Speak directly to the analyst to clarify any post sales queries you may have.

Unveiling the Multifaceted Role of Modified Cassava Starch as a Key Functional Ingredient Driving Innovation Across Food, Pharma, and Industrial Applications

Modified cassava starch has emerged as a versatile workhorse ingredient across multiple industrial and commercial ecosystems. Derived from the abundant cassava root, this native starch undergoes targeted modification processes to enhance its functional properties, such as thermal stability, viscosity control, and adhesive strength. These engineered attributes open new avenues for performance-oriented applications, transcending the limitations of unmodified starch and unlocking value in sectors ranging from food processing to paper manufacturing.As consumer demand for cleaner labels and natural ingredients intensifies, stakeholders have refocused on cassava as a renewable feedstock with a favorable environmental profile. The surge in innovation around chemical, enzymatic, and physical modification techniques has accelerated the development of tailored grades that meet stringent quality and regulatory standards. With robust integration into global supply networks, modified cassava starch now serves as a critical building block for formulators and product designers seeking to achieve both functional excellence and sustainability.

Decoding the Fundamental Transformations Redefining Modified Cassava Starch Amid Sustainability Imperatives and Technological Advancements

The landscape of modified cassava starch is undergoing a profound transformation driven by both regulatory pressures and technological breakthroughs. Green chemistry initiatives have catalyzed the adoption of enzyme-based modification pathways that reduce reliance on harsh chemicals, while advanced extrusion and micronization equipment have enabled precision in granule and powder performance. These innovations not only elevate the functional consistency of starch grades but also align with corporate sustainability commitments.Concurrently, digitalization has reshaped supply chain visibility, allowing raw material traceability from farm to processing facility. Blockchain pilots and real-time analytics solutions facilitate quality assurance and risk mitigation, ensuring that modified cassava starch delivers on purity and performance claims. With each of these shifts, stakeholders are compelled to reassess their strategies, forging partnerships that bridge contract farming networks, processing excellence, and data-driven logistics.

Assessing the Far Reaching Consequences of Enhanced United States Tariffs on Modified Cassava Starch Supply Chains and Trade Dynamics in 2025

The introduction of elevated United States tariffs on imported modified cassava starch in 2025 has created a ripple effect throughout global trade corridors. Importers faced immediate cost pressures, prompting many to negotiate longer-term contracts with domestic processors or to invest in local manufacturing facilities to bypass tariff barriers. As a result, the traditional supply hubs in Southeast Asia have pivoted toward alternate markets while intensifying their value-added service offerings to retain customer loyalty.These tariff measures have also driven procurement teams to diversify their sourcing strategies, exploring hybrid supply networks that balance local production with selective imports. While some end users absorbed incremental costs through price adjustments, others reengineered formulations to optimize starch usage and explore alternative bio-based thickeners. This period of adjustment has underscored the importance of agile supply chain design and flexible contract models to withstand evolving trade uncertainties.

Illuminating Critical Segmentation Insights to Navigate Diverse Product Types, Forms, Grades, End Users, and Distribution Channels within the Market

A deep dive into segmentation reveals that product development teams have capitalized on chemical modification techniques-acetylation, cross-linking, hydroxypropylation, and oxidation-to achieve bespoke viscosity profiles and freeze-thaw stability. Meanwhile, enzymatic modification has gained prominence for its precise molecular tailoring capabilities, and physical modification continues to offer cost-effective solutions where basic functional performance aligns with application requirements.In parallel, the physical form of modified cassava starch has become a strategic lever. Granules deliver consistent hydration properties for industrial adhesives, whereas liquid slurries provide convenient integration in high-speed food lines, and powdered variants optimize storage stability and transport efficiency. The quest for higher purity grades has driven investments in advanced filtration and drying technology, producing food-grade starch with consumer-safe profiles, industrial-grade products designed for robust manufacturing processes, and pharmaceutical-grade variants that meet exacting regulatory thresholds.

End users across animal feed, construction, cosmetics and personal care, food and beverage, paper and packaging, pharmaceuticals, and textiles each impose distinct performance criteria. As a result, distribution channels have matured into specialized networks: offline channels leverage direct sales teams and distributor-wholesaler partnerships for technical application support, while online platforms including company portals and e-commerce marketplaces streamline procurement for agile buyers and niche formulators.

Unraveling Regional Nuances Shaping the Demand and Adoption of Modified Cassava Starch across the Americas, EMEA, and Asia-Pacific Territories

Regional dynamics are reshaping the deployment and adoption of modified cassava starch in unique ways. In the Americas, strong downstream demand from food and beverage manufacturers and paper producers has been complemented by an emerging focus on bio-based adhesives for packaging. The region’s integrated supply chains and robust agricultural infrastructure have accelerated the shift toward locally sourced cassava derivatives, reinforcing supply resilience.Across Europe, the Middle East and Africa, stringent regulatory frameworks and consumer preference for eco-friendly ingredients have elevated the appeal of sustainably produced starch. Collaborative initiatives between processors and agricultural cooperatives are expanding capacity, particularly for specialty grades in the personal care and pharmaceutical sectors. Meanwhile, in the Asia-Pacific region, rapid industrialization and urbanization have spurred growth in construction and textile applications, with manufacturers leveraging cost-competitive production capabilities to meet rising local and export-oriented demand.

Profiling Leading Innovators and Strategic Collaborators Driving Advancements and Competitive Differentiation in the Modified Cassava Starch Arena

Leading global innovators have adopted differentiated strategies to maintain competitive advantage in the modified cassava starch arena. Some have invested heavily in proprietary modification processes that deliver superior functional consistency, while others have established joint ventures with cassava cultivation hubs to secure sustainable feedstock supply. A growing number of players have embedded circular economy principles into their operations, converting processing by-products into value-added derivatives or energy sources.In response to evolving customer requirements, top companies have broadened their application support services, offering technical laboratories and formulation assistance that drive faster product development cycles. Strategic acquisitions have also featured prominently, enabling key companies to expand geographic reach and enhance their portfolios with complementary ingredients that complement modified cassava starch in complex formulations.

Empowering Industry Stakeholders with Tactical Recommendations to Optimize Operability, Diversify Portfolios, and Capitalize on Emerging Growth Avenues

To thrive amid shifting trade policies and intensifying sustainability expectations, industry stakeholders should prioritize investment in green modification technologies that minimize water usage and effluent generation. By adopting enzymatic conversion pathways and optimizing reaction parameters, companies can not only reduce environmental footprints but also achieve more consistent product quality.Forging deeper partnerships across the value chain-from contract growers to end-use formulators-will enhance supply chain transparency and secure reliable raw material streams. Stakeholders can further differentiate by developing high-purity and ultra-high-viscosity grades tailored to emerging application niches, such as clean-label pharmaceuticals and advanced packaging solutions. Additionally, expanding digital sales channels through dedicated e-commerce portals will capture agile buyers and small-scale formulators seeking rapid procurement cycles.

Finally, proactive engagement with regulatory bodies and standard-setting organizations can smooth market entry barriers in new regions and align product specifications with evolving compliance requirements. This collaborative approach will safeguard market access and foster innovation in line with global sustainability mandates.

Detailing a Robust and Systematic Research Methodology Combining Primary Expert Consultations and Secondary Data Synthesis for Market Insights

This research combined primary insights gleaned from in-depth interviews with senior R&D executives, supply chain managers, and application engineers across leading starch processors and end-use manufacturers. On-site plant observations and technical deep dives supplemented these dialogues, ensuring that practical challenges and emerging best practices were captured in full context.Secondary research involved rigorous analysis of peer-reviewed studies, trade association white papers, and regulatory filings, all cross-validated through a structured data triangulation process. Market activity was continuously monitored for changes in import/export policies, raw material supply disruptions, and technological patent disclosures, providing a layered understanding of industry dynamics and enabling robust, actionable conclusions.

Synthesizing Core Findings to Chart a Clear Path Forward for Stakeholders in the Evolving Modified Cassava Starch Landscape

The evolving landscape of modified cassava starch underscores a broader industry transition toward sustainable, performance-oriented ingredients. As stakeholders deploy innovative modification pathways and diversify their product portfolios, the competitive environment will increasingly favor those who balance environmental stewardship with technical excellence.Moving forward, the alignment of supply chain agility, strategic partnerships, and regulatory engagement will determine which organizations capture the most value. With these insights at hand, decision-makers can chart a course that leverages the full spectrum of product, form, and regional opportunities inherent in the modern modified cassava starch market.

Market Segmentation & Coverage

This research report forecasts the revenues and analyzes trends in each of the following sub-segmentations:- Product Type

- Chemical Modification

- Acetylated

- Cross Linked

- Hydroxypropyl

- Oxidized

- Enzymatic Modification

- Physical Modification

- Chemical Modification

- Physical Form

- Granule

- Liquid

- Powder

- Purity Grade

- Food Grade

- Industrial Grade

- Pharmaceutical Grade

- End User

- Animal Feed

- Construction

- Cosmetics & Personal Care

- Food & Beverage

- Paper & Packaging

- Pharmaceuticals

- Textiles

- Distribution Channel

- Offline

- Direct Sales

- Distributors/Wholesalers

- Online

- Company Websites

- E-commerce Platforms

- Offline

- Americas

- North America

- United States

- Canada

- Mexico

- Latin America

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- North America

- Europe, Middle East & Africa

- Europe

- United Kingdom

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Sweden

- Poland

- Switzerland

- Middle East

- United Arab Emirates

- Saudi Arabia

- Qatar

- Turkey

- Israel

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Europe

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Thailand

- Malaysia

- Singapore

- Taiwan

- Ingredion Incorporated

- Archer‑Daniels‑Midland Company

- Cargill, Incorporated

- Thai Wah Public Co., Ltd

- Asia Modified Starch Co., Ltd.

- Bangkok Starch Industrial Co., Ltd

- Banpong Tapioca Products Company Limited

- Beneva Group

- BS Starch Chemical

- General Starch Limited

- Mc Andrew and Partners Co., Ltd

- Neo Nam Viet Co., Ltd.

- Roquette Frères S.A.

- SMS Corporation

- Sonish Starch Technology Co., Ltd

- SPAC Starch Products Private Limited

- Starch Asia

- Starpro Sanwa Ayutthaya Modified Starch Co., Ltd

- Tate & Lyle PLC

- Tereos S.A.

- Thai Flour Co., Ltd

- Viego Global JSC

- Visco Starch

Table of Contents

3. Executive Summary

4. Market Overview

7. Cumulative Impact of Artificial Intelligence 2025

Companies Mentioned

The companies profiled in this Modified Cassava Starch market report include:- Ingredion Incorporated

- Archer‑Daniels‑Midland Company

- Cargill, Incorporated

- Thai Wah Public Co., Ltd

- Asia Modified Starch Co., Ltd.

- Bangkok Starch Industrial Co., Ltd

- Banpong Tapioca Products Company Limited

- Beneva Group

- BS Starch Chemical

- General Starch Limited

- Mc Andrew and Partners Co., Ltd

- Neo Nam Viet Co., Ltd.

- Roquette Frères S.A.

- SMS Corporation

- Sonish Starch Technology Co., Ltd

- SPAC Starch Products Private Limited

- Starch Asia

- Starpro Sanwa Ayutthaya Modified Starch Co., Ltd

- Tate & Lyle PLC

- Tereos S.A.

- Thai Flour Co., Ltd

- Viego Global JSC

- Visco Starch

Table Information

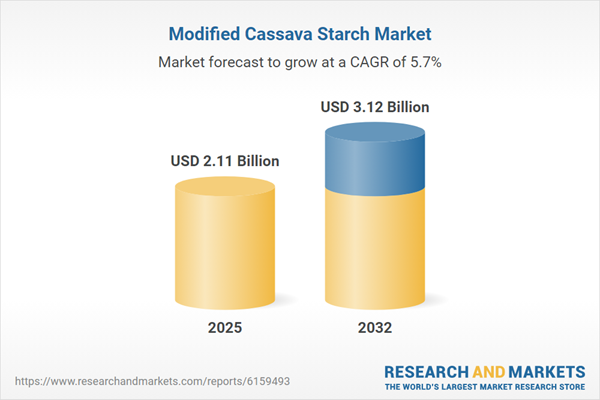

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | October 2025 |

| Forecast Period | 2025 - 2032 |

| Estimated Market Value ( USD | $ 2.11 Billion |

| Forecasted Market Value ( USD | $ 3.12 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |