As the global population continues to age, there is a marked rise in the number of individuals experiencing a weakened immune system, which significantly increases their risk of developing shingles (herpes zoster), a painful skin rash caused by the reactivation of the varicella zoster virus.

Rising Adoption of Antiviral Therapy

The antiviral therapy segment held a substantial share in 2024, owing to the effectiveness of agents like acyclovir, valacyclovir, and famciclovir in managing herpes zoster and reducing complications such as postherpetic neuralgia. These medications are typically prescribed to both immunocompetent and immunocompromised patients, with demand rising among aging populations and those with weakened immune defenses.Increasing Prevalence of Varicella (Chickenpox)

The varicella segment generated a substantial share in 2024. The breakthrough infections and unvaccinated populations continue to present treatment needs, particularly in developing regions. While antivirals may be used in severe pediatric or adult cases, the primary focus remains on prevention. To enhance their foothold, companies are working closely with public health authorities to expand access to varicella vaccines and raise awareness through school-based immunization programs.Growing Prevalence Among Geriatrics

The geriatrics segment will grow at a decent CAGR during 2025-2034, owing to the increased risk of herpes zoster and its complications among older adults. As immunity wanes with age, seniors are particularly vulnerable to reactivation of the virus, often requiring prompt antiviral therapy and, in many cases, long-term pain management. The introduction of highly effective vaccines like the recombinant zoster vaccine has shifted the focus toward prevention, yet there remains strong demand for supportive treatments in cases where vaccination is missed or ineffective.North America to Emerge as a Lucrative Region

North America varicella zoster virus infection treatment market is poised to witness significant growth by 2034, supported by robust healthcare infrastructure, high vaccine coverage, and a large aging population. The United States has seen strong uptake of shingles vaccines, with reimbursement support from both public and private payers. In addition, early adoption of advanced antiviral therapies has helped reduce complications associated with delayed treatment.Major players in the varicella zoster virus infection treatment market are Santa Cruz Biotechnology, Mylan, Pfizer, SK Chemicals, Changchun BCHT Biotechnology, Teva Pharmaceuticals, Apotex, Novartis, Bausch Health, Kamada, Sandoz, GlaxoSmithKline, Merck & Co., Glenmark Pharmaceuticals, Bio-Rad Laboratories, and Sinovac.

To maintain and grow their foothold in the varicella zoster virus infection treatment market, companies are employing multi-pronged strategies that combine product innovation, geographic expansion, and public health collaboration. R&D investment is being directed toward next-generation antivirals and improved vaccine formulations with longer-lasting immunity.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The key companies profiled in this Varicella Zoster Virus Infection Treatment market report include:- Apotex

- Bausch Health

- Bio-Rad Laboratories

- Changchun BCHT Biotechnology

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Kamada

- Merck & Co.

- Mylan

- Novartis

- Pfizer

- Sandoz

- Santa Cruz Biotechnology

- Sinovac

- SK Chemicals

- Teva Pharmaceuticals

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | September 2025 |

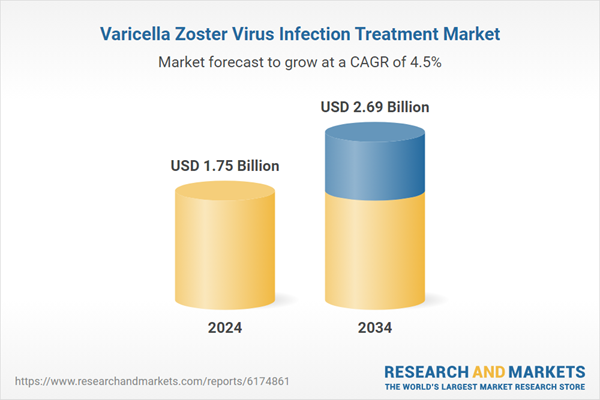

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 1.75 Billion |

| Forecasted Market Value ( USD | $ 2.69 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 17 |