The surge in smartphone adoption worldwide is a key driver for RCS, enabling these advanced messaging systems to reach a broader audience. As consumers transition from basic phones to smartphones with enhanced connectivity and operating systems, the pace of RCS adoption accelerates. This growth is fueled by RCS’s ability to support multimedia content, interactive features, and app-like messaging experiences. The increasing variety of connected devices motivates telecom operators to implement RCS, expanding business outreach and accelerating commercialization in both mature and emerging markets. The deployment of 5G networks offers the speed, bandwidth, and low-latency environment necessary for more reliable and efficient RCS messaging. With improved connectivity, features such as high-resolution media sharing, real-time notifications, interactive chatbots, and branded messaging perform more seamlessly. As carriers upgrade to 5G, enterprises gain opportunities to enhance customer interactions, boosting adoption rates and driving revenue growth globally.

The A2P segment held a 61% share in 2024 and is expected to grow at a CAGR of 19% through 2034. A2P RCS is widely used across sectors for interactive campaigns, secure alerts, and personalized customer engagement. Its recognition as a legitimate communication channel further strengthens its adoption, while CPaaS providers have simplified integration for enterprises. The ability to combine visuals and interactivity makes A2P the most commercially advanced segment of the Rich Communication Services Market.

The cloud-based RCS solutions segment was valued at USD 1.79 billion in 2024. These platforms provide scalable, low-latency messaging infrastructure, support for A2P campaigns, and elastic capacity to manage fluctuating demand while offering automatic updates. CPaaS providers have turned RCS into a service via accessible APIs, streamlining enterprise adoption and making it easier to deploy across industries.

United States Rich Communication Services Market reached USD 891.6 million in 2024. Strong smartphone penetration, the gradual rollout of 5G, and adoption across retail, banking, and telecom sectors support market growth. The increasing use of AI-enabled chatbots, A2P messaging, and brand-verified messaging enhances RCS-based customer engagement, accelerating its acceptance among major enterprises.

Key players in the Global Rich Communication Services Market include AT&T, China Mobile, Deutsche Telekom, Google, Huawei Technologies, KDDI, NTT DOCOMO, T-Mobile US, Verizon Communications, and Vodafone. Companies in the Rich Communication Services Market focus on strategies such as expanding cloud-based offerings, integrating AI and interactive features, and forming strategic partnerships with telecom operators. They emphasize A2P solutions to increase enterprise adoption, invest in scalable APIs for easier integration, and leverage 5G networks to enhance service reliability. Many firms also prioritize expanding global reach, improving customer experience through rich messaging features, and enhancing brand visibility to strengthen their market position and capture new revenue streams.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Rich Communication Services market report include:- AT&T

- China Mobile

- Deutsche Telekom

- Huawei Technologies

- Infobip

- KDDI

- Orange

- Sinch

- Tata Communications

- Telefonica

- Verizon Communications

- Vodafone Group

- Clickatell

- CM.com

- Gupshup

- Syniverse

- Tanla Platforms

- Telnyx

- Webex Connect

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

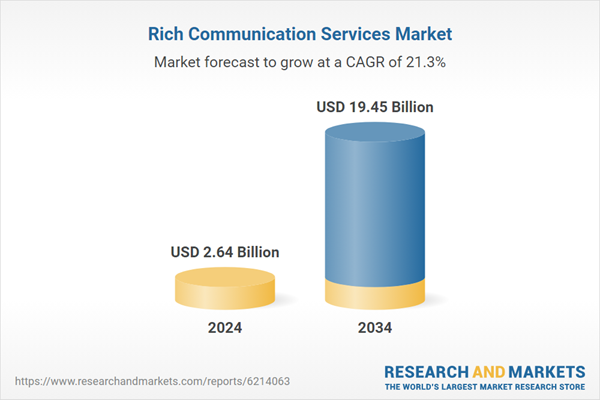

| Estimated Market Value ( USD | $ 2.64 Billion |

| Forecasted Market Value ( USD | $ 19.45 Billion |

| Compound Annual Growth Rate | 21.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |