Organic Shortening Powder Market

The Organic Shortening Powder market comprises spray-dried, clean-label fat systems formulated from certified-organic oils and carriers to deliver shortening functionality in a shelf-stable, easy-to-dose format. The market serves bakery mixes, laminated and filled pastries, cookies and crackers, confectionery centers, beverage creamers, meal replacement blends, instant desserts, dehydrated culinary bases, and plant-based applications where dairy-free, allergen-aware credentials are essential. Recent trends emphasize palm-free and sustainably sourced palm, coconut/MCT-forward formulations, non-GMO inputs, and transparent supply chains, alongside advances in microencapsulation that improve oxidation resistance and cold-water dispersibility. Growth is propelled by trans-fat elimination, reformulation toward natural labels, e-commerce and co-manufacturing models, and the shift from refrigerated fats to ambient powders in globalized supply chains. Competitively, global ingredient majors, regional spray-drying specialists, and private-label/contract manufacturers compete on flavor neutrality, particle engineering, solubility, and certification breadth (USDA/EU organic, kosher/halal, allergen control). Strategic priorities include carrier optimization (e.g., organic maltodextrin, acacia/tapioca), palm stewardship, carbon-footprint reduction, and hybridization with proteins or fibers for texture and stability. Quality systems (BRC/IFS), traceable sourcing, and agile MOQ/lead-time management matter as brands scale DTC and foodservice lines. Looking ahead, differentiation will hinge on multifunctional powders that deliver aeration, crumb tenderness, and heat stability across wider pH/processing windows, while meeting evolving organic standards, deforestation-free policies, and retailer scorecards. Partnerships between oil processors, dryers, and application labs will accelerate fast-cycle reformulation for bakery, beverages, and plant-based foods.Organic Shortening Powder Market Key Insights

- Clean-label premiumization: Buyers prioritize short ingredient lists, organic certification, and recognizable carriers. Vendors that pair flavor-neutral fats with minimal processing disclosures and robust allergen programs become preferred for bakery mixes, creamers, and instant desserts, especially where label scrutiny is high. This drives tighter supplier qualification and longer-term contracts.

- Functionality first: Success hinges on consistent aeration, lamination performance, crumb tenderness, and heat tolerance. Particle size distribution, emulsifier selection within organic constraints, and oxidation control determine reproducibility across industrial mixers, continuous sheeters, and high-shear beverage lines. Application labs that validate recipes shorten customer trial cycles.

- Palm strategy bifurcation: Some brands move palm-free (coconut/MCT/shea), while others retain organic palm within deforestation-free commitments. Both paths require credible traceability, origin storytelling, and contingency planning for crop variability. Suppliers offering equivalent functionality across palm and palm-free portfolios reduce reformulation risk.

- Carrier optimization: Choosing organic maltodextrin, tapioca, acacia, or rice-based carriers balances flowability, dispersibility, sweetness, and allergen profiles. Tailored carrier-fat ratios enable rapid hydration in cold beverages versus dough applications. Transparency on DE values and residue limits supports compliance audits.

- Oxidation and shelf-life management: Encapsulation efficiency, antioxidant systems permitted in organic frameworks, and barrier packaging (oxygen/water-vapor control) are decisive. Stability data under tropical and temperate lanes strengthens bids with global bakery and beverage accounts navigating long transit times.

- Regulatory and standard evolution: Alignment with USDA/EU organic rules, non-GMO verification, retailer scorecards, and corporate deforestation-free policies shapes specifications. Documentation agility - certificates, change controls, and mass-balance statements - often determines vendor onboarding speed.

- Plant-based and allergen-aware demand: Dairy-free and vegan platforms adopt shortening powders for creaminess without butter or hydrogenated fats. Cross-contact controls and “free-from” positioning open channels in nutrition powders, vending mixes, and institutional catering where uniformity and ambient stability are critical.

- Operational flexibility and service: Lead-time reliability, responsive MOQs, and dual-site drying mitigate supply risk. Technical field support, sample-to-scale assistance, and digital portals for specifications create sticky customer relationships beyond price.

- Sustainability as a tiebreaker: Carbon accounting, regenerative sourcing pilots, renewable energy in drying, and recyclable/monomaterial packaging influence RFP outcomes. Credible life-cycle narratives and audit readiness differentiate in retailer and QSR tenders.

- Go-to-market shifts: Growth of private label, co-manufacturing, and e-commerce accelerates customization in flavor, fat profile, and particle morphology. Suppliers offering modular SKUs and rapid prototyping capture agile brands moving from regional to multinational distribution.

Organic Shortening Powder Market Reginal Analysis

North America

Demand is anchored by bakery mixes, cookies, snacks, and powdered creamers, with strong pull from natural/organic retail and foodservice distributors. Brand owners emphasize palm-free options, allergen controls, and clean-label carriers. Auditable traceability, SQF/BRC certifications, and rapid technical support are prerequisites. Retailer scorecards and corporate sustainability targets push suppliers to document carbon and packaging impacts while maintaining flavor neutrality and consistent lamination performance.Europe

Stringent organic rules, retailer specifications, and deforestation-free obligations drive palm origin scrutiny and documentation depth. European bakeries value flavor-neutral, low-off-note powders that tolerate diverse wheat qualities and fermentation styles. Regional spray-drying capacity and proximity to logistics hubs reduce lead times. Private-label growth and discounter formats favor cost-optimized carrier systems that still meet non-GMO and additive-light expectations. Recyclable packaging and mass-balance transparency influence tenders.Asia-Pacific

Rapid bakery westernization, café culture, and emerging plant-based categories expand applications from laminated pastries to instant beverages. Sourcing optionality - organic palm, coconut/MCT, and shea - supports regional flavor preferences and pricing dynamics. Localized toll-drying and partnerships with beverage premixers enable agile customization. Compliance with varied organic schemes and hot-humid stability testing are decisive for cross-border e-commerce and regional foodservice networks.Middle East & Africa

Growth stems from premium bakery, confectionery centers, and HoReCa beverages, with ambient stability a core requirement. Import-reliant markets prioritize shelf-life, heat tolerance, and shipping robustness. Halal certification, simplified labels, and competitive landed costs are key. Distributors with application know-how and cold-water dispersibility demos help convert from butter/shortening blocks to powders in bakery and instant dessert lines.South & Central America

Expanding modern retail, bakery chains, and beverage premix manufacturing drive interest in organic formats. Currency volatility and tariff structures make local blending/toll-drying partnerships attractive. Customers seek versatile powders compatible with regional flours and sugar profiles, balancing cost with clean-label claims. Documentation for organic compliance and deforestation-free sourcing, plus packaging suited to humid climates, supports wider adoption across snack and bakery exporters.Organic Shortening Powder Market Segmentation

By Type

- Palm

- Soybean

- Others

By Application

- Food Industry

- Foodservice

- Household

Key Market players

AAK, Bunge Loders Croklaan (Bunge), Cargill, Archer Daniels Midland (ADM), Wilmar International, Corbion, Kerry Group, FrieslandCampina Ingredients (Kievit), MEGGLE Group, Lactalis Ingredients, Glanbia Nutritionals, Balchem, CoreFX Ingredients, Sternchemie (Stern-Wywiol Gruppe), IngredionOrganic Shortening Powder Market Analytics

The report employs rigorous tools, including Porter’s Five Forces, value chain mapping, and scenario-based modelling, to assess supply-demand dynamics. Cross-sector influences from parent, derived, and substitute markets are evaluated to identify risks and opportunities. Trade and pricing analytics provide an up-to-date view of international flows, including leading exporters, importers, and regional price trends.Macroeconomic indicators, policy frameworks such as carbon pricing and energy security strategies, and evolving consumer behaviour are considered in forecasting scenarios. Recent deal flows, partnerships, and technology innovations are incorporated to assess their impact on future market performance.

Organic Shortening Powder Market Competitive Intelligence

The competitive landscape is mapped through proprietary frameworks, profiling leading companies with details on business models, product portfolios, financial performance, and strategic initiatives. Key developments such as mergers & acquisitions, technology collaborations, investment inflows, and regional expansions are analyzed for their competitive impact. The report also identifies emerging players and innovative startups contributing to market disruption.Regional insights highlight the most promising investment destinations, regulatory landscapes, and evolving partnerships across energy and industrial corridors.

Countries Covered

- North America - Organic Shortening Powder market data and outlook to 2034

- United States

- Canada

- Mexico

- Europe - Organic Shortening Powder market data and outlook to 2034

- Germany

- United Kingdom

- France

- Italy

- Spain

- BeNeLux

- Russia

- Sweden

- Asia-Pacific - Organic Shortening Powder market data and outlook to 2034

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Malaysia

- Vietnam

- Middle East and Africa - Organic Shortening Powder market data and outlook to 2034

- Saudi Arabia

- South Africa

- Iran

- UAE

- Egypt

- South and Central America - Organic Shortening Powder market data and outlook to 2034

- Brazil

- Argentina

- Chile

- Peru

Research Methodology

This study combines primary inputs from industry experts across the Organic Shortening Powder value chain with secondary data from associations, government publications, trade databases, and company disclosures. Proprietary modeling techniques, including data triangulation, statistical correlation, and scenario planning, are applied to deliver reliable market sizing and forecasting.Key Questions Addressed

- What is the current and forecast market size of the Organic Shortening Powder industry at global, regional, and country levels?

- Which types, applications, and technologies present the highest growth potential?

- How are supply chains adapting to geopolitical and economic shocks?

- What role do policy frameworks, trade flows, and sustainability targets play in shaping demand?

- Who are the leading players, and how are their strategies evolving in the face of global uncertainty?

- Which regional “hotspots” and customer segments will outpace the market, and what go-to-market and partnership models best support entry and expansion?

- Where are the most investable opportunities - across technology roadmaps, sustainability-linked innovation, and M&A - and what is the best segment to invest over the next 3-5 years?

Your Key Takeaways from the Organic Shortening Powder Market Report

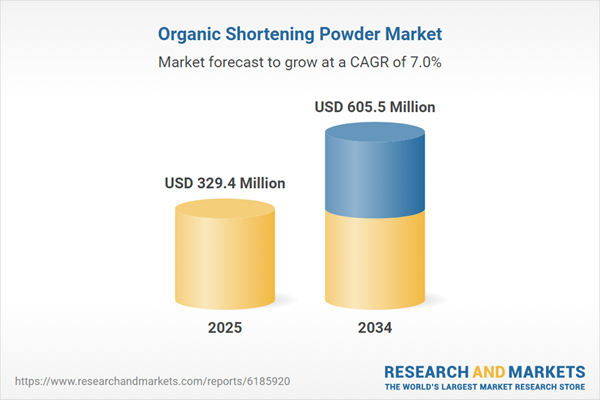

- Global Organic Shortening Powder market size and growth projections (CAGR), 2024-2034

- Impact of Russia-Ukraine, Israel-Palestine, and Hamas conflicts on Organic Shortening Powder trade, costs, and supply chains

- Organic Shortening Powder market size, share, and outlook across 5 regions and 27 countries, 2023-2034

- Organic Shortening Powder market size, CAGR, and market share of key products, applications, and end-user verticals, 2023-2034

- Short- and long-term Organic Shortening Powder market trends, drivers, restraints, and opportunities

- Porter’s Five Forces analysis, technological developments, and Organic Shortening Powder supply chain analysis

- Organic Shortening Powder trade analysis, Organic Shortening Powder market price analysis, and Organic Shortening Powder supply/demand dynamics

- Profiles of 5 leading companies - overview, key strategies, financials, and products

- Latest Organic Shortening Powder market news and developments

Additional Support

With the purchase of this report, you will receive:- An updated PDF report and an MS Excel data workbook containing all market tables and figures for easy analysis.

- 7-day post-sale analyst support for clarifications and in-scope supplementary data, ensuring the deliverable aligns precisely with your requirements.

- Complimentary report update to incorporate the latest available data and the impact of recent market developments.

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AAK

- Bunge Loders Croklaan (Bunge)

- Cargill

- Archer Daniels Midland (ADM)

- Wilmar International

- Corbion

- Kerry Group

- FrieslandCampina Ingredients (Kievit)

- MEGGLE Group

- Lactalis Ingredients

- Glanbia Nutritionals

- Balchem

- CoreFX Ingredients

- Sternchemie (Stern-Wywiol Gruppe)

- Ingredion

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | November 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 329.4 Million |

| Forecasted Market Value ( USD | $ 605.5 Million |

| Compound Annual Growth Rate | 7.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |