Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Technological Advancements

Technological advancements have been a cornerstone of the video game industry's growth. These innovations have not only enhanced the gaming experience but also expanded the market's reach. The continuous improvement of graphics technology, driven by powerful GPUs and CPUs, has allowed game developers to create visually stunning and realistic worlds. High-definition displays and 4K gaming have become standard, pushing the boundaries of immersion. The introduction of Solid-State Drives (SSDs) in gaming consoles and PCs has significantly reduced loading times, enabling seamless and uninterrupted gameplay experiences. This has elevated user satisfaction and engagement.Virtual Reality (VR) and Augmented Reality (AR)

VR and AR technologies have opened up new dimensions of immersive gaming. VR headsets like Oculus Rift and PlayStation VR offer unparalleled levels of immersion, while AR games like Pokémon GO have bridged the gap between virtual and physical worlds. Cloud gaming services like Google Stadia and Microsoft's xCloud have eliminated the need for high-end hardware by streaming games directly from data ce Changing Consumer BehaviorsMobile Gaming

The proliferation of smartphones has made gaming more accessible than ever. Mobile gaming, characterized by casual and free-to-play titles, appeals to a broader demographic, including those who may not identify as traditional gamers. Social media platforms and gaming communities have enabled players to connect and share experiences. Multiplayer and cooperative gameplay have become integral to many titles, fostering a sense of community among gamers. The ability to play games across different platforms, such as consoles, PCs, and mobile devices, has broken down barriers and expanded the player base. Games like Fortnite and Minecraft exemplify the success of cross-platform play.Live Services and Updates & Esports and Streaming

The transition from one-time purchases to live services and ongoing updates has prolonged the lifespan of games. Titles like"Fortnite" and"Grand Theft Auto Online" regularly introduce new content, keeping players engaged and invested. nters. This accessibility has widened the potential player base. The rise of esports and game streaming platforms has had a profound impact on the video game market. Esports, in particular, has grown into a global phenomenon with dedicated audiences and significant financial backing.Esports Tournaments

Major esports tournaments, such as The International (Dota 2) and League of Legends World Championship, offer massive prize pools, attracting top talent and viewership comparable to traditional sports events. Platforms like Twitch and YouTube Gaming have provided a space for gamers to showcase their skills and personalities. Streamers and content creators have become influential figures, driving interest in specific games. Esports and streaming have turned gaming into a spectator sport. Fans tune in to watch their favorite players and teams, contributing to the industry's growth through advertising, sponsorships, and merchandise sales.Digital Distribution and Monetization

The shift from physical copies to digital distribution has transformed the video game market's revenue models. This transition has facilitated greater convenience for players and new monetization opportunities for publishers. Platforms like Steam, PlayStation Network, and Xbox Live have made it easy for players to purchase and download games digitally. This has reduced the reliance on physical retail stores. In-game microtransactions and downloadable content (DLC) have become significant revenue streams. These optional purchases allow players to customize their experiences and support ongoing development. Many games now adopt the free-to-play model, where the core game is available for free, but revenue is generated through in-game purchases. This approach has attracted large player bases and consistent income.Globalization of Gaming

The video game market's globalization has broken down geographical barriers, expanding its reach and influence to a global scale. The internet has enabled players from diverse backgrounds to connect and compete online. Gamers can form international alliances, fostering cultural exchange and diverse gaming communities. Developers increasingly invest in localization efforts to make games accessible to non-English-speaking audiences. This has opened up new markets and expanded the industry's global footprint. Emerging markets, particularly in Asia, have experienced significant growth in the video game industry. China, for example, has become a major player in both game development and consumption. The global video game market's growth is driven by a complex interplay of technological advancements, changing consumer behaviors, the rise of esports and streaming, digital distribution, and globalization. Understanding these key drivers is essential for stakeholders in the industry and anyone interested in the ever-evolving world of video games. As the market continues to evolve, it will be fascinating to observe how these drivers shape its future.Key Market Challenges

Regulatory and Ethical Concerns

The video game industry faces regulatory and ethical challenges that impact game development, distribution, and overall reputation. Different countries have varying standards for content regulation. Games with violent or sexually explicit content may face censorship or age restrictions in some regions, limiting their market potential. The inclusion of loot boxes, which offer randomized in-game items for real money, has raised concerns about gambling-like mechanics in games. Some countries have classified loot boxes as a form of gambling, leading to potential legal and regulatory issues. As games become more connected and collect user data, privacy concerns arise. Data breaches and misuse of personal information can harm both players and the industry's reputation. Online multiplayer games often suffer from issues related to harassment and toxicity. This can discourage new players from joining the community and harm the overall gaming experience.Industry Consolidation

The video game industry has seen a trend toward consolidation, with major companies acquiring smaller studios. While this can lead to financial stability, it also presents challenges. As larger companies acquire smaller studios, there is a risk of stifling innovation. Creative independence may be compromised in favor of producing safe, financially predictable titles. Industry consolidation can lead to a few major players dominating the market. This concentration of power can limit consumer choice and potentially raise prices. Smaller, independent game developers may find it increasingly challenging to compete in a market where major players have significant resources and marketing budgets.Monetization and Loot Boxes

Monetization practices within the video game industry have come under scrutiny, particularly in relation to loot boxes and microtransactions. In-game purchases, loot boxes, and microtransactions have faced backlash from players who perceive them as exploitative or pay-to-win mechanics, potentially damaging a game's reputation. Governments and regulatory bodies are considering measures to address monetization practices in video games, including potential bans or restrictions on loot boxes. Finding the right balance between generating revenue through in-game purchases and ensuring a fair and enjoyable gaming experience for all players is a constant challenge for developers.Gaming Addiction and Mental Health

The immersive nature of video games has raised concerns about gaming addiction and its impact on mental health. Gaming addiction is now recognized as a mental health disorder by the World Health Organization (WHO). This recognition has led to increased awareness and calls for intervention. Game developers are under pressure to implement features that promote healthy gaming habits, such as time limits and breaks, while maintaining player engagement. Addressing gaming addiction without stigmatizing all gamers is a challenge. It's important to differentiate between healthy gaming and problematic gaming behavior.Key Market Trends

Shift Towards Cloud Gaming

Cloud gaming represents a significant trend that is reshaping the way games are accessed and played. Companies like Google (Stadia), Microsoft (xCloud), and NVIDIA (GeForce Now) have introduced cloud gaming platforms that allow players to stream games directly from remote servers. This eliminates the need for high-end gaming hardware and offers accessibility across a wide range of devices. Cloud gaming platforms offer extensive libraries of games, making it convenient for players to access a diverse range of titles without the need for downloads or installations. Improvements in internet infrastructure, including the rollout of 5G networks, have enabled high-quality game streaming with minimal latency, enhancing the overall gaming experience.Virtual Reality (VR) and Augmented Reality (AR)

VR and AR technologies continue to advance, with significant implications for the gaming industry. VR headsets, such as the Oculus Rift and Valve Index, offer increasingly immersive gaming experiences, enhancing immersion and presence within virtual worlds. AR technologies, like Microsoft's HoloLens and mobile AR apps, are blurring the lines between the physical and virtual worlds, creating new gaming experiences and opportunities. VR and AR are being used for health and fitness applications, such as VR exercise games and AR-assisted workouts, contributing to the gamification of physical activity.Cross-Platform Play

Cross-platform play is a trend that is gaining momentum, allowing gamers on different devices to play together. Cross-platform play eliminates the traditional barriers between console, PC, and mobile gamers, fostering a more inclusive and interconnected gaming community Games that support cross-platform play often have larger and more diverse player pools, leading to improved matchmaking and overall player experiences Cross-platform play facilitates social interactions and connections among friends and players from around the world, enhancing the social aspect of gaming.Segmental Insights

Gaming Type Insights

The online type segment accounted for the largest revenue share of around 44.0% in 2022. The growth of this segment is driven by a rise in internet penetration, growth of the online casual gaming sector, and increasing popularity of massively multiplayer online (MMO) and Free2Play (F2P) games. Technological trends like augmented reality (AR), virtual reality (VR), and mixed reality (MR) are also contributing to the growth of the market. Moreover, the popularity of esports events and multiplayer gaming contributes to the online gaming segment growth. For instance, FIFA 22, launched by Electronic Arts Inc., experienced 9.1 million players, 7.6 million team squads, and 460 matches played by gamers within the first month of launch. The offline segment is expected to record a considerable growth rate of nearly 10.0% from 2023 to 2030. The market for offline video games has witnessed substantial growth in recent years, establishing a significant presence within the broader video game industry. Such games offer unique gameplay experiences that set them apart from their online counterparts.Gaming Device Insights

The mobile device segment held the largest revenue share of over 40.0% in 2022. The increased proliferation of smartphones along with rising internet penetration worldwide is creating vast opportunities for mobile gaming. In recent years, technological developments in terms of smartphone gaming hardware in addition to their convenience, accessibility, and availability of low-cost alternatives have boosted the popularity of mobile games among the population worldwide, compelling gamers to shift from consoles and pre-installed PC games to smartphone gaming. In addition, the popularity of mobile gaming among the young population is expected to offer lucrative opportunities for the mobile device segment. For instance, according to the 2023 data from Techpenny, the average age of mobile gamers is 36.3 years. In addition, 86% of Gen Z (born between 1997 and 2012) plays video games on their mobile devices.Regional Insights

The North America region has established itself as the leader in the Global Video Game Market with a significant revenue share in 2022. North America captured the revenue share of around 25 % of the market in 2022. According to the Entertainment Software Association, over 65% of Americans play video games, with around 212.6 million players per week.Asia Pacific captured a substantial revenue share. The high popularity of gaming in countries, such as China, Japan, and South Korea, coupled with the deployment of multiple strategies by Chinese developers to attract gamers, contributed to the region’s growth. For instance, Tencent Holdings Ltd. has utilized the potential of its social messaging platform WeChat, an application with over 1 billion active users across China, to promote the games and swiftly connect players to other gamers. The company is headquartered in China and is well known for its organic growth strategies. In February 2022, Tencent Holdings Ltd. acquired 1C Entertainment and acquired the majority of stakes in Inflexion Games as part of the company's growth strategy.

Key Market Players

- Sony Corporation

- Microsoft Corporation

- Apple Inc.

- Google LLC

- Bandai Namco Entertainment Inc

- Take-Two Interactive Software Inc

- Nintendo Co. Ltd

- Activision Blizzard Inc

- Electronic Arts Inc

- Ubisoft Entertainment SA

Report Scope

In this report, the Global Video Game Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Video Game Market, by Gaming Devices:

- Console

- Table

- Smartphone

Global Video Game Market, by Gaming Type:

- Online

- Offline

Global Video Game Market, by End User:

- Kids

- Teenagers

- Adults

Global Video Game Market, by Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Video Game Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Sony Corporation

- Microsoft Corporation

- Apple Inc.

- Google LLC

- Bandai Namco Entertainment Inc.

- Take-Two Interactive Software Inc.

- Nintendo Co. Ltd.

- Activision Blizzard Inc.

- Electronic Arts Inc.

- Ubisoft Entertainment SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | October 2023 |

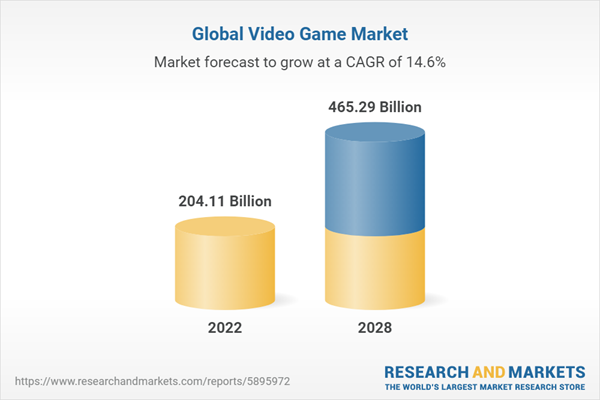

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 204.11 Billion |

| Forecasted Market Value ( USD | $ 465.29 Billion |

| Compound Annual Growth Rate | 14.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |