermore, demographic changes such as an aging population and growing numbers of on-the-go millennials are reshaping consumption patterns. Manufacturers are responding by introducing items that merge simplicity with functionality, positioning ready-to-eat soft foods as a mainstream alternative to traditional meal solutions. In this context, the focus on digestive health, protein preservation, and clean-label formulations underscores the critical role of soft food options in meeting multifaceted nutritional requirements.

Ultimately, this executive summary synthesizes the most salient findings regarding market dynamics, transformative shifts, regulatory impacts, and strategic imperatives. It seeks to provide decision-makers with a concise yet thorough understanding of the opportunities and challenges that define the ready-to-eat soft food landscape today.

Explore How Shifts in Health Trends, Packaging Technologies and Digital Engagement Are Shaping the Future Trajectory of Ready-to-Eat Soft Food Markets Globally

Health and wellness initiatives now dominate product roadmaps, driving manufacturers to fortify soft foods with essential vitamins, prebiotics, and functional ingredients that support digestive balance and immune resilience. As nutritional science uncovers novel bioactives, companies are reformulating classic offerings such as mashed foods and puréed meals to deliver targeted benefits beyond basic sustenance. Moreover, the rise of personalized nutrition has catalyzed the exploration of modular product systems, enabling brand owners to address specific dietary goals within a unified category.Simultaneously, packaging technologies are undergoing a revolution focused on sustainability and convenience. Innovations in eco-friendly pouches, recyclable cups, and lightweight trays are reducing environmental footprints while enhancing portability. In parallel, smart labels and tamper-evident seals are being integrated to reassure consumers of quality and safety, reflecting heightened transparency demands.

Moreover, digital engagement has accelerated, with direct-to-consumer platforms and subscription-based models reshaping how soft food products reach end users. Social commerce integrations and influencer partnerships further amplify brand visibility, driving trial and loyalty. Collectively, these transformative shifts in consumer expectations, packaging systems, and distribution paradigms are forging a new future for ready-to-eat soft foods.

Analyze the Far-Reaching Consequences of United States Tariffs Implemented in 2025 on Supply Chains, Pricing Strategies and Strategic Sourcing Decisions for Soft Food Manufacturers

In 2025, a fresh wave of United States tariffs on agricultural ingredients, including select grains, dairy proteins, and imported fruit concentrates, has introduced complexity to the soft food value chain. With Cereals and Porridge components like oatmeal and rice porridge subject to increased duties, manufacturers have faced immediate pressure to reassess ingredient sourcing strategies. Concurrently, packaging materials-particularly specialty films used in pouches and cups-have become more expensive due to tariffs on petrochemical derivatives, compelling cost containment initiatives.Consequently, many producers have sought to diversify their supplier base by forging partnerships with domestic farmers, expanding into alternative raw materials, and negotiating long-term contracts to secure stable pricing. These adjustments have led to incremental increases in production expenses, which companies have partially absorbed through operational efficiencies and process optimizations. Meanwhile, some brands have leveraged the tariff landscape as an opportunity to differentiate by promoting locally sourced or sustainably farmed ingredients, reinforcing premium positioning.

Ultimately, the cumulative impact of these policy measures has driven strategic realignment across the sector. Companies are balancing short-term margin pressures with longer-term investments in supply chain resilience, while regulatory uncertainty continues to influence risk management frameworks and pricing strategies for ready-to-eat soft food products.

Unlock Comprehensive Insights Into Product Types, Packaging Formats, Ingredient Preferences, Distribution Channels and End User Dynamics Driving Soft Food Consumption Trends

Product type distinctions play a central role in uncovering nuanced growth pockets within the ready-to-eat soft food market. Cereals and porridge offerings, subdivided into oatmeal and rice porridge, are enjoying particular popularity as consumers seek familiar textures with fortified nutrition. At the same time, fruit-based options and mashed or minced foods cater to those desiring simple fruit servings or gentle textures that require minimal preparation. Puréed meals are being reformulated to deliver balanced macronutrients, while soft dairy products-ranging from custards and puddings to yogurt-are increasingly enriched with probiotics and plant-derived proteins. Soups and broths have also expanded their footprint, evolving from traditional comfort fare to functional meal replacements tailored for active lifestyles.Packaging type continues to influence purchase behavior, whether through single-serve bottles that support on-the-go consumption, cups designed for microwave heating, resilient pouches favored for minimal storage space, or rigid trays that appeal to conventional retail displays. Each format carries distinct cost implications and recycling considerations, prompting brands to optimize their portfolios accordingly.

Meanwhile, consumer preferences for ingredient type remain divided between dairy-based indulgence and plant-based innovation, with zero-lactose and vegan formulations gaining traction among health-conscious segments. Distribution channels have also diversified, as products flow through offline outlets-encompassing convenience stores and supermarkets & hypermarkets-as well as online retailers, which include both e-commerce platforms and manufacturer websites. This omnichannel evolution allows brands to meet shoppers where they are, whether in bricks-and-mortar environments or digital storefronts.

End users span adults seeking lunch replacements, children requiring balanced snacks, and elderly consumers benefiting from easily chewable, nutrient-rich options. Segment-specific nutrition profiles and portion sizes are being refined to address each group’s unique physiological needs and lifestyle patterns.

Gain a Panoramic View of Key Regional Nuances in the Ready-to-Eat Soft Food Sector Spanning the Americas, Europe Middle East and Africa and the Asia-Pacific Regions

The Americas region leads with a robust appetite for convenience-driven solutions, as North American consumers embrace ready-to-eat soft foods for quick breakfast and post-workout meals. Urban centers in the United States and Canada are fertile grounds for premium innovations, while Latin American markets demonstrate growing interest in fortification and value-driven offerings. Supply chain synergies across the continent facilitate rapid product launches, fostering collaboration among ingredient suppliers, co-packers, and retail chains.Europe, the Middle East, and Africa collectively present a diverse regulatory and cultural tapestry. In Western Europe, stringent food safety standards and consumer advocacy have accelerated the adoption of clean-label and organic certified soft foods. Meanwhile, the Middle East shows rising demand for fortified soups and dairy-based puréed meals aligned with regional dietary preferences. In Africa, expanding retail infrastructure and rising middle-class populations create untapped prospects for affordable, nutrient-dense soft food alternatives.

Across the Asia-Pacific landscape, fast-paced urbanization and elevated disposable incomes have spurred an appetite for both international and locally inspired flavors. Japan and South Korea lead with advanced packaging technologies and premium soy-based yogurts, whereas Southeast Asian markets favor tropical fruit purées and rice porridge variants infused with indigenous spices. Australia and New Zealand are emerging hubs for plant-based dairy analogs, reflecting the global shift toward sustainable ingredient sourcing.

Examine the Competitive Landscape of Leading Players and Their Strategic Initiatives Fueling Innovation, Market Expansion and Partnerships in the Ready-to-Eat Soft Food Industry

The competitive arena is anchored by global conglomerates alongside nimble innovators. Leading multinational corporations have leveraged extensive R&D capabilities to extend their portfolios across multiple soft food segments, while regional specialists have carved out strongholds through targeted branding and local ingredient partnerships. This dual dynamic has driven continuous renewal of product pipelines and tightened the race for shelf space in both traditional retail and digital channels.Key players have embraced strategic initiatives that include co-development agreements with flavor houses, acquisition of niche brands to capture emerging subsegments, and the introduction of proprietary enzyme systems to enhance texture and nutrient bioavailability. Several companies have also launched incubator programs to scout start-ups focused on novel packaging solutions or hypoallergenic soft food formulations. Partnerships with technology firms have further enabled real-time manufacturing adjustments and transparency via blockchain-enabled traceability systems.

In addition, alliances between ingredient suppliers and co-manufacturers are optimizing cost structures and ensuring supply continuity in light of tariff-driven raw material volatility. Taken together, these strategic maneuvers illustrate the multifaceted approach that leading companies employ to maintain a competitive edge and anticipate the next wave of consumer demands in the ready-to-eat soft food domain.

Implement Targeted Recommendations Focused on Innovation, Supply Chain Resilience, Digital Transformation and Sustainability to Propel Leadership in the Soft Food Market

Companies seeking to secure market leadership should prioritize continuous innovation in texture and flavor profiles, ensuring each new release addresses specific nutritional objectives. By integrating emerging ingredients such as plant-based proteins and digestive-support prebionutrients, brands can differentiate offerings and command premium positioning. In parallel, investing in flexible manufacturing lines will allow swift adaptation to evolving ingredient sourcing and regulatory requirements.Strengthening supply chain resilience is equally critical. Diversifying raw material origins, establishing strategic reserves of key components, and forging long-term partnerships with regional growers can mitigate the impacts of tariff fluctuations and logistical disruptions. Collaborative forecasting mechanisms with channel partners will further diminish inventory risks and align production schedules with real-time consumer demand signals.

Digital transformation initiatives, including direct-to-consumer subscription models and data-driven personalization engines, will empower firms to deepen engagement with target audiences. Brands that harness predictive analytics to tailor promotional campaigns and product recommendations can achieve higher conversion rates and foster loyalty. Moreover, adopting sustainable packaging solutions-such as biodegradable films and reusable containers-will resonate with environmentally conscious consumers and preempt stricter regulatory mandates.

Finally, companies should implement rigorous compliance frameworks to navigate the complex regulatory environments across regions, thereby reducing time-to-market for new formulations and enhancing overall quality assurance.

Understand the Rigorous Multi-Stage Research Methodology Combining Primary Interviews, Secondary Sources and Data Triangulation Ensuring Depth and Accuracy of Market Insights

This study combines extensive primary research with comprehensive secondary analysis to ensure robust and reliable conclusions. The primary phase involved structured interviews with senior executives from manufacturing firms, ingredient suppliers, packaging innovators, and retail buyers. Supplementary surveys captured quantitative insights on consumer usage patterns and purchase intentions in key global markets.Secondary research encompassed a thorough review of trade publications, regulatory filings, academic journals, company reports, and industry databases. This desk-based investigation provided historical context, technological trend mapping, and competitive benchmarking. Specialized knowledge centers and regulatory bodies were consulted to validate compliance and safety considerations associated with soft food ingredients and packaging materials.

All collected data underwent a multilayered triangulation process to reconcile potential discrepancies and validate findings. Advanced statistical techniques and qualitative content analysis were applied to extract actionable insights and identify market drivers. Finally, internal quality checks and expert review panels ensured methodological rigor, transparency, and alignment with best practices in market research.

Conclude With a Concise Synthesis of Core Findings Highlighting Strategic Opportunities, Emerging Trends and Actionable Pathways for the Ready-to-Eat Soft Food Market

In summary, the ready-to-eat soft food market presents a wealth of opportunities fueled by shifting consumer lifestyles, nutritional awareness, and packaging ingenuity. Key drivers include heightened demand for clean-label formulations, the ascent of plant-based alternatives, and the integration of digital engagement across distribution channels. Regional dynamics further underscore the need for tailored strategies, with distinct opportunities emerging in the Americas, EMEA, and Asia-Pacific.Strategic recommendations center on fostering innovation in both product development and packaging, enhancing supply chain resilience in response to tariff-induced volatility, and leveraging data-driven personalization to strengthen brand loyalty. Leading companies are already forging partnerships, expanding through acquisitions, and streamlining operations to capture emerging subsegments and preempt competitive threats.

Looking ahead, sustained growth will depend on the sector’s ability to anticipate regulatory shifts, deliver meaningful nutritional benefits, and balance environmental stewardship with cost-efficiency. Organizations that harness these insights, adapt proactively to evolving market forces, and maintain unwavering focus on consumer priorities will shape the future of the ready-to-eat soft food landscape.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Cereals & Porridge

- Oatmeal

- Rice Porridge

- Fruits

- Mashed/Minced Foods

- Puréed Meals

- Soft Dairy Products

- Custards

- Pudding

- Yogurt

- Soups & Broths

- Cereals & Porridge

- Packaging Type

- Bottles

- Cups

- Pouches

- Trays

- Ingredient Type

- Dairy-based

- Plant-based

- Preservation Method

- Ambient

- Fresh / Short Shelf Life

- Frozen

- Refrigerated

- Distribution Channel

- Offline

- Convenience Stores

- Supermarkets & Hypermarkets

- Online Retailers

- E-Commerce Websites

- Manufacturer Websites

- Offline

- End User

- Adults

- Children

- Elderly

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- The Kraft Heinz Company

- Campbell Soup Company

- Brekki Foods, LLC

- Conagra Brands, Inc.

- Danone S.A.

- General Mills, Inc.

- Hodo, Inc.

- IFEX Group Srl

- INTERAL, SA

- Kellogg Company

- McCain Foods Limited

- Milky Mist

- MUSH Foods, Inc.

- Nestlé S.A.

- Orkla ASA

- Pulmuone Holdings Co., Ltd.

- Reser’s Fine Foods, Inc

- Sainsbury’s Group

- Simplot Global Food, LLC

- Simply Desserts

- Surgital Spa

- Surtiflavour

- The Hain Celestial Group, Inc.

- Turri's Italian Foods

- WEIKFIELD FOODS PVT. LTD

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Ready to Eat Soft Food market report include:- The Kraft Heinz Company

- Campbell Soup Company

- Brekki Foods, LLC

- Conagra Brands, Inc.

- Danone S.A.

- General Mills, Inc.

- Hodo, Inc.

- IFEX Group Srl

- INTERAL, SA

- Kellogg Company

- McCain Foods Limited

- Milky Mist

- MUSH Foods, Inc.

- Nestlé S.A.

- Orkla ASA

- Pulmuone Holdings Co., Ltd.

- Reser’s Fine Foods, Inc

- Sainsbury’s Group

- Simplot Global Food, LLC

- Simply Desserts

- Surgital Spa

- Surtiflavour

- The Hain Celestial Group, Inc.

- Turri's Italian Foods

- WEIKFIELD FOODS PVT. LTD

Table Information

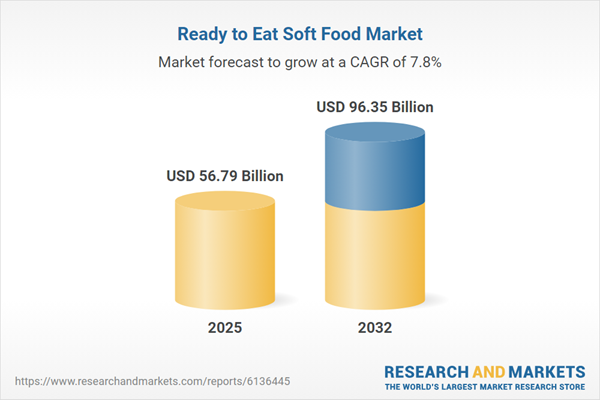

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 56.79 Billion |

| Forecasted Market Value ( USD | $ 96.35 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |