Sodium Alginate Market

The sodium alginate market spans food-grade thickeners and stabilizers (bakery fillings, dairy, plant-based beverages, noodles), pharmaceutical excipients (controlled-release matrices, wound dressings), personal care rheology modifiers, and industrial grades for textile printing, paper surface sizing, welding rod binders, and water treatment. Derived from brown seaweeds, supply hinges on macroalgae species mix, harvest seasons, and extraction yields, while demand is buoyed by clean-label formulation, vegan/halal/kosher compliance, and the shift from synthetic to bio-based rheology systems. Formulators value alginate’s shear-thinning, thermal stability, freeze-thaw resilience, and cold-set gelation with calcium, enabling encapsulation, spherification, and texture design without heat. Differentiation centers on viscosity grade and distribution, calcium reactivity, ash/metals profile, microbial specs, and lot-to-lot consistency across applications that span low-pH beverages to high-speed rotary textile printing. Producers compete on predictable rheology at low dose, dust-controlled granules for fast hydration, and tailored blends (alginate + fibers/pectins/CMC) that deliver specific mouthfeel or printability. Strategic headwinds include seaweed biomass variability from climate and coastal regulation, energy and chemical costs in extraction, and purity demands in pharma/medical. Tailwinds include growth in plant-based foods, premium wound care, and eco-friendly textile printing pastes compatible with reactive dyes and digital workflows. Winning suppliers secure upstream seaweed partnerships, deploy QA analytics to tighten viscosity windows, and offer application labs that co-develop recipes, cutting customer scale-up time. Sustainability narratives - responsible harvesting, traceable lots, and lower solvent/energy footprints - reinforce adoption in brands seeking bio-based performance without compromising processing efficiency.Sodium Alginate Market Key Insights

- Grade engineering is the moat: Narrow viscosity windows, controlled molecular weight, and defined mannuronic/guluronic ratios deliver predictable thickening, film-forming, and gel strength across food, pharma, and textile lines - reducing reformulation risk.

- Clean-label texture wins reformulations: Alginate replaces modified starches/gelatin in plant-based dairy, sauces, and fillings; calcium-set systems enable cold processing, improved syneresis control, and stable freeze-thaw for D2C frozen and ready meals.

- Calcium reactivity unlocks structures: From spherification beads to co-extruded sausage casings and encapsulated flavors, tuned sequestrants and calcium release curves provide firm yet elastic gels that withstand thermal and shear abuse.

- Medical and wound-care premiumization: High-purity, low-endotoxin grades enable absorbent calcium-alginate dressings and hemostatic products; documentation, bioburden controls, and validated sterilization support regulatory acceptance.

- Textile printing seeks print fidelity: Low-residue, high-flow alginates prevent screen clogging and maintain color yield with reactive dyes; blends tuned for digital pretreatments balance penetration with edge sharpness and wash-off ease.

- Processability and hygiene matter: Dust-reduced granules, rapid wet-out, and anti-fish-eyeing cuts mixing time and airborne exposure; consistent ash and metal profiles protect catalysts, enzymes, and dye chemistries downstream.

- Sustainability shifts procurement: Responsible wild harvest and growing seaweed farming programs reduce ecosystem pressure; LCA data, traceability, and reduced-chemical extraction improve acceptance in ESG-screened portfolios.

- Supply assurance over spot price: Multi-origin sourcing, safety stocks, and standardized specs across plants buffer climate and regulatory shocks; transparent change-control protects validated customer recipes.

- Synergy blends expand utility: Pairing alginate with pectin, CMC, locust bean gum, or fibers tunes yield stress and mouthfeel for low-sugar systems, while in pharma it co-forms matrices for controlled release without solvent exposure.

- Applications move upstream in design: Early rheology mapping with customers - mixing energy, pH, ion load, shear profile - prevents scale-up surprises; pilot-to-plant support and analytics dashboards shorten commercialization cycles.

Sodium Alginate Market Reginal Analysis

North America

Clean-label reformulation in retail and foodservice elevates alginate in sauces, plant-based dairy, and frozen ready meals. Wound-care and dental impressions sustain medical-grade demand. Buyers emphasize dust-controlled granules, rapid hydration, and tight viscosity control with robust documentation. Textile printing adoption favors low-residue grades compatible with reactive dyes and water-efficient wash-off.Europe

Strong sustainability and labeling norms drive interest in traceable, responsibly harvested seaweed inputs and low-solvent extraction. Premium bakery, confectionery, and alternative dairy use alginate for stable structure with reduced sugar. Technical textiles and digital pretreatments value consistent rheology and easy wash-out. Pharma suppliers require rigorous change-control and validated microbial limits.Asia-Pacific

Largest biomass base and processing footprint with integrated seaweed supply in coastal hubs. Rapid growth in convenience foods and plant-based categories boosts food-grade volumes; textile clusters adopt performance pastes for high-speed lines. Local medical device makers expand calcium-alginate dressings. Price tiers range from commodity viscosities to high-purity pharma grades, with quick customization via regional labs.Middle East & Africa

Food manufacturing and QSR supply chains adopt alginate for viscosity stability in hot climates and for encapsulation in beverages and flavors. Healthcare investments drive targeted demand for wound-care materials. Import-reliant markets prioritize consistent specs, long shelf life, and clear halal documentation; technical support for hydration and calcium control is valued.South & Central America

Growing processed foods and dairy alternatives pull food-grade alginate, while textile printing in select hubs seeks clean wash-off and color yield. Domestic seaweed initiatives emerge but most buyers rely on imports with predictable viscosity and ash profiles. Distributors win with application support, training on cold-set gels, and inventory programs that buffer seasonality and logistics variability.Sodium Alginate Market Segmentation

By Product Grade

- Food & Pharmaceutical

- Technical

By Function

- Stabilizers

- Thickeners

- Gelling Agents

- Emulsifiers

By End-User

- Textiles

- Food & Beverages

- Pharmaceuticals

Key Market players

CP Kelco, IFF (DuPont Nutrition & Biosciences; formerly FMC BioPolymer), KIMICA Corporation, Algaia S.A., Qingdao Bright Moon Seaweed Group, Qingdao Gather Great Ocean Algae Industry Group, Qingdao Allforlong Bio-Tech Co., Ltd., Lianyungang Huanyu Seaweed Co., Ltd., SNAP Natural & Alginate Products Pvt. Ltd., CEAMSA (Compañía Española de Algas Marinas), Marine Hydrocolloids (Meron), Alginate Industries Limited (India), Qingdao Seawin Biotech Group, Shandong Jiejing Group Corporation, Qingdao Hyzlin Biology Development Co., Ltd.Sodium Alginate Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Sodium Alginate Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Sodium Alginate market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Sodium Alginate market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Sodium Alginate market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Sodium Alginate market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Sodium Alginate market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Sodium Alginate value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Sodium Alginate industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Sodium Alginate Market Report

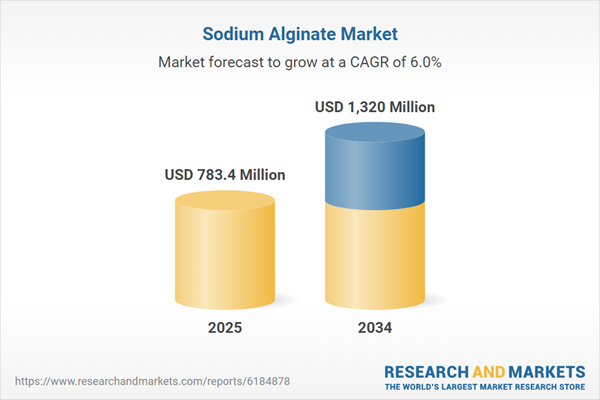

- Global Sodium Alginate market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Sodium Alginate trade, costs, and supply chains

- Sodium Alginate market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Sodium Alginate market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Sodium Alginate market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Sodium Alginate supply chain analysis

- Sodium Alginate trade analysis, Sodium Alginate market price analysis, and Sodium Alginate supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Sodium Alginate market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- CP Kelco

- IFF (DuPont Nutrition & Biosciences; formerly FMC BioPolymer)

- KIMICA Corporation

- Algaia S.A.

- Qingdao Bright Moon Seaweed Group

- Qingdao Gather Great Ocean Algae Industry Group

- Qingdao Allforlong Bio-Tech Co. Ltd.

- Lianyungang Huanyu Seaweed Co. Ltd.

- SNAP Natural & Alginate Products Pvt. Ltd.

- CEAMSA (Compañía Española de Algas Marinas)

- Marine Hydrocolloids (Meron)

- Alginate Industries Limited (India)

- Qingdao Seawin Biotech Group

- Shandong Jiejing Group Corporation

- Qingdao Hyzlin Biology Development Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 783.4 Million |

| Forecasted Market Value ( USD | $ 1320 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |